Factors That Make O-I Glass (OI) a Lucrative Bet Now

O-I Glass, Inc. OI is poised to gain from the growing global preference for glass as a healthy, premium and sustainable packaging option for food and beverage. The company’s investment in incremental capacity to capitalize on this trend will fuel growth. Benefits from its portfolio optimization program, acquisitions and product innovation are likely to act as key catalysts.

The company has been delivering year-over-year improvement in its top and bottom lines in the last five quarters, benefiting from higher prices and continued margin expansion initiatives. A positive business outlook for 2023 reinforces investors’ confidence in the stock.

Top Zacks Rank & Upbeat Price Performance

The company currently sports a Zacks Rank #1 (Strong Buy).

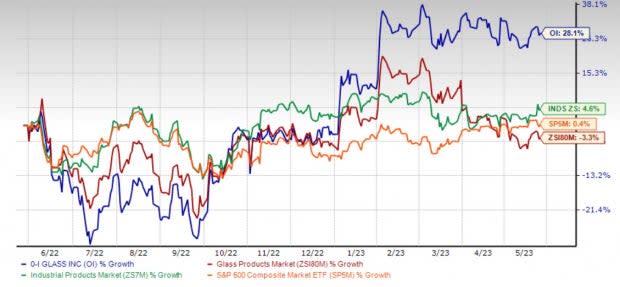

Shares of the company have gained 28.1% in a year’s time against the industry’s decline of 3.3%. The Zacks Industrial Products sector has gained 4.6% and the S&P 500 composite has risen 0.4% in the same time frame.

Image Source: Zacks Investment Research

Solid Earnings Surprise History

O-I Glass’ bottom line outpaced estimates in all the trailing four quarters, the average surprise being 21.2%.

Upbeat Outlook for 2023

OI projects adjusted earnings per share to be in the range of $3.05 to $3.25 in 2023. The midpoint of the guidance indicates year-over-year growth of 37%, which reflects incremental net price realization as well as strong operating and cost performance. The company expects free cash flow to be at least $475 million.

Upward Revision in Estimates

The Zacks Consensus Estimate for OI’s earnings for 2023 has moved up 23% over the past 30 days and is currently pegged at $3.17 per share. The consensus mark for 2024 has also seen a northward revision of 17% to $3.09 per share.

Superior Return on Equity

O-I Glass’ trailing 12-month Return on Equity (ROE) supports its growth potential. The company’s ROE of 27.4% is much higher than the industry’s average ROE of 1.4%, reflecting its efficiency in utilizing shareholders’ funds.

Efforts to Capitalize on Glass Demand Bode Well

Demand for glass packaging has increased, given its recyclability, and being a healthier and safer alternative to plastic packaging. O-I Glass is thus investing in incremental capacity, joint ventures and acquisitions in emerging geographies to capitalize on this trend. To this end, OI intends to invest up to $630 million in new capacity expansion over the next three-year period, which is expected to generate an average internal return rate of 20%.

MAGMA Expected to Be a Key Catalyst

O-I Glass is firmly focused on driving innovation. Its glass melting technology, known as the MAGMA program, aids in reducing the amount of capital required to install, rebuild and operate OI’s furnaces. The MAGMA program is being implemented using a multi-generational development roadmap.

Transformation Plan to Aid Earnings

O-I Glass is taking a few initiatives as part of its transformation plan from 2022 through 2024. It expects its margin expansion initiative will likely generate annual benefits of more than $100 million. The company successfully completed its $1.5-billion Portfolio Optimization program and proceeds from the program have been utilized to repay debt, fund attractive expansion projects and improve financial strength.

Other Stocks to Consider

Some other top-ranked stocks in the Industrial Products sector are Worthington Industries, Inc. WOR, The Manitowoc Company, Inc. MTW and Pentair plc PNR. WOR and MTW sport a Zacks Rank of 1 at present, while PNR carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Worthington Industries has an average trailing four-quarter earnings surprise of 27.5%. The Zacks Consensus Estimate for WOR’s fiscal 2023 earnings is pegged at $4.93 per share, up 17.7% in the past 60 days. WOR has gained 27.8% in the past year.

Manitowoc has an average trailing four-quarter earnings surprise of 38.8%. The Zacks Consensus Estimate for MTW’s 2023 earnings is pegged at 85 cents per share, up 63.5% in the past 60 days. MTW’s shares have gained 20.8% in the past year.

The Zacks Consensus Estimate for Pentair’s 2023 earnings per share is pegged at $3.66, up 3% in the past 60 days. It has a trailing four-quarter average earnings surprise of 7.2%. PNR has gained 14.9% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

O-I Glass, Inc. (OI) : Free Stock Analysis Report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

Pentair plc (PNR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance