Franco-Nevada (FNV) Q1 Earnings & Sales Top Estimates, Up Y/Y

Franco-Nevada Corporation FNV reported adjusted earnings of 58 cents per share in first-quarter 2020, up 65.7% from the prior-year quarter. Additionally, the bottom line surpassed the Zacks Consensus Estimate of 55 cents.

The company generated revenues of $241 million in the reported quarter, reflecting a year-over-year improvement of 34%. Further, the top line beat the Zacks Consensus Estimate of $234 million. In the reported quarter, 89% of revenues were sourced from gold and gold equivalents (69.4% gold, 9.2% silver, 9.4% platinum group metals and 1% from other mining assets) and 11% from energy (oil, gas and natural gas liquids).

The company sold 134,941 Gold Equivalent Ounces (GEOs) in the quarter, up from 122,049 GEOs in the prior-year quarter. The year-over-year improvement of 10.6% was driven by higher contributions from Cobre Panama, Guadalupe-Palmarejo and Hemlo, offset by lower contributions from Candelaria, Antapaccay and Sabodala mines.

During the reported quarter, adjusted EBITDA climbed 36.8% to $193 million from the $141 million witnessed in the comparable period last year.

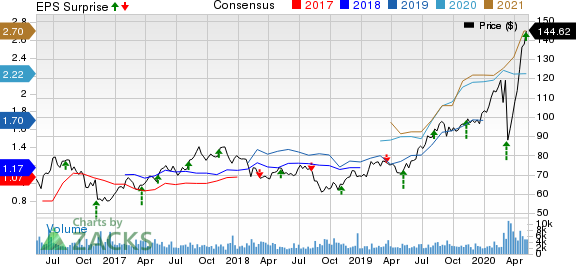

FrancoNevada Corporation Price, Consensus and EPS Surprise

FrancoNevada Corporation price-consensus-eps-surprise-chart | FrancoNevada Corporation Quote

Prices

In first-quarter 2020, the average gold price was $1,583 per ounce, 21.4% higher than the year-ago quarter. Silver prices averaged $16.90 per ounce in the quarter, up 8.5% year over year. Platinum prices went up 9.7% year over year to $903 per ounce, while palladium prices jumped 59.2% year over year to $2,284 per ounce.

Financial Position

The company had $209.8 million cash in hand as of Mar 31, 2020, up from $132.1 million reported as of Dec 31, 2019. It recorded operating cash flow of $195.2 million in the reported quarter, up from the prior-year quarter’s $143.6 million.

Franco-Nevada is debt free and uses its free cash flow to expand its portfolio and pay dividends. The company’s board has announced a quarterly dividend of 26 cents per share, marking a 4% increase from the prior dividend of 25 cents per share. This marks the 13th consecutive annual dividend increase for the company’s stakeholders.

Suspension of Guidance

Franco-Nevada has withdrawn the GEO sales guidance for the current year as its mining operators have been facing the unfavorable impact of the coronavirus outbreak, which led to temporary suspension of operations and production curtailment. It has also revoked the current-year energy revenue guidance, given the sluggish oil and gas prices. Operations at Cobre Panama and Antamina have been temporarily suspended, while Antapaccay and Candelaria continue to operate at normal levels.

Franco-Nevada’s mining revenues are likely to be affected by the production curtailments across its mining portfolio. Energy is expected to be less than 10% of the company’s current-year revenues as energy assets have been impacted by a sharp drop in commodity prices and drilling activity. Weakness across the energy sector is expected to be more than offset by strength in gold equivalent assets.

Price Performance

Franco-Nevada’s shares have surged 86.4% compared with the industry’s growth of 88.3%.

Zacks Rank & Stocks to Consider

Franco-Nevada currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Newmont Corporation NEM, Barrick Gold Corporation GOLD and Wheaton Precious Metals Corp WPM, each currently carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Newmont has an expected earnings growth rate of 90.2% for 2020. The company’s shares have surged 103.6% in the past year.

Barrick Gold has an estimated earnings growth rate of 60.8% for the ongoing year. Its shares have soared 112.7% over the past year.

Wheaton has a projected earnings growth rate of 62.5% for the current year. The company’s shares have appreciated 107% in a year’s time.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

FrancoNevada Corporation (FNV) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Wheaton Precious Metals Corp (WPM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance