A Foolish Take: US Retailers Post Strongest Holiday Growth in 6 Years

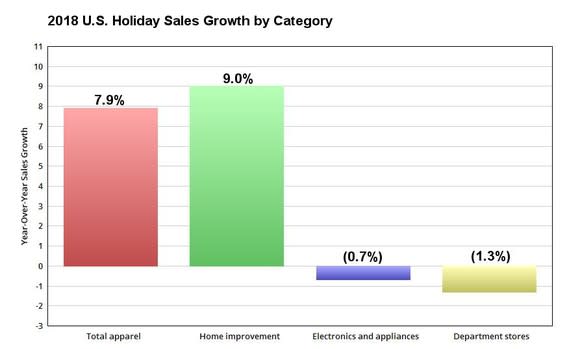

U.S. holiday sales rose 5.1% to over $850 billion in 2018 and marked the retail industry's strongest growth in six years, according to Mastercard SpendingPulse. The report, which tracked holiday spending between Nov. 1 and Dec. 24, also revealed that certain retail categories outperformed others.

Data source: Mastercard SpendingPulse. Chart by author.

The strength of the apparel sector was good news for retailers like American Eagle Outfitters (NYSE: AEO) and Abercrombie & Fitch (NYSE: ANF), which are both riding multiquarter streaks of comparable-store sales growth. American Eagle's expansion is supported by its high-growth lingerie brand Aerie, and A&F's turnaround is led by Hollister.

The strength of home improvement retailers like Home Depot (NYSE: HD) also wasn't surprising, since they're largely immune to e-commerce competition. However, rising interest rates and slowing home sales -- which Home Depot warned investors about last year -- could throttle that growth.

Finally, the weakness of department stores wasn't surprising. Major chains like Macy's and J.C. Penney have been shuttering stores, but their core businesses remain exposed to competition from Amazon and Walmart. Mastercard's report suggests that pressure will continue for the foreseeable future.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Leo Sun owns shares of Amazon. The Motley Fool owns shares of and recommends AMZN and MA. The Motley Fool has the following options: short February 2019 $185 calls on Home Depot and long January 2020 $110 calls on Home Depot. The Motley Fool recommends Home Depot. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance