First Cobalt Takes on The DRC While Building Major Ontario Camp

Forget Cobalt’s Price. Think Surety of Supply. Ask the Chinese

There's a decent case to be made to own good cobalt with savvy management that can navigate the DRC and has diversified into excellent politically friendly areas. Maybe Canada?

Investors know that globally, the vast majority (65%) of this technology critical metal is hacked out of the Africa's DRC which, depending on with whom you speak, is both a hell hole and a saviour.

Fortunately, things are moving more toward the latter. The other part to the growth of the sector is a serious effort to establish, for lack of a better characterization, more politically friendly supply. As with most critical metals, particularly the cobalts, lithium, manganese etc., the other non-negotiable aspect is surety of supply.

For several years now, top producers such as Glencore (OTCPK:GLCNF) and Ivanhoe (TSX:IVN) have upheld Paris' sustainability directives. Robert Friedland's Kamoa-Kakula discovery (joint venture between Ivanhoe Mines, Zijin Mining Group Co., Ltd. and the Government of the Democratic Republic of Congo) in the DRC is the largest copper-cobalt discovery ever made on the African continent.

Now, First Cobalt (TSX-V: FCC) (OTC: FTSSF) is the latest group to make a serious commitment to the DRC. Further FCC mandates itself to revive and build a world class cobalt camp in, where else? Cobalt Ontario, Canada.

On the conflict (or 'Blood') cobalt discussion, it represents about 10% of DRC production at the high end. FCC will fully adopt the Paris Clean Cobalt standards. Management will demand nothing less than the highest standards in all of its activities, be they social, economic or environmental.

Ubiquitous, but salient facts:

- Democratic Republic of Congo produces 65% of global Cobalt

- China refines almost 60% globally

- Chinese have spent $6 billion in DRC to establish surety of supply

- Social issues identified with DRC artisan and local mines, but will take time to resolve

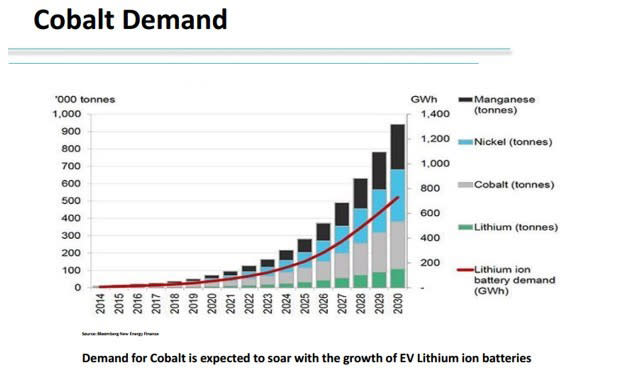

- EV needs 17% of all cobalt by 2021

- 900 tonne deficits in 2017, 5340 tonne deficits in 2020

- Lithium cobalt oxide and lithium nickel cobalt aluminum oxide; US stockpiling as strategic

- Cobalt CAGR conservatively forecast to grow 5% for next decade

Largely anecdotal, but likely having a good measure of truth is the apparent hoarding of cobalt by governments—particularly the Chinese (5k tonnes in 2014, 2015 and likely equal or higher to date) and some hedge funds. US Government is also stockpiling as the aerospace industry requires that 'surety of supply'.

You get the point. First, cobalt will likely be a major growth commodity for at least a decade. Second, supply will get pinched by those who require more and more cobalt. Third, the price will continue to be uber-volatile.

FCC Plans in DRC

This relationship will allow First Cobalt to firmly establish a presence in one of the richest mining camps in the world.

On FCC's seven DRC properties the Company has established a partnership with strong in-country operator Madini.

All seven properties are on prospective ground proximal to several major copper-cobalt operations and projects in the Central African Copperbelt. The claims total 190 km2 and some are contiguous allowing for systematic exploration.

Surface mineralization is confirmed at all properties. Within the cluster of 5 properties near Lubumbashi, small scale mining has exposed cobalt and copper mineralization. One of the properties has a test pit exploring for mineralization at depth and another is adjacent to a pilot open pit developed by state-owned mining company Gécamines S.A.

Highlights of DRC Properties

- Transaction represents a low-risk entry point into the world's leading cobalt jurisdiction

- Properties join the Company's Keeley-Frontier Mine option in Canada to expand its global portfolio of cobalt properties

- First Cobalt to become a 70% joint venture partner on each of seven properties

- Properties represent substantial land package totaling 190 km2 (19,000 hectares) on the Central African Copperbelt in Katanga, DRC, all with known surface mineralization

- Madini will appoint Congolese Serge Ngandu, Pr. Eng., to the First Cobalt board of directors

- Madini will have an 8.5% ownership interest of First Cobalt

FCC has constructed the relationship with African partners to ensure social, economic and environmental sensitivity to ensure sustainable growth and the delivery of consistent shareholder value.

FCC Plans in Cobalt Ontario; Keeley-Frontier

The Company is currently advancing its Silver Centre, Ontario property, a 2,100-hectare property in a historic mining camp located 400 km north of Toronto and 25 km south of Cobalt, Ontario. The property includes the former producing Keely-Frontier mine, a high-grade mine that produced over 3.3 million pounds of cobalt and 19.1 million ounces of silver.

Nearby Cobalt and Silver Centre have seen 50 million pounds of cobalt and 60 million ounces of silver extracted during a 60-yer period.

In 2012, a 6-hole 2,058-metre diamond drill program, power-stripping and channel sampling was completed by Canadian Silver Hunter. Results from this exploration program and compilation of historical data suggest that there is significant potential to discover new high-grade cobalt and silver mineralization.

On June 5th, 2017, the Company announced the completion of a testing phase at the Keeley-Frontier property.

Dr. Frank Santaguida, Vice President, Exploration commented,

"The completion of this phase of our exploration program at Keeley-Frontier is essential to our strategy to unlock the cobalt potential in this camp. …, as it will help predict the location of previously unknown vein sets. We are looking forward to completing the interpretation of the geophysical data in the coming weeks."

As one of two of the largest players (along with strategic partner Cobalt One) in the area, the plan is to revive and eventually consolidate the mines and area after 75 years of inactivity. The plan includes utilizing the Yukon refinery on a 50/50 basis as well as 40 acres of permitted property. FCC believes the potential in the area lends itself to being developed into a major mining camp because of modern mining and exploration techniques that were not available half a century ago.

The Yukon refinery is one of only four such permitted facilities in Canada, and the only refinery in North America with no set limits on processing or storing arsenic from feeds; significant given that the camp has produced silver-cobalt arsenide ores throughout its history.

3 M's: Money, Moxey, Management.

FCC has $6 million and no debt. The challenges of the DRC don't scare the Company. It intends to bring online the former producing Keeley-Frontier mine, a high-grade silver-cobalt mine (produced over 3.3 million pounds of cobalt and 19.1 million ounces of silver 1908 - 1965).

"The Cobalt Ontario mining camp was historically a series of a small, high-grade, narrow vein mines," stated Trent Mell CEO and President of FCC. "Modern mining techniques favour large bulk-scale mining – something never considered for the Cobalt mining district until our team's assessment. Our conclusion was that after laying fallow for 75 years after Keeley-Frontier's heyday, there is significant potential for a new approach."

Key Management

Trent Mell

President & CEO

Mr. Mell is a mining executive and capital markets professional with extensive international transactional experience acquired through more than 200 transactions, including M&A and over $2.6 billion in equity and debt financings.

Dr. Frank Santaguida, P.Geo.

Vice President, Exploration

Dr. Santaguida is a geoscientist with over 25 years of experience and he has worked around the world on a wide range of base and precious metal ore deposits. His extensive experience in world-class base metal mining camps such as the Kidd Creek (Canada), Mt. Isa (Australia) and the African Copperbelt (Zambia-DRC) aligns with the Company's strategy of building a geographically diversified portfolio of cobalt projects.

Peter Campbell, P.Eng.

Vice President, Business Development

Mr. Campbell is a Professional Engineer with 35 years' experience in mining operations, mineral exploration and capital markets. His mining experience includes working in day-to-day mining operations, mine design and on new mine developments for Falconbridge Limited (now Glencore), an industry leader in the cobalt industry.

Conclusion

There is little doubt that cobalt deserves at least a small part in a speculative/junior mining/tech portfolio.

The fact that investors no longer find it necessary to make the 'everything needs cobalt' argument is testament to the fact the metal is a solid commodity increasingly worthy of investment and note.

And while investors may have an opinion on the history and or practices in the DRC, it remains the pre-eminent area and better to align with western companies such as Glencore, Ivanhoe and First Cobalt that understand the situation and are committed to be all or part of the solution.

The foregoing should interest and intrigue those looking for a compelling vehicle to gain global cobalt exposure. The added benefit is management that is second to none in the mining industry as a whole as well as the DRC in particular.

Also, the potential to develop a world class mine in Ontario should not be discounted or eschewed. The bottom line is the world needs ever-increasing amounts of cobalt.

Now you know how, with whom and where we are going to get it.

Legal Disclaimer/Disclosure: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Baystreet.ca has been compensated four thousand dollars for its efforts in presenting the FCC profile on its web site and distributing it to its database of subscribers as well as other services. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Yahoo Finance

Yahoo Finance