Forex Daily Recap – GBP Bulls Stood Aside Paving the Way for the Bears

USD Index

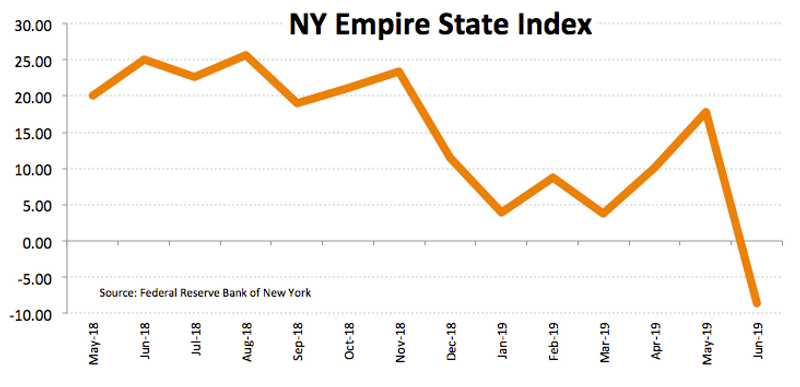

The Greenback showcased a high swing performance in the early hours after making the opening near 97.50 levels. The morning gains came in after the Fiber slipped over weak economic data. And, any fall in the rival EUR/USD adds to a definite push in the USD Index. Last week, at the end of a strong uptrend, the Index had managed to mark weekly highs near 97.58 levels. Today, while taking the upward path, the US Dollar Index was testing the same highest point. Fortunately, the act of testing proved worth the effort. At around 07:00 GMT, the Greenback quoted a fresh daily high near 97.60 levels. However, the performance started losing shine after the release of the NY June Empire State Manufacturing Index.

The market had expected 10.0 points this time over previous 17.8 points. But, the actual figures came out as -8.6 points, the lowest since October 2017. Such disappointing economic data adds in more pressure for a Fed rate cut in the next few months. Anyhow, the US labor market appeared to remain stronger discounting rate cut probabilities. The market now eyes for the Fed meeting scheduled on Wednesday.

GBP/USD

The Cable made the opening on Monday near 1.2595 bottom levels amid Brexit tensions. The pair had remained consolidated in the early hours lacking direction. However, the GBP/USD pair lost ground at around 05:45 GMT showcasing a downtrend. The decline in the pair got support near 1.2572 levels and reversed the trend. The overall sentiment remained fragile throughout the day as Britishers continued to fear over a hard Brexit.

Boris Johnson, former Mayor, and Foreign Secretary stay in front of the Tory Leadership race. Boris has already mentioned that he will take the opportunity to execute Brexit irrespective of a deal. Few other candidates who got through the second ballet came up with soft-Brexit stances. In the meantime, Dominic Raab mentioned of a Brexit idea with a Parliament bypass. Amid such deteriorating sentiment, the pair slipped from 1.2605 levels straight down to 1.2536 levels.

USD/CAD

The pair kept hold onto the 1.3410 top levels as the economic docket weighed lower with lack of significant events. The Crude prices suffered a sharp pullback slumping 2.32% reaching $51.71 per barrel in the early hours. The plunge in the prices amid rising Middle East tensions. The US Secretary of State Mike Pompeo said that Washington does not want to go to war with Iran. But, the US will take every action necessary, including diplomacy, to guarantee safe navigation in the Middle East. However, the OPEC-led supply cuts helped the commodity to choose pickup, rebounding from $51.77 bbl reaching $52.48 bbl. Anyhow, the disappointing US data kept the downward pressure intact over the pair’s movements. Despite that, Canadian April Foreign Portfolio Investment reported $-12.80 billion over the previous $-1.56 billion. Today, the USD/CAD pair mainly remained consolidated near 1.3410 levels except a small dip rebounding from 1.3392 levels.

EUR/USD

Following Friday’s closing on a lower note near 1.1205 levels, the pair showed some functional recovery today.

The EUR/USD pair marked the day’s highest point near 1.1248 marks in the early European session. Disappointing US data generated a pullback in the Greenback which provided support for Fiber upsurge. Earlier the day, Eurozone Labor Cost for the first quarter came out. The Street analyst had hoped for a 0.3% rise in the data, expecting 2.6% this time. Somehow, the reports remained lower than the estimates but were higher than the previous statistics.

This article was originally posted on FX Empire

More From FXEMPIRE:

Gold Price Prediction – Gold Rallies Buoy by Draghi Comments

Crude Oil Price Forecast – Crude oil market spike for the day

Gold Price Forecast – Gold markets continue to test major resistance

Crude Oil Price Update – Daily Trend Changes to Up on Trade Through $54.99

Stock Market Overview – Stocks Surge on Potential China Deal

Yahoo Finance

Yahoo Finance