Football’s ‘dirty dozen’ have paraded their weaknesses for all to see

At one level, the owners of “dirty dozen” big football clubs could shrug and say nothing has changed. They didn’t have their horrible European Super League this time last week and they still don’t have it. Shares in Manchester United, listed in New York, jumped 10% on the initial announcement and have merely returned to where they were.

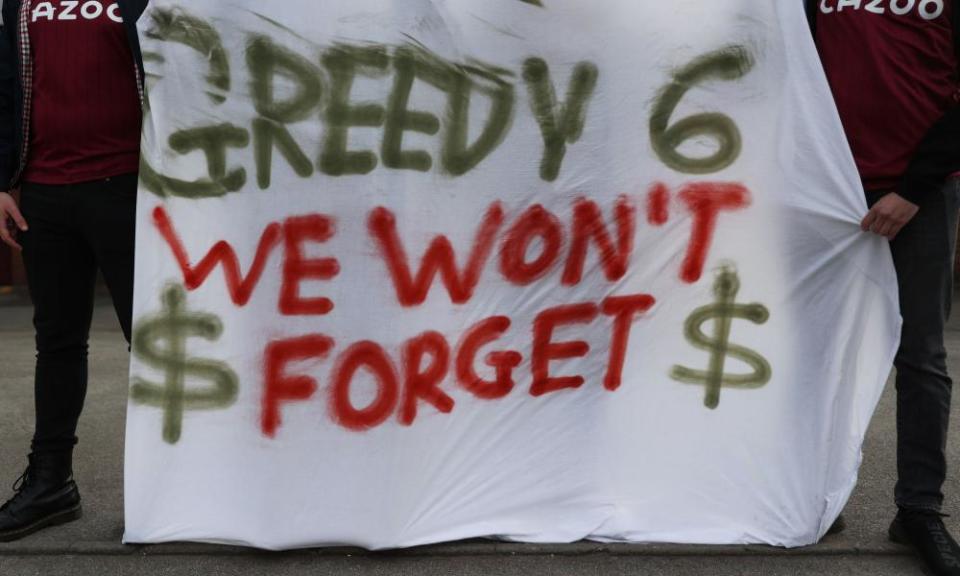

To conclude that no harm has been done, though, would be ridiculous. Rather like a company that launches a hostile bid and quickly folds in chaotic fashion, the big clubs have paraded their weaknesses for all to see.

There is a parallel with Kraft Heinz’s attempted £115bn assault on Unilever in early 2017. That, too, provoked public and political uproar about hard-nosed Americans trying to crush European traditions (in that case Unilever’s “sustainability” culture). The adventure was also pulled after 48 hours amid divisions in the ranks – Warren Buffett, backer of Kraft Heinz, couldn’t stand the heat.

The point to note is that Kraft Heinz’s share price then fell by two-thirds in the next three years. Investors’ perceptions were transformed. They suddenly saw a heavily indebted and aggressively-managed company that had run out of costs to cut and was seeking a big deal to paper over the cracks.

In the same way, the football club owners have just advertised their anxieties over debt and their inability to raise broadcast revenues under European football’s current model. At a stroke, they have also made those problems harder to solve.

The get-out-of-jail card of a closed shop competition with salary caps is dead, or at least delayed by a decade or three. The “other 14” members of the Premier League may feel emboldened to cement the voting powers of the “big six” once and for all.

And the new unpredictable element is a UK government flirting with the idea of giving fans a financial stake in clubs.

It is hard to see how owners can be compelled to sell shares, but, for any billionaire, oligarch or sovereign wealth fund now wishing to cash up, the politics of stepping off football’s merry-go-round look more complicated.

Kraft Heinz had specific problems, including an accounting scandal that emerged later. But a spectacularly misjudged strategic gamble that falls at the first hurdle is usually a reliable “sell” signal wherever it appears. It means the financial woes are probably worse than feared.

Foxtons should go for zero

Here are a few factors the remuneration committee of Foxtons, the London estate agency, could have cited to award no bonuses to executives for 2020.

The company took £4.4m in furlough support from the public purse. It enjoyed relief from business rates amounting to £2.5m. It reported a pretax loss of £1.4m. The share price fell by a third over the course of the year. And shareholders were obliged to inject £21m in fresh equity during the pandemic.

The pay committee, however, thought deeply and decided a bonus of £389,000 was in order for chief executive Nic Budden. That was in addition to £550,000 in salary and the award of £569,000 in shares under a long-term incentive scheme.

Pay chair Alan Giles offered a grating explanation about how he and his nonexec chums applied “discretion” to nudge the bonus down from an ever larger one. Come on, zero was the only sensible choice. You’ve taken a large dollop of taxpayer cash in a rotten 12 months. It was not a moment for boardroom bonuses of any size.

Shareholders vote on Foxtons’ pay report on Thursday. If fund managers can’t summon a collective thumbs-down – on a mere advisory poll – they never will.

Retail park pain

House prices are rising, but commercial property prices aren’t – at least not on retail parks.

Back in February last year, Hammerson agreed the sale of seven such parks, ranging from Didcot to Falkirk to Middlesbrough, for £400m. The deal collapsed, however, as the buyer, Orion, got cold feet when the pandemic arrived. Now there is a new buyer, Canadian giant Brookfield, but there’s a big difference in the terms: the price is now £330m.

Hammerson could be viewed as a distressed seller since new chief executive Rita-Rose Gagné is trying to repair a balance sheet ruined by the last management. Even so, a £70m, or 17.5%, fall in the departing portfolio’s value over 14 months is steep.

Retail parks, remember, are supposed to be a corner of the retail property market that has been semi-protected during lockdown since cautious shoppers have been able to travel by car. This transaction suggests a lot more pain to come for high street landlords.

Yahoo Finance

Yahoo Finance