The Fox (NASDAQ:FOXA) Share Price Is Down 34% So Some Shareholders Are Getting Worried

Fox Corporation (NASDAQ:FOXA) shareholders should be happy to see the share price up 14% in the last month. But that is minimal compensation for the share price under-performance over the last year. In fact, the price has declined 34% in a year, falling short of the returns you could get by investing in an index fund.

See our latest analysis for Fox

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the Fox share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

With a low yield of 1.8% we doubt that the dividend influences the share price much. Fox's revenue is actually up 6.6% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

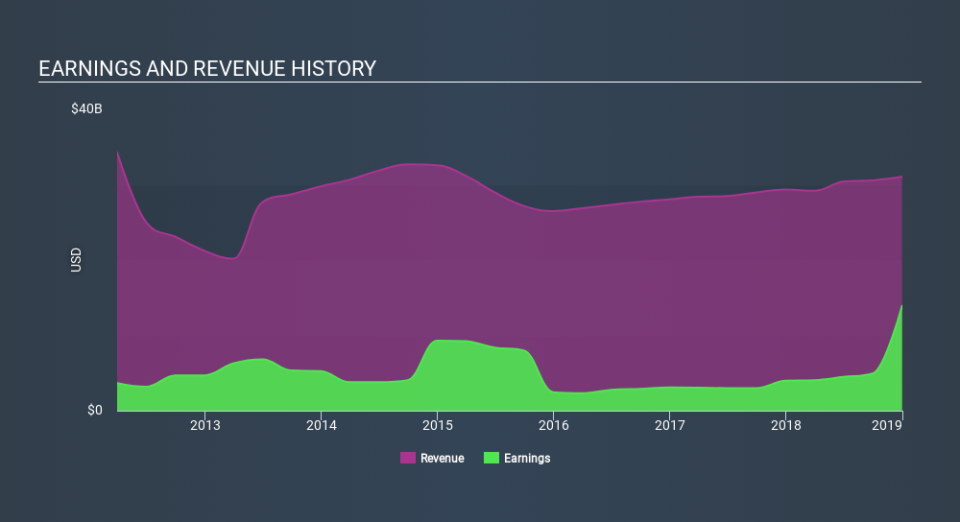

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Fox stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We doubt Fox shareholders are happy with the loss of 32% over twelve months (even including dividends) . That falls short of the market, which lost 3.3%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Notably, the loss over the last year isn't as bad as the 35% drop in the last three months. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. It's always interesting to track share price performance over the longer term. But to understand Fox better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Fox you should be aware of, and 1 of them shouldn't be ignored.

Fox is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance