Factors to Know Ahead of Forum Energy's (FET) Q2 Earnings

Forum Energy Technologies, Inc. FET is expected to release second-quarter 2019 results after the closing bell on Thursday, Jul 25. The current Zacks Consensus Estimate for the quarter under review is a loss of 5 cents on revenues of $258.1 million.

In the preceding three-month period, the energy equipment provider beat the consensus mark by 42.9% on successful introduction of new products, operating efficiency and strict cost discipline.

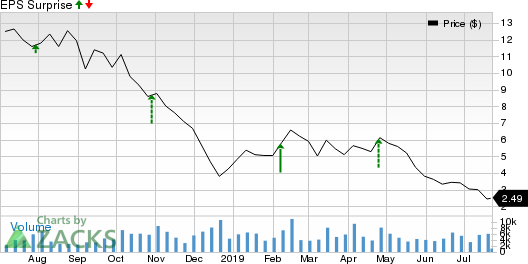

As far as earnings surprises are concerned, the Houston, TX-based company is on an excellent footing, having gone past/met the Zacks Consensus Estimate in the last four reports. This is depicted in the graph below:

Forum Energy Technologies, Inc. Price and EPS Surprise

Forum Energy Technologies, Inc. price-eps-surprise | Forum Energy Technologies, Inc. Quote

Investors are keeping their fingers crossed and hoping that the provider of technical products and services to drillers of oil and gas wells can continue winning ways by surpassing earnings estimate this time around too. However, our model indicates that the company might not beat on earnings in the second quarter.

Let’s delve deeper and find out the factors impacting the results.

Factors to Consider This Quarter

E&P Spending Restraint: Clients are taking a more conservative approach on their investment decisions. Per the new paradigm in the energy sector, a disciplined capital expenditure strategy (resulting in free cash flow) is being prioritized over reckless spending beyond operating cash flows. Consequently, major upstream oil companies are now committed to investor returns rather than adding production by outspending cash flows. This has created an extremely challenging operating environment for the service providers as there is not enough incentive to trigger investments in mature field development, exploring unconventional resources, or expanding offshore programs. This slowdown in activity hurts overall demand for services and equipment across the industry spectrum and does not bode well for Forum Energy’s upcoming earnings release.

In particular, near-term pressure pumping activity levels (primarily associated with new equipment) are expected to be a major casualty of upstream operators’ belt tightening. The company’s ‘Completions’ segment is likely to suffer as a result, reflected by management’s recent lowering of revenue and EBITDA guidance for this unit.

Lower Rig Count: Moreover, during the second quarter of 2019, U.S. oil rig count decreased by 23, from 816 to 793. While there is a typical delay of around three-four months between oil price changes and its reflection on rig counts, the statistics suggest weakening North American activity in the April-June timeframe. Forum Energy, with sizable presence in the region through its ‘Drilling & Downhole’ segment, is expected to suffer on this sentiment.

Recovery in International Operations: One bright spot in the otherwise gloomy earnings outlook is the recovery in overseas markets. In the last quarter, Forum Energy’s international business delivered sequential top line growth of 20%. We expect continued revenue growth from activity outside North America on strong demand for coiled tubing products.

Cost Efficiencies: Forum Energy continues to boost margins by driving down cost and improving efficiency. The company’s EBITDA in each of its segments rose sequentially in the first quarter on successful cost reduction efforts. We expect profitability to increase further in the to-be-reported quarter.

Earnings Whispers

Our proven model does not conclusively show that Forum Energy will beat estimates this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) to be able to beat consensus estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

That is not the case here as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is -2.86%.

Zacks Rank: Forum Energy currently has a Zacks Rank of 3, which increases the predictive power of ESP. But we need to have a positive Earnings ESP to be sure of the positive surprise.

Note that we caution against stocks with a Zacks Ranks #4 or 5 (Sell rated) going into an earnings announcement, especially when the company is seeing a negative estimate revision.

Stocks to Consider

While earnings beat looks uncertain for Forum Energy, here are some companies from the energy space you may want to consider on the basis of our model, which shows that they have the right combination of elements to post earnings beat this quarter:

Helix Energy Solutions Group, Inc. HLX has an Earnings ESP of +7.61% and a Zacks Rank #1. The company is anticipated to release earnings on Jul 24. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

TechnipFMC plc FTI has an Earnings ESP of +7.73% and a Zacks Rank #3. The company is likely to release earnings on Jul 24.

Royal Dutch Shell plc RDS.A has an Earnings ESP of +0.55% and a Zacks Rank #3. The company is anticipated to release earnings on Aug 1.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TechnipFMC plc (FTI) : Free Stock Analysis Report

Forum Energy Technologies, Inc. (FET) : Free Stock Analysis Report

Helix Energy Solutions Group, Inc. (HLX) : Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance