The Fintech Select (CVE:FTEC) Share Price Is Up 133% And Shareholders Are Boasting About It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It hasn't been the best quarter for Fintech Select Ltd. (CVE:FTEC) shareholders, since the share price has fallen 22% in that time. But in three years the returns have been great. In fact, the share price is up a full 133% compared to three years ago. After a run like that some may not be surprised to see prices moderate. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

Check out our latest analysis for Fintech Select

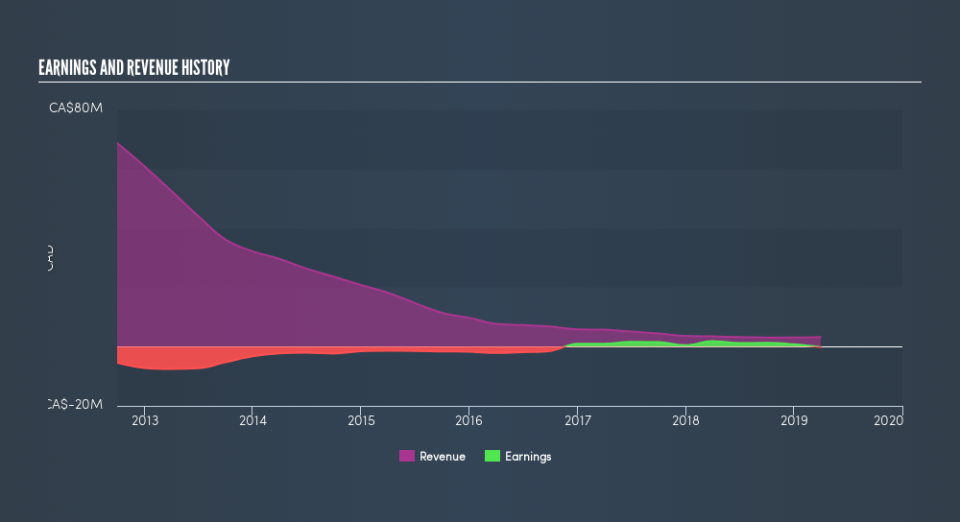

Because Fintech Select is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Fintech Select actually saw its revenue drop by 35% per year over three years. So the share price gain of 33% per year is quite surprising. It's fair to say shareholders are definitely counting on a bright future.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Fintech Select's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Fintech Select had a tough year, with a total loss of 65%, against a market gain of about 0.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 37% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like Fintech Select better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance