FedEx Adjusts to the Headwinds

FedEx's (NYSE: FDX) fiscal fourth-quarter earnings revealed a company in the throes of transformation while it deals with some weaker-than-expected end-market conditions and operational issues relating to the 2016 acquisition of TNT Express. It's an eventful time to say the least, so let's take a closer look at what happened with FedEx's recent earnings report.

FedEx's fourth-quarter earnings report: The raw numbers

Starting with the headline numbers from report:

Full-year total revenue increased 6.5% year over year to $69.7 billion, but the $4.24 billion increase was slightly below CEO Fred Smith's expectation for a $4.5 billion year-over-year increase.

Full-year adjusted diluted EPS of $15.52 came in at the middle of the guidance range of $15.10-$15.90.

Image source: Getty Images.

Smith began the earnings call by citing a slowdown in global trade and "the less favorable service mix of TNT Express business after the NotPetya cyberattack and continued rapid growth of e-commerce demand."

Surging e-commerce demand, although a good thing in the long-term, is creating the demand for UPS (NYSE: UPS) and FedEx to invest heavily in their networks to service demand, and it also creates margin challenges because of the expensive nature of business-to-consumer deliveries. Essentially, it's both a challenge and an opportunity for FedEx and UPS.

Segment performance

The express segment bore the brunt of the difficulties in the quarter. To be fair, it was largely anticipated, as CFO Alan Graf had already prepared investors for a decline in express earnings because of anticipated weakness in international volumes. In addition, on the third-quarter earnings call, Graf similarly predicted the ground segment's impressive revenue growth and its margin compression.

In the U.S., total package volume growth was 9.3% in the quarter, with revenue growing by 7.5%. However, it was a different story internationally, with total international export package volume growth rising only 3.2%, and revenue declined 2.3%.

FedEx Segment | Q4 Revenue | Year-Over-Year Growth (Decline) | Operating Income | Year-Over-Year Growth |

|---|---|---|---|---|

Express | $9.5 billion | (1%) | $766 million | (12%) |

Ground | $5.32 billion | 11% | $810 million | 0% |

Freight | $1.96 billion | 5% | $194 million | 15% |

Total | $17.8 billion | 3% | $1.32 billion | (1%) |

Data source: FedEx presentations.

Discussing TNT, Smith highlighted the impact of the NotPetya virus on TNT's operations and how it had caused the company to lose business, but he promised investors that "the integration of TNT is now progressing at a good clip, and we will see significant benefits by this time in summer 2021."

Meanwhile, 2020 was described as a transitional year, whereby investment for future growth will constrain earnings. In fact, management forecast just mid-single-digit growth in EPS -- before pension accounting adjustments and TNT integration expenses -- for 2020.

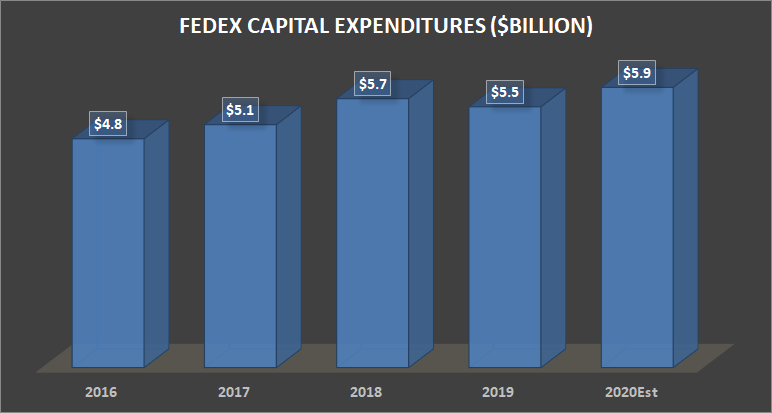

Moreover, the forecast for capital expenditures of $5.9 billion in 2020 continues the recent trend whereby UPS and FedEx elevate spending to invest for future growth.

Data source: FedEx presentations. Chart by author.

Looking ahead

Just as with UPS, it's a case of wait and see for FedEx investors. Both companies are seeing margin pressure from e-commerce growth and a relative lack of growth from higher-margin activity such as priority deliveries. Moreover, FedEx has to deal with the difficulties of the TNT integration. It could take a little while for the benefits of its investments to come through.

More From The Motley Fool

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends FedEx. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance