Forex Recap – Despite RBA Rate Cut, AUD/USD Pair Generated Positive Price Actions

AUD/USD

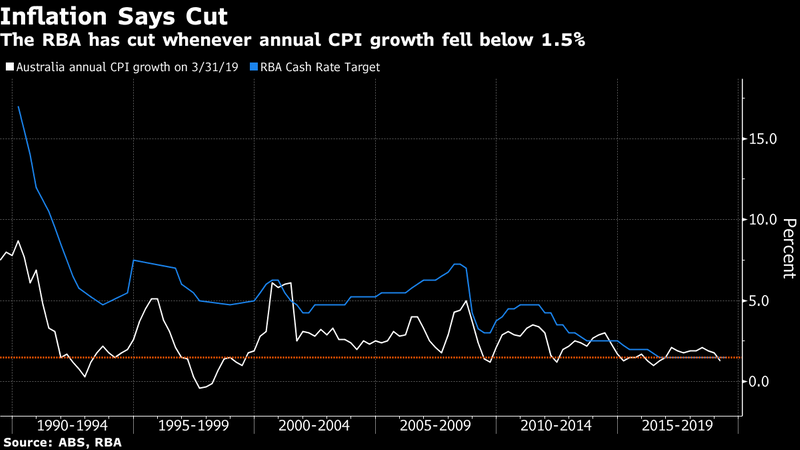

At around 04:30 GMT, the RBA announced a 25 bps rate cut this time, bringing down the interest rates from 1.25% to 1.00%. The market had already expected a rate cut since last night. The AUD/USD pair had dropped around 0.66% yesterday amid rate cut hopes. The Central Bank has applied this rate cut, considering the slowly growing global economy. However, today’s upliftment in the pair was brought about by upbeat Home Sales figures. The May MoM HIA New Home Sales recorded 28.8%% over the previous -11.8%. After marking the opening near 0.6965 level, the pair kept moving upwards. With the positive trend intact, the pair was testing the strong 0.7002 resistance. However, the Aussie pair seemed to lack the energy required to breach this vital line and rebounded downwards. Anyhow, the pair could quote the day’s high near 0.7002 level in the early European session.

Meanwhile, RBA Governor Philip Lowe mentioned that “We will be closely monitoring how things evolve over coming months. Given the circumstances, the board is prepared to adjust interest rates again if needed to get us closer to full employment and achieve the inflation target in a way that supports the collective welfare of all Australians.”

EUR/USD

The Euro was the only currency that elevated against the Greenback on Tuesday. The EUR/USD pair showcased some initial dips after marking the day’s opening near 1.1286 level. The elevated sentiment in the pair as some reports revealed that the ECB wouldn’t rush into additional monetary stimulus in July. At the same time, the policymakers also agree that they could tweak at any point as outlook deteriorates. The Officials also highlighted the risk of upliftment in the EUR/USD if the Fed decides a rate cut on July 25 as expected. Despite the data being mere rumors, the investor emotion seemed uplifted, helping the Fiber to recover last day’s losses.

Meantime, the German May YoY Retail Sales figures reported 1.3% higher than the consensus estimate of around 2.7%. Hence, the Fiber advanced significantly in the initial hours, reaching the daily high near 1.1320 level. The accumulated gains lost steam in the next trading hours in the middle of adverse Euro-specific economic events. The May France Budget and Eurozone MoM Producer Price Index came out lower than the market expectations.

NZD/USD

The Kiwi pair was taking rounds near the last closing throughout the day. The overall price actions of the pair appeared like a seesawed performance today. In the first slump, the NZD/USD pair touched the bottom near 0.6656 mark and soon took the flight upwards. Anyhow, the daily gains remained capped under the robust resistance line near 0.6679 handle. In the meantime, the New Zealand GDT Price Index came out at around 14:28 GMT. Street analysts had hoped the Index to rise 0.2% this time. Somehow, the Price Index reported -0.4% over -3.6% forecasts. Following such higher-than-expected results, the NZD/USD pair soared 0.29% then, reaching 0.6678 mark.

GBP/USD

The UK economic docket remained weaker today. The June Markit Construction PMI data release shocked the market participants. The crucial data reported 14.39% lower than the consensus estimates of around 49.3 points.

Also, the UK June MoM Nationwide Housing Prices published a 0.1% drop over market hopes of 0.2%. A major decline of 0.34% in the GBP/USD pair’s movements came following BoE’s Carney’s dovish medium-term economic outlook. Carney was talking about the ongoing trade uncertainties and no-deal Brexit concerns.

This article was originally posted on FX Empire

More From FXEMPIRE:

US Stock Market Overview – The Dow Hits Fresh All-time Highs as All Sectors Rallied

S&P 500 Price Forecast – Stock markets reached towards highs again

Silver Price Forecast – Silver markets all over the place on Wednesday

E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – July 3, 2019 Forecast

Crude Oil Price Forecast – Crude oil markets bounced slightly on Wednesday

Yahoo Finance

Yahoo Finance