Forex Daily Recap – Cable Scaled Up +1.14% on Positive Brexit Updates

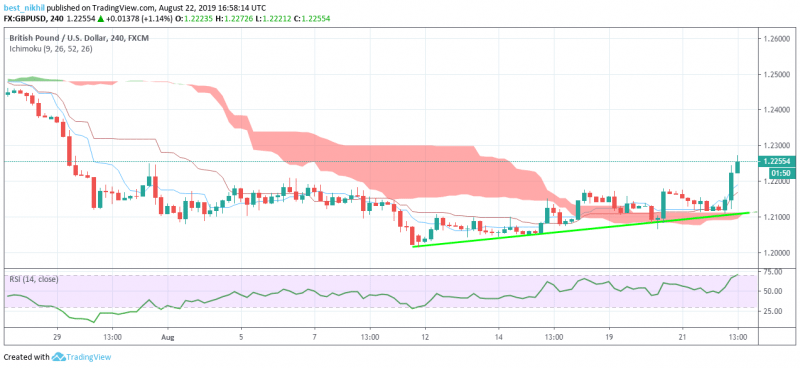

GBP/USD

Cable remained the best performer for the day following positive updates on Brexit front. Quite notably, the GBP/USD pair had already made an upper drift, crossing above the Red Ichimoku Clouds that acted as firm support. Also, the base line and the conversion line stood below the trading pair, providing additional strength to the bulls.

Earlier, German Chancellor Angela Merkel had given Britain 30-days time to come up with a solution for the Irish Backstop. However, today, Merkel clarified that she wanted to highlight “shorter time” by mentioning 30-days.

“It was said we would probably find a solution in two years. But we could also find one in the next 30 days, why not?” said Merkel, Europe’s most powerful leader.

Anyhow, later the day, French President Emmanuel Macron commented that it was too late to get a whole new deal before the deadline. However, both parties were simultaneously preparing to face the repercussions in case of a no-deal Brexit.

Meantime, the Relative Strength Index (RSI) has skyrocketed to 71 levels, revealing higher buyer interest.

EUR/USD

The Fiber was almost near its opening mark as the day was approaching closing, forming a Grave Stone Doji Candlestick. Noticeably, the RSI remained muted near 40 mark, showing neutral buyer interest. The major downside developed as counterpart GBP rose amid optimistic Brexit updates. Anyhow, the economic docket remained green on the backdrop of upbeat economic data releases. German August Markit Manufacturing PMI reported 43.6 points, higher than 43.0 market expectations. Also, August Eurozone Markit PMI Composite recorded 1.17% above the 51.2 points consensus estimates.

At around 11:30 GMT, ECB Meeting minutes read that the outlook for the economy remains weaker and further stimulus would come as early as in September. Meantime, reports suggested that the Eurozone economy had hardly grown in the Q2’19 while German steps in for a probable recession.

“Downside risks had become more pervasive and that their persistence could ultimately also necessitate a revision to the baseline growth scenario,” the ECB minutes read.

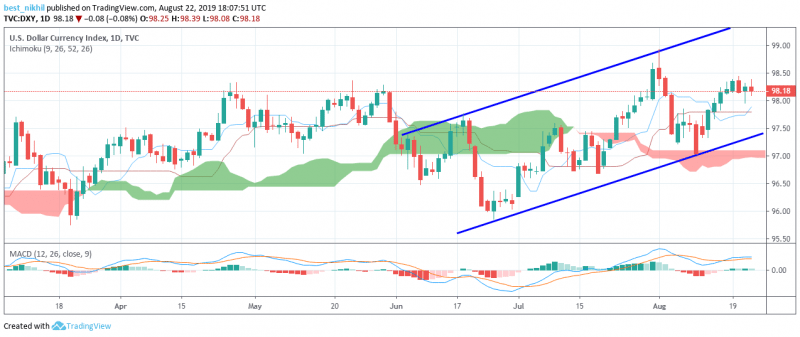

USD Index

Greenback had maintained a choppy performance today, remaining within 98.14/98.38 range levels. Also, the USD Index was hovering above the Ichimoku Clouds, sustaining a positive trend. The US economic docket showcased mixed data on Thursday.

This time, the Continuing Jobless Claims computed since August 9 reported 1.674 million over 1.700 million forecasts. And, the Initial Jobless Claims calculated since August 16 recorded 7K lower than 216K market expectations. Anyhow, the August Markit PMI data displayed adverse reports. Notably, the August Markit PMI Composite published 1.57% lower than the 50.9 points market hopes.

USD/CHF

After marking the day’s opening near 0.9827 level, the Swiss Franc pair was 0.11% up in the North American session. Earlier the day, the Q2 YoY Industrial Production data recorded 4.8% over the previous 4.3%. Such an upbeat Swiss data release had pleased the pair bears. Anyhow, the bulls seemed to overtake the bears and kept the uptrend intact. However, any downside would have got caught near the stable 0.9694 support handle. On the upper side, strong resistances remained stemmed near 0.9947, 1.0013, and 1.0098 marks in order to cap any potential upward drifts.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance