Factors Setting the Tone for Mondelez's (MDLZ) Q3 Earnings

Mondelez International, Inc. MDLZ is set to release third-quarter 2019 results on Oct 29, after market close. We note that the company’s bottom line surpassed the Zacks Consensus Estimate in two of the trailing four quarters, the average being 2%. Let’s discuss the factors that are likely to be reflected in the upcoming quarterly results.

Estimates for Q3

The Zacks Consensus Estimate for third-quarter 2019 earnings has been stable in the past 30 days at 61 cents, which suggests a decline of 1.6% from the year-ago quarter’s reported figure. The consensus mark for revenues is $6,321 million, which indicates an improvement of 0.5% from the prior-year quarter’s figure.

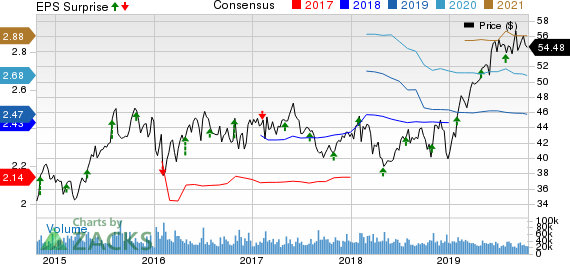

Mondelez International, Inc. Price, Consensus and EPS Surprise

Mondelez International, Inc. price-consensus-eps-surprise-chart | Mondelez International, Inc. Quote

Factors Likely to Impact Results

Well-chalked endeavors such as innovations under the SnackFutures platform, efforts to broaden good-for-you offerings, brand building through promotions and strategic buyouts are likely to have benefited Mondelez’s top line in the third quarter.

Markedly, acquisitions have played a vital role in augmenting Mondelez’s snacking business. In this context, the buyouts of Hu Master Holdings, Uplift Foods and minority stakes in Perfect Snacks are noteworthy. Also, the acquisition of Tate’s Bake Shop as well as partnerships with Keurig Dr Pepper and Post Consumer are expected to have contributed favorably.

However, Mondelez has been struggling with higher raw material costs. In this context, the impact of unfavorable commodity hedging is likely to have affected the company’s bottom line in the third quarter. Further, production delays and service delivery issues may persist. Moreover, the impact of any adverse currency fluctuation cannot be ignored.

Although the company has been on track with strategic pricing and savings initiatives, it is yet to be seen how these efforts have pared the aforementioned challenges when third-quarter numbers are reported.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Mondelez this season. The combination of a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although Mondelez has a Zacks Rank #3, its Earnings ESP of -0.99% makes surprise prediction difficult.

Stocks Poised to Beat Earnings Estimates

Here are some companies that you may want to consider, as our model shows that these have the right combination to post an earnings beat:

Church & Dwight CHD has an Earnings ESP of +0.93% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Conagra Brands CAG has an Earnings ESP of +0.60% and a Zacks Rank #3.

Campbell Soup Company CPB has an Earnings ESP of +1.41% and a Zacks Rank #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Conagra Brands Inc. (CAG) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Campbell Soup Company (CPB) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance