Fed meeting, retail sales, bitcoin futures — What you need to know for the week ahead

There are just two full trading weeks left in 2017.

And in the week ahead, the Federal Reserve’s latest policy statement will serve as one of the year’s final remaining catalysts, with markets expecting the central bank to raise interest rates for the third time in 2017.

This would also mark the fifth rate hike since the financial crisis and the fifth — and likely final rate hike — of outgoing Fed Chair Janet Yellen’s tenure.

The economics calendar will also feature key readings on job openings, inflation, and retail sales as one of the best year’s for the U.S. economy since the financial crisis comes to a close. On the earnings side, highlights this week should come from Oracle (ORCL), Adobe (ADBE), and Costco (COST).

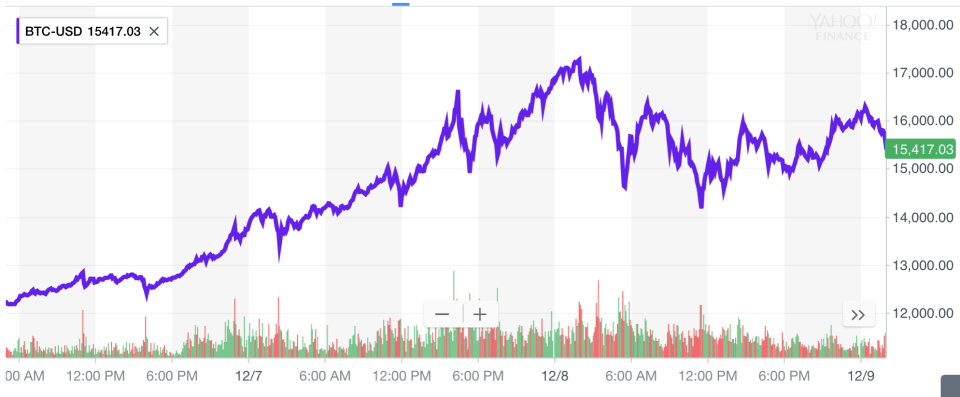

Markets will also be keeping an eye on bitcoin (BTC-USD) over the weekend with bitcoin futures set to begin trading on the CBOE Sunday evening. This past week, bitcoin prices dominated headlines after a sharp run higher, culminating in Wednesday’s wild day of trading that saw the price of the digital currency rise, then fall, $3,000 in just hours.

On Sunday morning, the price of bitcoin was sitting near $15,400 after trading into the $13,000s for a good part of the day on Saturday.

Tax reform will also continue to be a background focus for markets, as the House and Senate continue to work towards a unified tax plan that can pass in both chambers of Congress, though market moves over the last couple weeks have broadly indicated that the passage, or failure to pass, tax reform isn’t likely to be a major market catalyst in the coming weeks.

Away from markets, this coming week will also see the special Senate election in Alabama, which pits Republican Roy Moore against Democrat Doug Jones in a vote to fill the seat vacated by current Attorney General Jeff Sessions. Moore has been accused of sexual misconduct by multiple women, leading many members of the GOP to distance themselves from his campaign, though President Donald Trump this week formally endorsed Moore.

Economic calendar

Monday: Job openings and labor turnover survey, October (6.1 million previously)

Tuesday: Small business optimism, November (104 expected; 103.8 previously); Producer prices, November (+0.4% expected; +0.4% previously)

Wednesday: Consumer price index, month-on-month, November (+0.4% expected; +0.4% previously); “Core” consumer price index, year-on-year, November (+1.8% expected; +1.8% previously); Federal Reserve interest rate decision (1.25%-1.5% expected; 1%-1.25% previously)

Thursday: Initial jobless claims (239,000 expected; 236,000 previously); Retail sales, November (+0.3% expected; +0.2% previously); Import price index, November (+0.8% expected; +0.2% previously); Markit flash manufacturing PMI, December (54 expected; 53.9 previously)

Friday: Empire State manufacturing, December (18 expected; 19.4 previously); Industrial production, November (+0.3% expected; +0.9% previously); Capacity utilization, November (77.2% expected; 77% previously)

Janet Yellen’s farewell tour

On Wednesday, Janet Yellen will field questions from the media for about an hour following the release of the Federal Reserve’s latest monetary policy decision.

This will be Yellen’s final post-meeting press conference at Fed chair.

After taking over as Fed chair from Ben Bernanke in February 2014, Yellen has overseen the successful end of the Fed’s crisis-era policy, which had interest rates pinned near 0% while the central bank was buying $85 billon per month of Treasury bonds and mortgage-backed securities.

As 2017 comes to an end, and with just about eight weeks remaining on Yellen’s term, the Fed has not only ceased its asset purchases but begun slowly shrinking the size of its $4 trillion balance sheet, which ballooned after the financial crisis.

Wednesday’s policy decision is also expected to see the announcement of a fifth interest rate hike since the financial crisis, pushing the Fed’s benchmark interest rate to around 1.37%, the highest since October 2008.

And with the stock market at a record high, unemployment at a 17-year low, GDP growth at a six-year high, inflation stable just below the Fed’s 2% target, and the U.S. economy still creating in excess of 150,000 jobs per month, Yellen has stuck the landing. Jeff Gundlach, the CEO of DoubleLine Funds and a widely-followed bond manager, has said on recent webcasts that Yellen must be counting the days until her time is over because so far, almost nothing has gone wrong during her time in office.

Surely, some will argue that inflation having not exceeded the Fed’s 2% target during Yellen’s tenure is a disappointment. So too is the somewhat modest — though accelerating — wage growth the economy has seen in recent years, even with a cycle-low in unemployment.

The rise in the valuation of financial assets amid slow wage gains has also exacerbated inequality in the U.S., and some would point to the Fed’s post-crisis policies as having favored capital over labor and thus the haves over the have nots.

But when Yellen took over the Fed, monetary policy operated much as it had since the financial crisis. Now, policy is on the path towards normalization while the economy is enjoying its best run since the crisis. And while organizational leaders may get too much credit for successes and too much blame for failure, Yellen’s tenure at the Fed has been a clear success, and her legacy as a central banker will reflect as much.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance