FICO Scores Are at an All-Time High

Credit scores in America are getting better. In fact, the national average FICO score has hit an all-time high, according to new numbers pulled by the credit-scoring company.

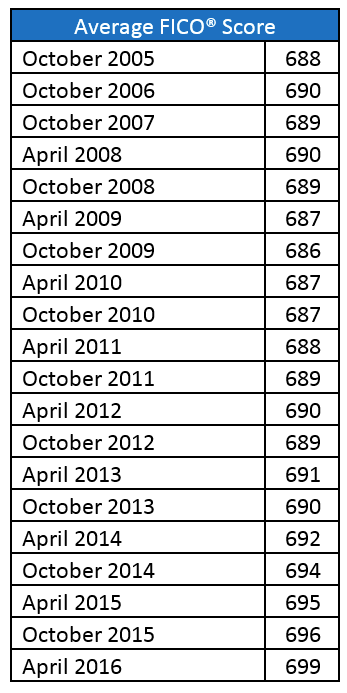

The national average FICO score hit 699 in April, up nine points since October 2006, per the table below. That's also a three-point improvement over the national average from just six months prior in October 2015. The continued climb is due to low rates of default across credit cards and other consumer loan products, according to Ethan Dornhelm, a principal data scientist at FICO.

"We are now seven years past the nadir of the Great Recession in 2008-2009, which means that, per the Fair Credit Reporting Act mandate, all derogatory payment information from the spike in foreclosures and defaults must now be removed from consumers' credit files," Dornhelm said in an email. "Plus, there continues to be a steady decrease in the percentage of consumers with recent serious delinquencies (defined as 90-plus days past due). Because payment history comprises roughly 35% of the overall FICO Score calculation, this sustained reduction in delinquency is clearly a key driver of the ongoing upswing."

Also, consumers are becoming more educated about credit scoring and why their credit is important, Dornhelm said.

There are many different credit scores available to lenders, and they each develop their own credit score range. That's important, because if you get your credit score, you need to know the credit score range you are looking at so you understand where your number fits in.

Here are a few credit score ranges among various scoring models:

FICO Score range: 300–850

VantageScore 3.0 range: 300–850

VantageScore scale (versions 1.0 and 2.0): 501–990

PLUS Score: 330–830

TransRisk Score: 100–900

Equifax Credit Score: 280–850

A 699 FICO score is pushing right up against the FICO "good credit" threshold, as you can see here:

Excellent Credit: 750+

Good Credit: 700–749

Fair Credit: 650–699

Poor Credit: 600–649

Bad Credit: Below 600

If your credit scores aren't on the same trajectory as the average American's, there are some things you can do to help get your scores moving in the right direction.

Check Your Credit Report

Errors on credit reports are actually more common than you may think, so combing over your credit report can benefit your score if it is indeed being pulled down by someone else's negative information. If it isn't, the exercise can be instrumental in illustrating what you need to do to improve your creditworthiness. Most versions of reports point out what items are particularly detrimental to the person's score.

Everyone is entitled to a free credit report from the three major bureaus — Experian, Equifax or Transunion — each year. You can also monitor your score for free and get advice on what might be pulling down your score with Credit.com's Credit Report Card.

Pay Down Credit Card Debt

One of the only surefire ways to give your credit score a quick boost is to pay down any existing debt you may be carrying on a credit card. This will have an immediate (and positive) impact on your credit utilization ratio, which essentially involves how much credit you are using versus how much is actually available to you.

Keep in mind, the move will only work if you pay down the debt then refrain from running up a big balance on the card. Issuers report current balances along with your payment status on a monthly basis, so it won't take long for these new charges to catch up to you.

Make All Payments on Time

A first missed payment can cause a great credit score to fall 100 points or more. The good news is, so long as you don't follow up this misstep with an even bigger one, you won't feel the full effect for the entire seven years it takes the line item to age off your credit report. Begin to undo the damage by getting current on your payments and recommitting yourself to making all future ones on time.

To avoid unconsciously missing a due date, you can enroll in auto pay by linking your credit card and debit card accounts. You also might be able to do enroll for these options via your issuer's tablet or mobile app.

More from Credit.com

Yahoo Finance

Yahoo Finance