Factors Setting the Tone for Tyson Foods' (TSN) Q4 Earnings

Tyson Foods, Inc. TSN is scheduled to release fourth-quarter fiscal 2019 results on Nov 12. This renowned meat products company’s earnings outpaced the Zacks Consensus Estimate by almost 7%, on average, over the trailing four quarters. In the last reported quarter, earnings were in line with the consensus mark.

The Zacks Consensus Estimate for fourth-quarter earnings improved by a penny in the past 30 days and is currently pegged at $1.23 cents per share. The estimate suggests a decline of 22.2% from the year-ago quarter’s reported figure. The consensus mark for revenues is pegged at $11,104 million, which indicates a rise of 11.1% from the prior-year quarter’s level.

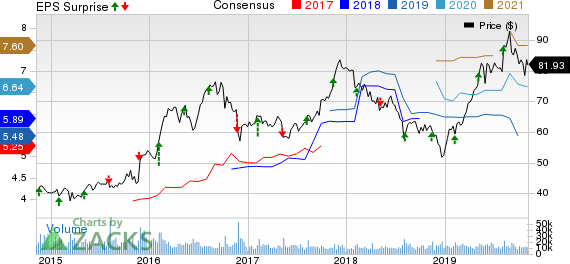

Tyson Foods, Inc. Price, Consensus and EPS Surprise

Tyson Foods, Inc. price-consensus-eps-surprise-chart | Tyson Foods, Inc. Quote

Key Factors to Note

Rising demand for protein-packed food products has been a key catalyst. In particular, the company is gaining from robust demand in the beef category. It has been undertaking acquisitions along with offloading certain non-protein businesses to increase focus on areas with high growth potential. These factors are likely to have bolstered fiscal fourth-quarter sales.

To this end, the acquisitions of European and Thai operations of BRF S.A, and Keystone Foods among others are expected to have contributed to Tyson Foods’ performance in the fiscal fourth quarter. Apart from this, the company has been gaining from efforts to bolster presence in the fresh prepared foods category, owing to consumers rising demand for natural fresh meat offering.

However, there are certain headwinds that are likely to have exerted pressure on the company’s performance in the to-be-reported quarter. In September, the company issued a press release, highlighting certain adversities. This includes reversal of a gain on mark to market grain derivatives, adverse impacts of a fire breakout in a beef processing plant and implementation of certain food-safety initiatives. Management had also expressed concerns related to slower-than-expected operational improvements in the chicken unit.

These challenges, along with rising input costs in some of the units, are likely to get reflected in the company’s fourth-quarter results.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Tyson Foods this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Tyson Foods carries a Zacks Rank #4 (Sell) and Earnings ESP of +1.90%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks Poised to Beat Earnings Estimates

Here are some companies that you may want to consider, as our model shows that these have the right combination to post an earnings beat:

Grocery Outlet GO has an Earnings ESP of +2.70% and a Zacks Rank #2.

Foot Locker FL has an Earnings ESP of +2.8% and a Zacks Rank #2.

Ollie's Bargain Outlet OLLI has an Earnings ESP of +3.45% and a Zacks Rank #3.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

Foot Locker, Inc. (FL) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance