First American Financial (FAF) Q2 Earnings & Revenues Beat

First American Financial Corporation FAF reported second-quarter 2021 operating income per share of $2.13, which outpaced the Zacks Consensus Estimate by 30.7%. Moreover, the bottom-line doubled year over year.

The company’s results reflect improved segmental revenues, partially offset by increase in expenses.

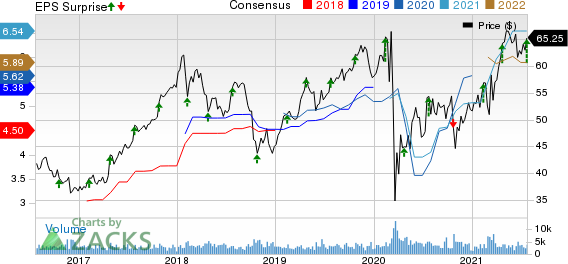

First American Financial Corporation Price, Consensus and EPS Surprise

First American Financial Corporation price-consensus-eps-surprise-chart | First American Financial Corporation Quote

Behind the Headlines

Operating revenues of $2.3 billion increased 40.8% year over year on the back of higher direct premiums and escrow fees, agent premiums, information and other. Moreover, the top-line figure beat the Zacks Consensus Estimate by nearly 20.9%.

Net investment income however decreased 4% to $56 million.

Total expense of $1.9 billion increased 34.9% year over year due to higher personnel costs, premiums retained by agents, provision for policy losses and other claims, interest, premium taxes and other operating expenses.

Segment Results

Title Insurance and Services: Total revenues increased 44.1% over year to $2.1 billion. The upside came on the back of improved direct premiums and escrow fees, agent premiums and higher information and other revenues.

Pretax margin expanded 280 basis points (bps) year over year to 19.1%.

Title open orders decreased 6.2% to 329,500 while Title closed orders increased 6.5% year over year to 271,100, driven by growth in purchase and commercial orders, partially offset by lower refinance orders.

Average revenue per order increased 50% year over year to $11,100. Shift in the order mix from lower-premium residential refinance transactions to higher-premium commercial and purchase transactions impacted average revenue per order.

The average revenue per direct title order increased to $2,651 due to higher average revenue per order from commercial transactions related to larger deal size and from residential transactions primarily driven by strong home price appreciation.

Specialty Insurance: Total revenues increased 13.6% year over year to $151.6 million, driven by higher direct premiums and escrow fees.

Pretax margin expanded 750 bps to 13%.

Financial Update

First American exited the quarter with cash and cash equivalents of $2.2 billion, up 74.3% from 2020 end. Notes and contracts payable were $1 billion, down 0.2% from 2020 end.

Cash flow from operations was $253 million, down 26.4% year over year. The downside was due to the deferral of estimated tax payments, allowed by taxing authorities during the height of pandemic in 2020.

Stockholders’ equity was $5.2 billion, up 7.2% from 2020 end.

Zacks Rank

First American currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other insurance industry players, which have reported second-quarter earnings so far, the bottom line of The Progressive Corporation PGR, RLI Corp. RLI and The Travelers Companies, Inc. TRV beat the Zacks Consensus Estimate.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

First American Financial Corporation (FAF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance