Forex Daily Recap – Ninja Dropped Sharply as China Retaliates with Tariffs

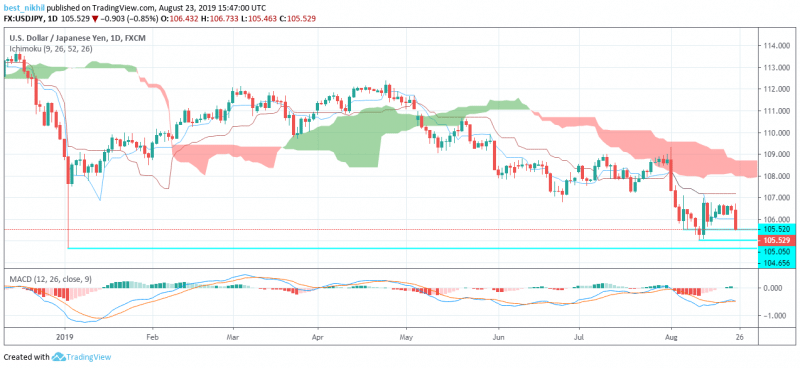

USD/JPY

The Japanese Yen pair was testing the firm 105.520 support level in the North American session. Notably, the USD/JPY pair remained 0.81% down on Friday on the backdrop of US-Sino trade updates. Today, China proclaimed that it would impose 5% tariff on US soybeans from Sept 1. The Chinese counterpart also declared a 10% tariff on US wheat, corn and sorghum from Dec 15. Additionally, a 10% tariff on US beef and pork would come into action from Sept 1. Quite noticeably, such an immediate retaliatory tariff action develops over the latest US tariff imposition on $300 billion worth of Chinese goods.

“Any escalation in the trade dispute with China is a major concern to U.S. pork producers,” the National Pork Producers Council said in a statement.

Following this news, the USD/JPY pair shed the most gains amongst other forex pairs. On the technical side, the Ninja continued to trade under the shadow of Red Ichimoku Clouds. Also, the base line stood above the pair. Anyhow, the conversion line appeared to move inline with the pair, generating conflicting signals. Any movement on the downside would have immediately activated 105.050 and 104.656 support lines.

USD/INR

The Indian Rupee had maintained some strong uptrend price actions since last few sessions, forming a rising wedge pattern. Quite remarkably, the USD/INR bulls have thrashed above the 71.752 and 71.808 sturdy resistance marks. Anyhow, the primary trend as the day approached closing was a negative one. Nevertheless, strong support conflux made up of significant SMAs remained stalled on the downside to prevent any potential daily sharp falls.

Today, the Indian rupee currency rose in value as the country’s Finance Minister Nirmala Sitharaman, declared government’s moves to boost the economy. Minister mentioned that the pre-budget position was retained. The main highlights read that the Foreign Institutional Investors would remain exempted from the Super-rich tax radar, as mentioned in the budget. Also, the government has removed the surcharge on the long term, and short term gains attained out of equity share trading.

USD Index

Today, Fed Chair Jeremy Powell said that the US stays in a safe place and will act appropriately in the upcoming meetings. Meantime, the bears had already conquered and were controlling the US Dollar Index. From a broader perspective, the Greenback was forming a rising wedge pattern that further supported the bearish sentiment. Somehow, the Parabolic SAR remained below the Greenback, giving hopes to the near-term bulls.

Powell also mentioned that the bank would primarily focus on the uprising US-Sino trade tensions and also the possibility of a hard brexit. On the other side, US President Trump again took to Twitter on Friday as Powell was set to speak saying, “Now the Fed can show their stuff,”

USD/CAD

The Loonie pair remained slightly up as estimated in our USD/CAD daily forecast article. Noticeably, the Canadian June MoM Retail Sales data had recorded upbeat reports, surpassing above the market estimates. However, the US July New Home Sales data published adverse data this time, dragging down the pair. Along with that, the elevated US-Sino trade tensions out of the latest Chinese retaliation added more oil to the fire.

This article was originally posted on FX Empire

More From FXEMPIRE:

Natural Gas Price Prediction – Prices Slip as Demand is Flat

Natural Gas Price Forecast – Natural gas markets do very little on Friday

GBP/JPY Weekly Price Forecast – British pound continues recovery

Forex Daily Recap – Ninja Dropped Sharply as China Retaliates with Tariffs

S&P 500 Price Forecast – Stock markets get hammered on Friday

Yahoo Finance

Yahoo Finance