Fox Corp (FOXA) Q1 Earnings & Revenues Beat Estimates, Up Y/Y

Fox Corporation FOXA reported first-quarter fiscal 2020 adjusted earnings of 83 cents per share that beat the Zacks Consensus Estimate by 18.6% and increased 1.2% year over year.

Revenues were up 5% year over year to $2.67 billion. The figure also surpassed the consensus mark by 3.8%.

Affiliate fees (52.3% of revenues) grew 4.3% to $1.39 billion. Advertising (39% of revenues) revenues decreased 2.1% to $918 million.

Other revenues (8.7% of revenues) surged 64.5% from the year-ago quarter to $232 million, driven by higher revenues from the operations of the FOX Studios Lot for third parties.

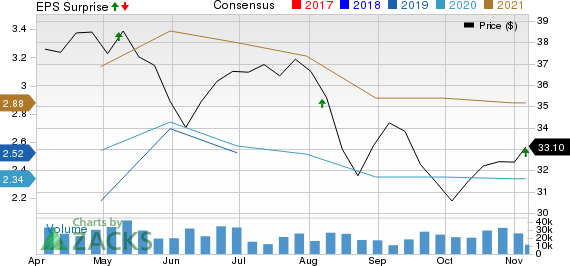

Fox Corporation Price, Consensus and EPS Surprise

Fox Corporation price-consensus-eps-surprise-chart | Fox Corporation Quote

Notably, Fox became a standalone, publicly-traded company on Mar 21, following the merger of Disney and Twenty-First Century Fox, Inc.

The standalone Fox’s portfolio comprises Twenty-First Century Fox’s news, sports and broadcast businesses. These include FOX News, FOX Business, FOX Broadcasting Company (the FOX Network), FOX Sports, FOX Television Stations Group, sports cable networks like FS1, FS2, FOX Deportes and Big Ten Network, and certain other assets.

Top-Line Details

Cable Network Programming (48.2% of revenues) revenues increased 1.6% year over year to $1.29 billion. While revenues from Affiliate fees were flat year over year, advertising revenues declined 3.8%.

Other revenues jumped 48.4% on a year-over-year basis, driven by higher revenues generated from pay-per-view boxing and increased sports sublicensing revenues.

Affiliate revenues benefited from contractual price increases, offset by net subscriber declines. A year-over-year decline in advertising revenues primarily reflects the impact of fewer FIFA World Cup matches and the absence of Ultimate Fighting Championship content.

Television (50.8% of revenues) revenues increased 6.2% from the year-ago quarter to $1.36 billion. While advertising revenues declined 1.5%, revenues from affiliate fees and other revenues grew 14.3% and 42.5%, respectively.

Affiliate revenues grew on increased programming fees from third-party FOX affiliates and higher average rates per subscriber for the company’s owned and operated stations. Other revenues grew primarily owing to higher digital content licensing revenues and the consolidation of Bento Box.

However, advertising was negatively impacted by fewer FIFA World Cup matches and lower political-ad revenues.

Operating Details

In first-quarter fiscal 2020, operating expenses decreased 1.5% year over year to $1.47 billion. However, as a percentage of revenues, operating expenses declined 360 basis points (bps) to 55%.

Selling, general & administrative (SG&A) expenses increased 17.7% on a year-over-year basis to $352 million. As a percentage of revenues, SG&A expenses expanded 140 bps to 13.2%.

The year-over-year growth in SG&A expenses was primarily attributed to higher costs related to FOX operating as a standalone public company.

Segment EBITDA rose 12.5% year over year to $856 million. EBITDA margin expanded 210 bps on a year-over-year basis to 32.1%.

Cable Network Programming EBITDA improved 8.1% to $684 million. EBITDA margin grew 320 bps to 53.2%.

Television EBITDA surged 46.8% to $251 million. EBITDA margin expanded 510 bps to 18.5%.

Balance Sheet

As of Sep 30, 2019, Fox had $3.34 billion in cash and cash equivalents compared with $3.23 billion as of Jun 30, 2019. Long-term debt was flat at $6.75 billion.

Zacks Rank & Stocks to Consider

Fox currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader consumer discretionary sector include Cumulus Media CMLS, Entercom Communications ETM and Liberty Media Corp FWONK. All three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

While both Cumulus and Liberty Media are set to report quarterly results on Nov 11, Entercom is scheduled to report on Nov 8.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cumulus Media, Inc. (CMLS) : Free Stock Analysis Report

Entercom Communications Corporation (ETM) : Free Stock Analysis Report

Fox Corporation (FOXA) : Free Stock Analysis Report

Liberty Media Corporation (FWONK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance