Fastenal (FAST) Stock Down on Q4 Earnings and Sales Miss

Fastenal Company’s FAST shares fell almost 2% at the time of writing, following unsatisfactory results in fourth-quarter 2019. The top and bottom lines missed the respective Zacks Consensus Estimate due to continued slower activity levels. Moreover, this slowdown was exacerbated in December 2019 by holiday timing and longer-than-usual year-end plant shutdowns.

Earnings & Sales in Detail

The company reported earnings of 31 cents per share, which lagged the consensus mark of 32 cents by 3.1%. However, the reported figure increased 3.3% from the year-ago profit level of 30 cents.

Net sales during the reported period were $1,276.9 million, missing the consensus mark of $1,293.4 million by 1.3% but increasing 3.7% from the year-ago figure of $1,231.6 million. The growth was driven by higher unit sales, primarily related to growth drivers, with notable contributions from industrial vending and Onsite locations.

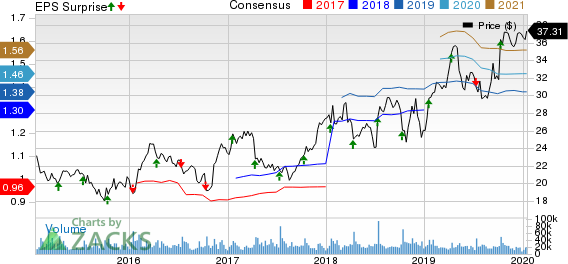

Fastenal Company Price, Consensus and EPS Surprise

Fastenal Company price-consensus-eps-surprise-chart | Fastenal Company Quote

The company reported daily sales growth of 3.7%, lower than 13.2% and 6.1% increase registered in fourth-quarter 2018 and third-quarter 2019, respectively, as end-market activity continued to slow down in the quarter.

On a monthly basis, daily sales improved 4.3%, 5.7% and 1% in October, November and December compared with 12.4%, 12.3% and 14.5%, respectively, in the comparable months of the prior year.

Daily sales of Fastener products (mainly used for industrial production and accounting for approximately 33.6% of fourth-quarter sales) rose 1.8% year over year.

Non-fastener products’ daily sales (mainly used for maintenance and representing 66.4% of the quarterly sales) increased 5.1% year over year.

Vending Trends and Other Growth Drivers

As of Dec 30, 2019, Fastenal operated 89,937 vending machines, up 10.8% year over year. During 2019, the company signed 21,857 machine contracts, down from 22,073 reported in 2018. However, the metric in fourth-quarter 2019 was 5,144 compared with 4,980 contracts a year ago.

Fastenal signed 362 new Onsite locations during 2019 and 79 in fourth-quarter 2019. The metric was 336 in 2018 and 67 in fourth-quarter 2018. As of Dec 30, 2019, the company had 1,114 active sites, up 24.6% from the comparable year-ago period. Daily sales to national account customers (representing 54.8% of total revenues) increased 8.2% on a year-over-year basis during the quarter.

Higher Costs Hurting Margins

Gross margin of 46.9% in the quarter contracted 80 basis points (bps) from the prior-year period due to changes in product and customer mix, and freight.

Also, operating margin contracted 30 bps year over year to 18.7% in the quarter, owing to lower gross margin.

Financials

Cash and cash equivalents were $174.9 million as of Dec 30, 2019, up from $167.2 million on Dec 31, 2018. Long-term debt at the end of the quarter was $342 million, down from $497 million at 2018-end.

In 2019, cash provided by operating activities totaled $842.7 million compared with $674.2 million in the comparable year-ago period.

Company’s Views

Fastenal — which shares space with Builders FirstSource, Inc. BLDR, Tecnoglass Inc. TGLS and BMC Stock Holdings, Inc. BMCH in the Zacks Building Products – Retail industry — acknowledged the fact that overall activity in end-markets served slowed down in the quarter. This offset the continued double-digit growth of vending and onsite locations. The company projects to sign 22,000-24,000 vending devices in 2020.

Zacks Rank

Fastenal currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.6% per year. So be sure to give these hand-picked 7 your immediate attention.

See 7 handpicked stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BMC Stock Holdings, Inc. (BMCH) : Free Stock Analysis Report

Fastenal Company (FAST) : Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance