Some Fomento de Construcciones y Contratas (BME:FCC) Shareholders Are Down 22%

Fomento de Construcciones y Contratas, S.A. (BME:FCC) shareholders should be happy to see the share price up 15% in the last month. The stock is actually down over the last year. But on the bright side, its return of 22%, is better than the market, which is down 0.234607.

See our latest analysis for Fomento de Construcciones y Contratas

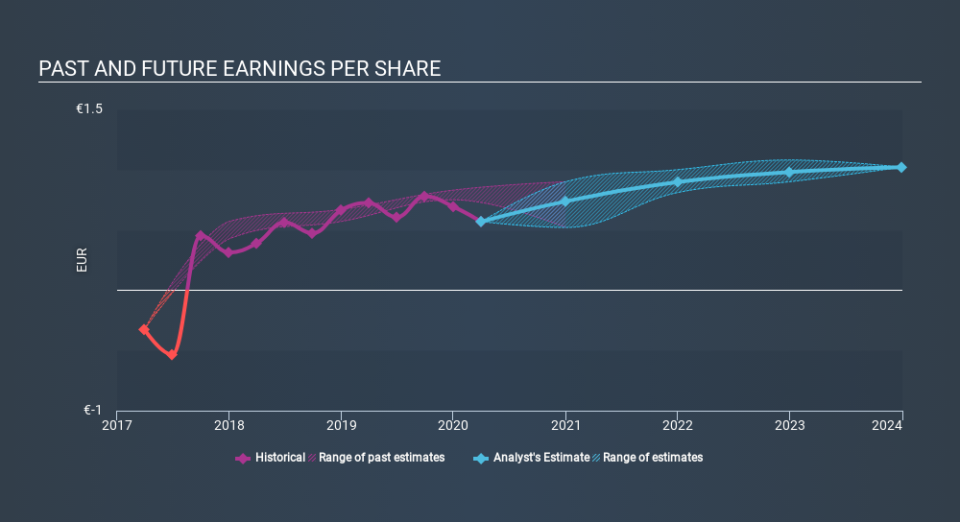

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unhappily, Fomento de Construcciones y Contratas had to report a 21% decline in EPS over the last year. This change in EPS is remarkably close to the 22% decrease in the share price. So it seems that the market sentiment has not changed much, despite the weak results. Instead, the change in the share price seems to reduction in earnings per share, alone.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Fomento de Construcciones y Contratas's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Fomento de Construcciones y Contratas's TSR, which was a 22% drop over the last year, was not as bad as the share price return.

A Different Perspective

The total return of 22% received by Fomento de Construcciones y Contratas shareholders over the last year isn't far from the market return of -23%. So last year was actually even worse than the last five years, which cost shareholders 0.3% per year. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Fomento de Construcciones y Contratas is showing 4 warning signs in our investment analysis , and 1 of those is significant...

Fomento de Construcciones y Contratas is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance