Factors Likely to Influence Stitch Fix (SFIX) Earnings in Q4

Stitch Fix, Inc. SFIX is scheduled to report fourth-quarter fiscal 2019 financial numbers on Oct 1, after the closing of the bell. We note that earnings of this California-based company have surpassed estimates in all the trailing four quarters. Let’s see what’s in store for Stitch Fix in the upcoming quarterly announcement.

Where are Estimates Heading?

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at 4 cents, which indicates a decline from 17 cents reported in the year-ago quarter. We note that the consensus mark for earnings was stable in the last 30 days. The consensus mark for revenues stands at $432.1 million, which suggests an increase of 35.8% from the year-ago quarter’s reported figure.

For fiscal 2019, the consensus estimates for the top and bottom line are pegged at $1.58 billion and 32 cents, respectively.

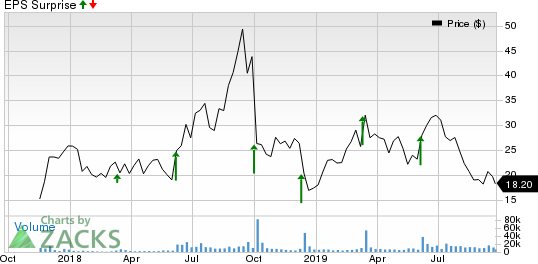

Stitch Fix, Inc. Price and EPS Surprise

Stitch Fix, Inc. price-eps-surprise | Stitch Fix, Inc. Quote

Factors to Consider

Stitch Fix has witnessed healthy demand in the men’s category. We note that the unit has registered year-over-year growth in every quarter since its launch. Moreover, the company is undertaking efforts to ramp up its kids’ category, which will likely support the top line in the near term. Management expects fiscal fourth-quarter revenues in the range of $425-$435 million, suggesting year over year increase of 34-37%, buoyed by net revenues per active client and consistent active client growth. For fiscal 2019, the company anticipates revenues in the band of $1.57-$1.58 billion, indicating a rise of 28-29%. Also, fiscal fourth-quarter adjusted EBITDA is projected in the range of $5-$10 million and adjusted EBITDA margin is expected in the band of 1.2%-2.3%.

Further, the company is witnessing improved gross margins since the past few quarters. Notably, the metric rose 150 basis points to 45.1% in third-quarter fiscal 2019. This upside can be attributed to reduced clearance activity and lower shrink costs year over year.

On the flip side, Stich Fix has been grappling with elevated SG&A expenses for a while. The metric surged 47.1% in the third quarter of fiscal 2019, following a rise of 32.2% and 29.1% in the second and the first quarter, respectively. The increase in SG&A expenses may be attributed to higher compensation and benefits expenses, stock-based compensation, investment in technology talent, higher advertising as well as investments related to U.K. launch. Any deleverage in SG&A expenses may weigh on the company’s profitability in the near term.

What Does the Zacks Model Say?

Our proven model does not conclusively show that Stitch Fix is likely to beat estimates in fourth-quarter fiscal 2019. A stock needs to have — a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stitch Fix currently carries a Zacks Rank #3 and an Earnings ESP of 0.00%, which makes surprise prediction difficult.

Stocks With Favorable Combination

Here are some better-ranked companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Levi Strauss LEVI has an Earnings ESP of +6.10% and Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Rite Aid Corporation RAD has an Earnings ESP of +6.67% and a Zacks Rank #3.

Costco Wholesale COST has an Earnings ESP of +0.37% and a Zacks Rank #3.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Rite Aid Corporation (RAD) : Free Stock Analysis Report

Stitch Fix, Inc. (SFIX) : Free Stock Analysis Report

Levi Strauss & Co. (LEVI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance