Forget GE -- This Restructuring Industrial Giant Is a Better Buy

General Electric (NYSE: GE) is all over the headlines as iconic industrial company struggles to work its way back from a deeply troubling period. As it attempts to rebuild, GE is shedding assets to reposition its business. However, GE isn't the only industrial giant reworking its portfolio. Eaton (NYSE: ETN) is also selling assets as it looks to the future. But Eaton's efforts are being made from a position of strength, which is why most investors should ignore GE and take a closer look at Eaton.

Making the right moves

Eaton recently made a big move to spin off its lighting business. This unit has been struggling for a number of years as competition has heated up for highly efficient lighting systems driven by LED lights. Margins in the division have been weak and Eaton was actually passing up opportunities because it didn't believe the bidding prices were rational. Management is pretty strict about its portfolio, expecting all of its units to hit specific margin targets. If a unit can't hold its own after an appropriate period of time, it gets pushed out.

Image source: Getty Images.

That's what Eaton has decided to do with lighting. That's just par for the course, really, with the company making similar moves on a fairly regular basis. Lighting just happens to be a pretty big division, so this decision is drawing more attention. But the industrial giant isn't just shedding assets -- it's also working to build up a new segment called eMobility. As the name implies, this division is focused on electric vehicles, which Eaton thinks could be a $4 billion revenue operation some day. Right now it's small and development costs are high, but Eaton is already starting to win valuable contracts.

GE, in comparison, is shedding assets just to raise cash so it can strengthen its balance sheet. In fact, some of its moves have been characterized by industry watchers as "desperate." The biggest transaction recently, which looks like it will help stabilize the troubled company, was its announcement to sell a portion of its health division. That will help financially, but it basically means GE had to raid the crown jewels to save itself; healthcare is one of its best-performing businesses overall. And that doesn't even consider the fact that it still has to turn around its weaker segments, where margins are in the single digits or worse. Eaton's worst-performing division is the new eMobility unit it's building from scratch, with operating margins of 6%. All of its other businesses are performing at roughly double that rate or better.

Looking at the financials

If you're a conservative investor, Eaton and its 3.6% yield are likely to be a better option than GE, which is basically a high-risk turnaround story right now. Note that GE cut its dividend down to a token $0.01 per share per quarter because of its struggles. But there's more to like about Eaton than just the big-picture portfolio moves management is making.

For example, Eaton's first-quarter operating cash flow came in at record levels. The company's earnings were up 15% year over year when you exclude one-time costs (largely related to the portfolio shifts it's making). And management upped the company's full-year guidance. Put simply, Eaton is performing quite well today. GE is in the middle of a transition year, in which it expects to use more cash than it generates. Yes, 2020 should be better for GE, but only if its turnaround plan pans out as hoped.

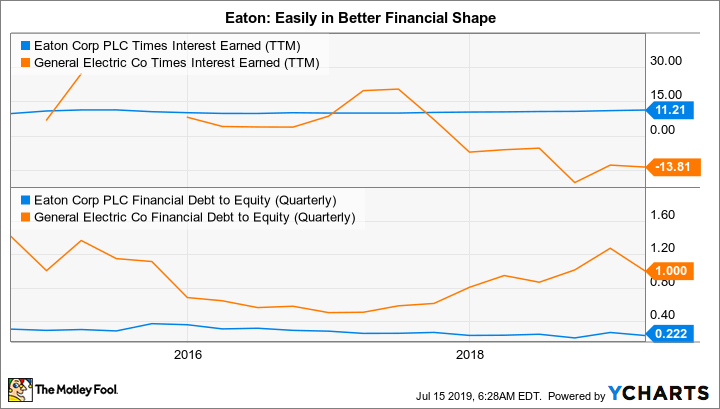

ETN Times Interest Earned (TTM) data by YCharts.

Eaton's balance sheet is also fairly strong. Debt to equity is around 0.22 times, a reasonable, if not conservative, number. And it covers interest expenses by a robust 11 times. There's little reason to worry about its financial condition. GE's finance unit makes it hard to figure out what's going on with the company's balance sheet, but debt to equity is roughly 1 and it didn't cover its interest costs in the first quarter. Clearly, Eaton is in much better financial shape.

Not worth the risk

There's probably a lot of potential at GE, assuming the company's turnaround effort is successful. But there's also a lot of uncertainty to deal with that likely isn't worth it for moderate and conservative investors. Eaton's big changes are being made with a much stronger financial foundation and aren't about trying to save a sinking ship. They are about improving the company's overall performance (jettisoning the low-margin lighting operation) and preparing it for the future (building eMobility). Most investors should ignore GE's big moves and take a closer look at what Eaton is doing today.

More From The Motley Fool

Reuben Gregg Brewer owns shares of Eaton. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance