Food Stock Earnings Roster for May 7: THS, HAIN, NOMD & More

Food companies kept supply lines flowing during the coronavirus pandemic that started in the mid of March. Focus on innovation and reinvention of product mixes, around-the-clock shifts, improving delivery options and adopting safety measures are likely to have influenced the quarter’s performance of the industry participants.

However, closure of restaurants and less-frequent grocery shopping led to reduced demand for fresh produce and fisheries’ products, affecting producers and suppliers. Agriculture, fisheries and aquaculture companies may have particularly been hit by restrictions on tourism, closure of restaurants and cafeterias, and school meal suspensions. Moreover, costs associated with additional efforts to support growth amid the crisis are likely to have been a limiting factor. Rising input costs, escalated logistics and packaging expenses, and higher advertising costs may have also been hurdles for several food companies.

Meanwhile, food players’ focus on cost-saving and efficient pricing actions may have benefited from innovation, buyouts and other brand-building efforts. This makes us somewhat optimistic on the first-quarter performance of food stocks, which belongs to the Zacks Consumer Staples sector. Notably, the sector is currently ranked among the top 32% out of the 16 Zacks sectors.

The latest Zacks Earnings Preview suggests that the Consumer Staples sector’s March-quarter earnings are expected to grow 9.1% year over year, with revenues advancing 9.9%.

That said, let’s take a look at five Consumer Staples stocks, which are scheduled to report results on May 7. Our research shows that for stocks with the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), the chance of a positive earnings surprise is high. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

TreeHouse Foods, Inc. THS has been witnessing a drab sales trend for a while now, partly due to SKU rationalization efforts and adverse volume/mix. Also, foreign currency headwinds have been concerning. We note that the company has been particularly struggling with sluggish Baked Goods and Meal Solutions units. Incidentally, it recently informed that it will reorganize itself into two segments on the basis of market dynamics (Snacking & Beverages, and Meal Preparation), effective first-quarter 2020.

Nevertheless, the company’s focus on healthy and organic product offerings bodes well. Also, TreeHouse Foods’ restructuring initiatives have been yielding results. To this end, the company has been benefiting from its Structure to Win program, which focuses on aligning SG&A expenses with its division structures. Moreover, it has been on track with its TreeHouse 2020 plan. Alongside cost savings, the initiative has been helping the company manage its portfolio, and optimize production and supply chain.

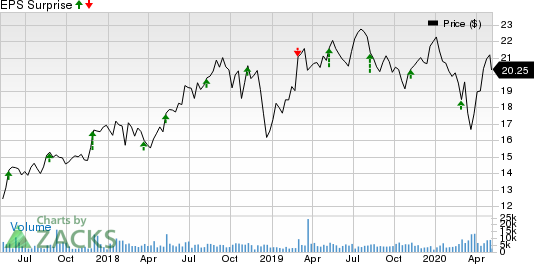

TreeHouse Foods, Inc. Price and EPS Surprise

TreeHouse Foods, Inc. price-eps-surprise | TreeHouse Foods, Inc. Quote

Our proven model predicts an earnings beat for TreeHouse Foods in first-quarter 2020. The company has a Zacks Rank #3 and an Earnings ESP of +25.00%. (Read More: Factors to Know Ahead of TreeHouse Foods' Q1 Earnings)

The Hain Celestial Group, Inc. HAIN has been gaining from its transformation strategy and Project Terra, which are expected to get reflected on third-quarter fiscal 2020 results. In addition, the divestiture of underperforming units to focus on areas with better potential has been aiding the company. Elimination of uneconomic spending, innovation and stock-keeping unit rationalization program are expected to have aided quarterly performance.

However, any deleverage in SG&A expenses may show on the company’s profits. Foreign currency translation woes and divestiture of brands and units that may have led to sales loss are likely to have affected the overall top line in the to-be-reported quarter.

The Hain Celestial Group, Inc. Price and EPS Surprise

The Hain Celestial Group, Inc. price-eps-surprise | The Hain Celestial Group, Inc. Quote

Our proven model predicts an earnings beat for Hain Celestial this time around. The company sports a Zacks Rank #1 and has an Earnings ESP of +9.24%. (Read More: Factors to Note Ahead of Hain Celestial's Q3 Earnings)

Post Holdings, Inc. POST has been benefiting from contributions of buyouts and other efforts to expand its customer base. The company’s foodservice segment has been performing well on the back of buyouts over the past few quarters and gaining from solid performance in Bob Evans side dishes. The second-quarter fiscal 2020 is not likely to have been an exception.

However, it has been witnessing increasing SG&A expenses, which is concerning. Also, the company recently informed that on Feb 27 a fire broke out at its Michael Foods farm operation in Bloomfield, NE. The impact of the incident is expected to get reflected in its quarterly results.

Post Holdings, Inc. Price and EPS Surprise

Post Holdings, Inc. price-eps-surprise | Post Holdings, Inc. Quote

Our proven model does not conclusively predict an earnings beat for Post Holdings this season. The company has a Zacks Rank #3 and an Earnings ESP of -15.15%. (Read More: Factors to Watch Before Post Holdings' Q2 Earnings)

Nomad Foods Limited NOMD has been witnessing robust organic revenue improvement for the past few quarters mainly on growth in the majority of its core markets. The company is likely to have benefited from solid execution of core categories and strategic expansion in the first quarter of 2020. Moreover, the company may have gained from the expansion of the Green Cuisine range, which has an ambitious launch calendar in many countries in the first half of 2020.

However, the company expects adjusted EBITDA to decline year over year in double-digit percentage in the first quarter due to gross margin phasing and the timing of A&P. Further, it is expected to have witnessed continued impact from raw material inflation and forex.

Nomad Foods Limited Price and EPS Surprise

Nomad Foods Limited price-eps-surprise | Nomad Foods Limited Quote

Our proven model predicts an earnings beat for Nomad Foods this time around. The company has a Zacks Rank #2 and an Earnings ESP of +5.32% at present.

Corteva, Inc.’s CTVA efforts to boost digital capabilities, expedite the process of product launches and cost containment are commendable. The company has been gaining from cost synergies over the past few quarters and the first-quarter 2020 may have also benefited from the same.

However, it has been grappling with soft sales in the North America market. Market disruptions due to weather-related delays, and soft volumes and pricing have been weighing on North America sales. The headwinds may have hurt the Crop Protection segment’s performance. Nonetheless, the company expects normalized conditions in the North America market coupled with continued ramp-up of products globally in both Crop Protection and Seed segments to aid results in the first quarter.

Corteva, Inc. Price and EPS Surprise

Corteva, Inc. price-eps-surprise | Corteva, Inc. Quote

Our proven model does not conclusively predict an earnings beat for Corteva this season. The company has a Zacks Rank #4 and an Earnings ESP of -2.09%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hain Celestial Group, Inc. (HAIN) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report

Corteva, Inc. (CTVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance