Fed meeting, Nike earnings — What you need to know for the week ahead

Stocks are at a record high.

The Dow closed at a record on Friday after Thursday marked the blue chip index snapping a 164-day stretch without a new high, while the S&P 500 on Thursday also logged a record close. To cap the week, the S&P 500 fell less than 0.1% while the tech-heavy Nasdaq was the laggard, dropping 0.5%.

“School has been back in session for less than a month now, but the S&P 500 already had its first test of the semester and came out passing with flying colors,” Bespoke Investment Group said in an email on Friday.

“After breaking out to new highs at the end of August, the S&P 500 pulled back over the following few days and found support right at its prior highs from January. After holding that level, the S&P 500 has now traded higher on eight of the last ten trading days, rallying to higher highs. It doesn’t get much more textbook than that!”

In the week ahead, the big event of the week for investors will be the Federal Reserve’s latest policy meeting, set to begin Tuesday with a monetary policy statement slated for release at 2:00 p.m. ET on Wednesday. This will be followed by a press conference with Fed chair Jerome Powell at 2:30 p.m. ET.

Investors widely expect the Fed to raise its benchmark interest rate target range by 25 basis points to a new band of 2%-2.25%, which would set the target Fed Funds rate at around 2.13%, the highest since April 2008.

“We believe the most notable change to the statement will be to drop the reference to policy being ‘accommodative,’ and to make no further assessment of whether policy is stimulative or restrictive,” said Michael Feroli, an economist at JP Morgan. “We expect Powell will continue to play defense at the press conference, and to not push any strong views on the outlook.”

In addition to the Fed’s latest policy decision, the Fed will also release an updated summary of economic projections, which will include the first look at the Fed’s economic forecasts for 2021.

Other notable economic data scheduled for release in the week ahead will include two readings on consumer confidence, the third look at second quarter GDP, and the Fed’s preferred inflation measure.

In the week ahead, the corporate earnings calendar will remain subdued with results from Nike (NKE) after the market close on Tuesday serving as the week’s highlight. Expect the company to be asked on its earnings conference call about its latest ad campaign featuring Colin Kaepernick and reports that online sales for Nike products rose sharply after the ad was debuted on Labor Day.

Other members of the S&P 500 scheduled to report results include Cintas (CTAS), Carnival Cruise (CCL), Accenture (ACN), McCormick (MKC), and Conagra (CAG).

A large billboard stands on top of a Nike store showing former San Francisco 49ers quarterback Colin Kaepernick at Union Square, Wednesday, Sept. 5, 2018, in San Francisco. (AP Photo/Eric Risberg)

Economic calendar

Monday: Dallas Fed manufacturing activity index, September (31 expected; 30.9 previously)

Tuesday: FHFA home price index, July (+0.2% expected; +0.2% previously); S&P Case-Shiller home price index, July (-0.1% expected; +0.11% previously); Richmond Fed manufacturing index, September (21 expected; 24 previously); Conference Board consumer confidence, September (132 expected; 133.4 previously)

Wednesday: New home sales, August (+0.5% expected; -1.7% previously); Federal Reserve interest rate decision (2%-2.25% expected; 1.75%-2% previously)

Thursday: Second quarter GDP, third estimate (+4.2% annualized pace of growth expected; +4.2% previously); Durable goods orders, August (+1.9% expected; -1.7% previously); Initial jobless claims (210,000 expected; 201,000 previously); Pending home sales, August (-0.2% expected; -0.7% previously); Kansas City Fed manufacturing activity, September (16 expected; 14 previously)

Friday: Personal income, August (+0.4% expected; +0.3% previously); Personal spending, August (+0.3% expected; +0.4% previously); “Core” PCE, year-over-year, August (+2% expected; +2% previously); Chicago PMI, September (62 expected; 63.6 previously); University of Michigan consumer sentiment, September (100.5 expected; 100.8 previously)

Weed is the new blockchain

Earlier this week, we argued that cannabis is the new blockchain.

Bloomberg News reporter Luke Kawa quipped, one of these is about “unrealistic, reckless rebellion and escapism; definitely something that should be kept away from children. And the other is a Schedule 1 drug.”

But for those of us tracking market trends the similarity between the mania around cannabis stocks over the last week and the frenzy we saw around cryptocurrencies late last year are unmistakable.

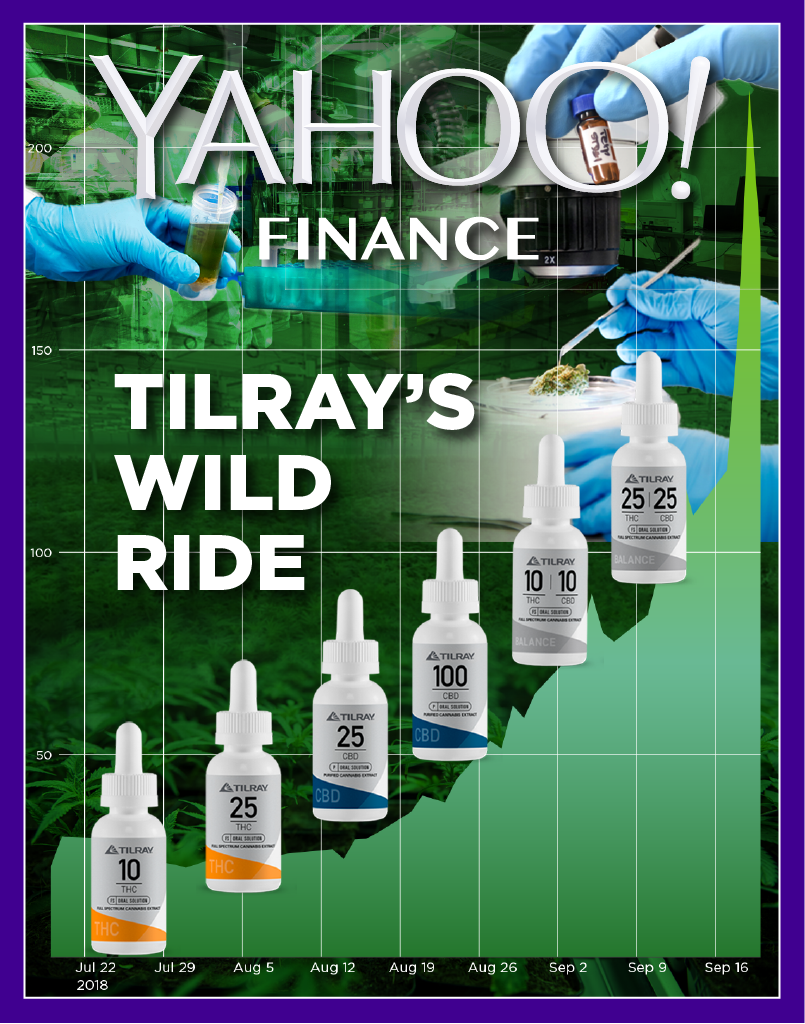

On Wednesday, shares of the British Columbia-based medical marijuana company Tilray (TLRY) rose more than 90% to $300 per share before crashing, getting halted five times, and then finishing the week around $123.

Yahoo Finance’s Emily McCormick has all the gory details of why Tilray became the market’s big fascination this week, but that the company was at one point assigned a value by the market in excess of Clorox (CLX) will suffice to capture the expectations foisted upon a name known well by those in the cannabis space, but not known at all by the broader investing public.

But what we find most interesting about this latest flareup of enthusiasm around cannabis stocks is that it comes at a time when the regular stock market is hitting record highs.

Yes, the U.S. stock market is broadly outperforming its peers and fund managers right now are overweight U.S. equities and aren’t excited about much else. But the S&P 500 is not a bit player in the global stock market framework, it is the signature global stock index and it has never traded at a higher price.

Arguments will certainly be made that stocks at a record are not something to celebrate but to be wary of. This logic might extend to say that record highs merely pull closer the inevitable crash, an idea that has been a major part of the U.S. economic and stock market discussion since 2013. One suspects this sort of “the end is near” thinking in investing never really goes out of fashion.

Meanwhile, the ETF revolution has made it easier and cheaper than ever to gain exposure to the broad stock market. If you want to benefit from the stock market now, it will cost you about 0.05% per year to buy the S&P 500 and then go on living the rest of your life.

But in thinking about what seems at first like a bug in the system — as if the ability to invest cheaply in the broad market would eradicate speculation — may in fact be a feature of this new market reality.

The investor who wants a little bit of action day-trading stocks can still find their thrills in micro-cap pharma names, but trying to figure out whether Ford (F) has bottomed or if Macy’s (M) will have a strong holiday season has been rendered largely irrelevant. Strong convictions on the auto space or retail industry can be rendered via ETFs or simply ignored because you’re buying the whole market anyway.

And so with the bulk of an investor’s portfolio being taken care of by cheap index funds, a slice of someone’s investable assets might be set aside for taking big swings. If you’ve allowed yourself to take 1%, or 3%, or 5% of your investment portfolio and put it into something that you won’t care if it goes to $0, why not take a shot at Tilray? Or bitcoin? Or dogecoin?

In the space of about nine months we’ve now seen two massively speculative bubbles pop up in markets. Both have fundamental stories that aren’t terrible, but seem stretched when the stocks or the coins rise 5x in a month.

This cadence suggests a phenomena that isn’t going away, but becoming more frequent. And while many see these bubbles as signs of broad market exuberance, we’d see them as side effects of a new market structure, one where it’s so easy to be responsible that you’ve got to really go crazy to have some fun.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance