Fortuna Silver (FSM) Stock Down 24% on Q3 Earnings Miss

Shares of Fortuna Silver Mines Inc. FSM have declined 24% since reporting third-quarter 2021 adjusted earnings per share of 8 cents, which missed the Zacks Consensus Estimate of 11 cents. The bottom line declined 11% from the year-ago quarter. Apart from the earnings miss, the ongoing uncertainty regarding whether the company will be able to operate the San Jose mine following its environmental authorization expiry on Oct 23, 2021 hurt the stock further. A recent court order allows the mine to keep running but on a temporary basis. The company is currently working to secure a new permit, which would allow operations to continue for another 10 years.

Including one-time items, Fortuna Silver reported break-even earnings per share in the quarter under review, compared with 7 cents in the year-ago quarter.

Fortuna Silver’s revenues surged 95% year over year to a record $163 million in the third quarter. This was aided by 27,494 ounces of gold sold from the Yaramoko mine, which generated $49 million. The Lindero mine reported adjusted sales of $41.8 million from 23,559 ounces of gold sold. San Jose reported adjusted sales of $43.7 million, down 32% from last year due to a 24% decline in the price of silver and 21% decrease in the volume of silver and gold ounces sold. Meanwhile, Caylloma reported adjusted sales of $28.0 million, up 49% year over year, primarily on a 36% rise in the volume of silver sold, and increases in the volume and price of lead and zinc sold.

Fortuna Silver Mines Inc. Price, Consensus and EPS Surprise

Fortuna Silver Mines Inc. price-consensus-eps-surprise-chart | Fortuna Silver Mines Inc. Quote

On Jul 2, 2021, the company acquired all of the issued and outstanding common shares of Roxgold Inc. Following the completion of the buyout, the company acquired the high-grade Yaramoko mine and the Séguéla advanced exploration project. Fortuna Silver produced 1,711,881 ounces of silver and 65,425 ounces of gold in the third quarter. Gold production soared 411% year over year, while silver production was down 20%.

Cost of sales went up 178% to $115 million in the quarter under review. Fortuna Silver reported mine-operating profit of $47 million in the quarter under review, reflecting year-over-year improvement of 12%. Operating profit was $21.8 million, down 23.5% from $28.5 million in the last-year quarter.

Adjusted EBITDA improved 78% year over year to $75.3 million in the third quarter of 2021. This can be attributed to Lindero and Yaramoko´s contribution of $21.8 million and $25.8 million, respectively, and higher EBITDA at Caylloma. Adjusted EBITDA margin was 46.3%, indicating a 430 basis point contraction from the last-year quarter.

Financial Position

Fortuna Silver ended third-quarter 2021 with around $136 million of cash and cash equivalents, up from the $132 million held at the end of third-quarter 2020. Cash flow from operating activities were $39.4 million in the reported quarter compared with $32.4 million in the prior-year quarter.

Guidance For 2021

Fortuna Silver expects consolidated silver production in the range of 6.8 million ounces to 7.6 million ounces, and gold production in the band of 194,000 ounces to 223,000 ounces in 2021. This translates to 283,000 to 323,000 gold equivalent ounces, representing year-over-year increase of 90-116%.

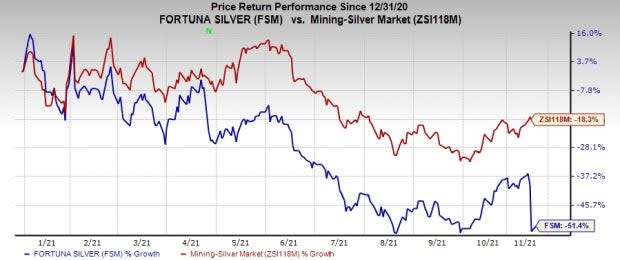

Price Performance

Image Source: Zacks Investment Research

Shares of the company have fallen 51.4% so far this year compared with the industry’s decline of 18.3%.

How Other Stocks Fared in Q3

Pan American Silver Corp. PAAS reported third-quarter 2021 adjusted earnings per share of 18 cents, missing the Zacks Consensus Estimate of 35 cents. The company had reported adjusted earnings per share of 28 cents in the year-ago quarter.

Pan American Silver expects silver production between 19 million ounces and 20 million ounces, and gold production between 560,000 ounces and 588,000 ounces in 2021. The stock carries a Zacks Rank #3 (Hold). Shares of the company have fallen 19.5% so far this year.

Avino Silver & Gold Mines Ltd. ASM reported break-even earnings per share in third-quarter 2021 compared with the Zacks Consensus Estimate of 1 cent per share. The company had reported a loss of 1 cent per share in the prior-year quarter.

Avino Silver’s revenues slumped 29% year over year to $1.88 million due to only one month of sales. The top line missed the Zacks Consensus Estimate of $6 million. Shares of the company, which currently has a Zacks Rank #4 (Sell), have declined 19.2% year to date.

Zacks Rank & a Stock to Consider

Fortuna Silver currently carries a Zacks Rank #3.

A better-ranked stock worth considering in the basic materials space is Nutrien Ltd. NTR, which flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nutrien has an expected earnings growth rate of 212.2% for the current year. The Zacks Consensus Estimate for its current-year earnings has been revised upward by 13.5% over the last 60 days.

Nutrien beat the Zacks Consensus Estimate for earnings in three of the last four quarters but missed once. It has a trailing four-quarter earnings surprise of roughly 73.5%, on average. NTR shares have gained around 43% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortuna Silver Mines Inc. (FSM) : Free Stock Analysis Report

Pan American Silver Corp. (PAAS) : Free Stock Analysis Report

Avino Silver (ASM) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance