Fed meeting — What you need to know in markets on Wednesday

Wednesday is Fed Day.

At 2:00 p.m. ET, the Federal Reserve will release its latest monetary policy statement, which markets expect will see the central bank raise the target range for its benchmark interest rate by 25 basis points to a new band of 2%-2.25%.

This would peg interest rates at the highest level since April 2008.

The Fed’s announcement will be followed by a press conference with Fed chair Jerome Powell at 2:30 p.m. ET as well as the Fed’s latest summary of economic projections, which will include Fed officials’ first estimates for economic growth, unemployment, and inflation in 2021.

“Inflation is at target, the unemployment rate is below target and falling, and yet the funds rate remains 100bp below the Fed’s estimate of its neutral level,” said Goldman Sachs economists Jan Hatzius and David Mericle in a note published last week. “Most FOMC participants now agree that this makes little sense — the Fed has some catching up to do.”

The Fed meeting on Wednesday was the market’s primary concern on Tuesday as stocks finished the day mixed, but little-changed, though we did see a slight sell-off during President Trump’s speech before the UN.

Since 1994, the S&P 500 has actually done quite well on Fed days, rising an average of 0.29% on all Fed days and 0.25% on days the central bank raises rates, according to Bespoke Investment Group.

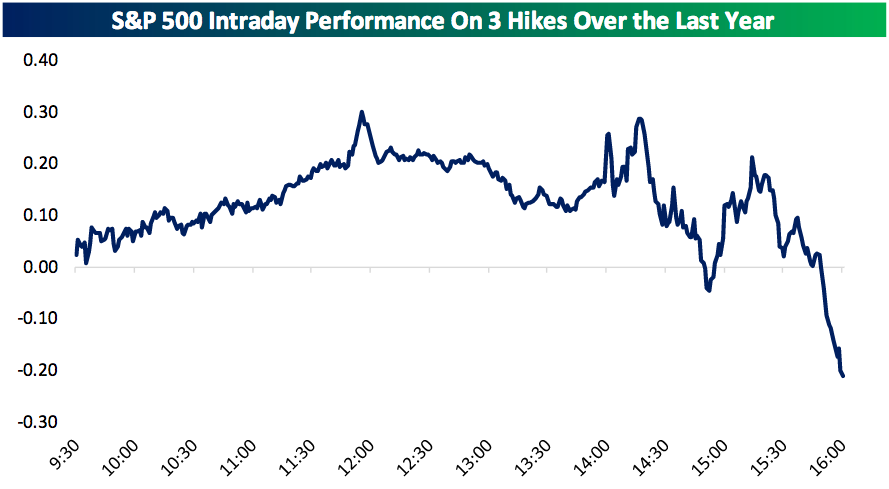

More recent Fed actions, however, have taken on a more negative tone for markets with stocks drifting lower ahead of the Fed’s announcement and seeing a fairly pronounced sell-off into the bell after the last three Fed rate hikes.

“S&P 500 performance on Fed Days has been poor lately regardless of the Fed’s decision,” Bespoke said in a note on Tuesday. “Over the last 10 Fed Days, the S&P has averaged a one-day decline of 0.13%…this reading has rarely dipped into negative territory over the last 20+ years, so it’s not very common to see this kind of weakness on FOMC days.”

Outside of the Fed, the August report on new home sales is due out in the morning, while CarMax (KMX) and Bed, Bath & Beyond (BBBY) will be the notable companies reporting earnings.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance