Will FedEx (FDX) Q4 Earnings Bring More Cheer to Its Industry?

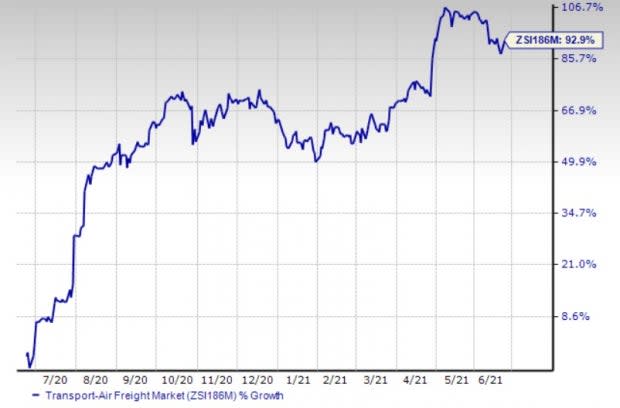

It is a well-documented fact that the widely-diversified transportation sector is on the mend this year as coronavirus-induced restrictions are being eased and economic activities are picking up with more people getting vaccinated each day. The Zacks Transportation - Air Freight and Cargo industry has remained the brightest spot amid the pandemic and has surged 92.9% in the past year.

Image Source: Zacks Investment Research

Amid this bullish backdrop, FedEx Corporation FDX, which along with United Parcel Service UPS, dominates and defines the Zacks Transportation - Air Freight and Cargo industry, will release its fourth-quarter fiscal 2021 (ended May 31, 2021) results tomorrow i.e. Jun 24.

Factors Likely to Impact FedEx Q4 Results

Even though coronavirus-led restrictions have eased, e-commerce is still likely to have been the primary growth driver for FedEx in the to-be-reported quarter. Backed by e-commerce growth, the Zacks Consensus Estimate for fiscal fourth-quarter revenues at the FedEx Ground unit, which handles e-commerce deliveries for many retailers, stands at $7,903 million, indicating an increase of 23.6% from the reported figure in the year-ago quarter.

Owing to higher revenues, the Zacks Consensus Estimate for operating income at the segment stands at $1,033 million, indicating an increase of 53.4% from the fiscal fourth-quarter 2020 actuals. Residential volume growth is likely to have driven Fedex Ground revenues in the quarter to be reported.

The Ground unit apart, other primary segments. namely FedEx Express and FedEx Freight, are likely to report higher revenues year over year. While international export and U.S. domestic-package volume growth are anticipated to have generated higher revenues at FedEx Express, higher revenues per shipment and average daily shipments are likely to have boosted revenues at the FedEx Freight unit in the to-be-reported quarter.

Notably, the Zacks Consensus Estimate for revenues in the fiscal fourth quarter at the FedEx Express unit currently stands at $10,878 million, indicating an increase of 27.1% from the reported figure in the year-ago quarter. Similarly, the consensus mark for Freight segment’s revenues is currently pegged at $1,986 million, 22.9% above the year-ago quarter’s actuals.

Driven by impressive performance at the segments, total sales are likely to have benefited. Notably, the consensus mark of $21.43 billion for total sales suggests an increase of 23.4% from the year-earlier quarter’s reported number.

Why a Likely Earnings Beat

Adding to the optimism, the proven Zacks model predicts an earnings beat for FedEx this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a positive earnings surprise. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company currently has an Earnings ESP of +1.71% as the Most Accurate Estimate is pegged at $5.10, higher than the Zacks Consensus Estimate of $5.01. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Moreover, FedEx carries a Zacks Rank #2.

In the event of the prediction coming true, the FedEx stock, which has surged in excess of 100% in the past year, is likely to get a further boost. This is because an earnings beat more often than not leads to stock price appreciation.

Stocks to Watch

In fact, an earnings outperformance from FedEx is likely to buoy the shares of fellow industry players like UPS, Atlas Air Worldwide Holdings AAWW and Air Transport Services Group ATSG, which too are riding high on the e-commerce boom.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

Air Transport Services Group, Inc (ATSG) : Free Stock Analysis Report

Atlas Air Worldwide Holdings (AAWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance