Four Days Left To Buy loanDepot, Inc. (NYSE:LDI) Before The Ex-Dividend Date

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that loanDepot, Inc. (NYSE:LDI) is about to go ex-dividend in just four days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Accordingly, loanDepot investors that purchase the stock on or after the 31st of December will not receive the dividend, which will be paid on the 18th of January.

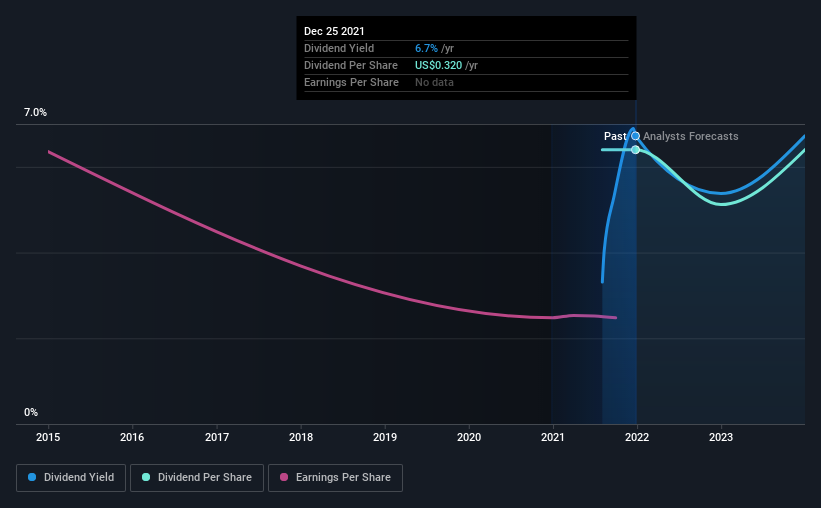

The upcoming dividend for loanDepot is US$0.08 per share. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for loanDepot

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. loanDepot paid out just 1.0% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances. loanDepot paid a dividend despite reporting negative free cash flow last year. That's typically a bad combination and - if this were more than a one-off - not sustainable.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. From this perspective, we're disturbed to see earnings per share plunged 30% over the last 12 months, and we'd wonder if the company has had some kind of major event that has skewed the calculation.

This is loanDepot's first year of paying a dividend, which is exciting for shareholders - but it does mean there's no dividend history to examine.

The Bottom Line

Should investors buy loanDepot for the upcoming dividend? loanDepot's earnings per share have declined over the past 12 months, although we note that it is paying out a low fraction of its earnings. Ordinarily we wouldn't be too concerned about a one-year decline, especially given the payout ratio is low. This makes us wonder if the company is incurring costs by reinvesting in its business. From a dividend perspective we struggle to see value in a company with declining earnings per share, but it's also true that a one-year decline often doesn't mean much. So we wouldn't be too quick to write this one off. We think there are likely better opportunities out there.

If you're not too concerned about loanDepot's ability to pay dividends, you should still be mindful of some of the other risks that this business faces. To help with this, we've discovered 4 warning signs for loanDepot (2 are concerning!) that you ought to be aware of before buying the shares.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance