Exxon (XOM) Signs MoU to Join Acorn CCS Project in Scotland

Exxon Mobil Corporation XOM signed a memorandum of understanding (MoU) to participate in the Acorn carbon capture and storage (“CCS”) project in Scotland to address the national climate goals of the U.K.

The project is being conducted by Pale Blue Dot Energy, a wholly-owned subsidiary of UK-based CCS developer Storegga Geotechnologies. Notably, Exxon joined fellow oil giants Royal Dutch Shell Plc (RDS.A) and Harbour Energy plc (HBRID) in the development led by Pale Blue Dot.

The Acorn CCS project intends to capture and store 5-6 million tons of carbon dioxide (CO2) per year by 2030 from gas terminals at the St Fergus terminal of Peterhead, one of which is jointly owned by Exxon and Shell. The project aims to be among the first large-scale operational CCS projects in the country by the middle of the decade.

The project is capable of providing more than 50% of the UK government’s target of 10 million tons of CO2 storage per year. Once expanded, it can store more than 20 million tons of CO2 emissions per year by mid-2030.

Exxon mentioned that it joined NECCUS, an organization consisting of industry, government and academic experts, who committed to reduce emissions from industrial facilities in Scotland. Exxon’s participation will allow the alliance to explore the potential of technology-driven solutions to reduce emissions by building on its long-term experience with carbon capture and storage.

Exxon has more than three decades of experience in CCS and established low-carbon solution businesses to commercialize low-emission technologies. As a world leader in the development and use of carbon capture and storage, Exxon and partners will determine how technology-driven solutions can play a crucial role in reducing Scotland’s emissions.

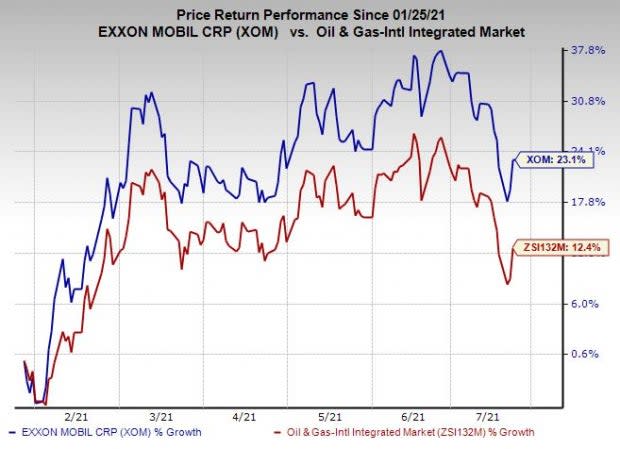

Company Profile & Price Performance

Headquartered in Irving, TX, ExxonMobil is one of the leading integrated energy companies in the world.

Shares of the company have outperformed the industry in the past six months. The stock has gained 23.1% compared with the industry’s 12.4% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

The company currently carries a Zack Rank #3 (Hold).

Some better-ranked players in the energy space are Range Resources Corporation RRC and W&T Offshore, Inc. WTI, each currently sporting a Zacks Rank #1 (Strong Buy), and Hess Corporation HES, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Range Resources’ earnings for 2021 are expected to increase 19.5% year over year.

W&T Offshore’s earnings for 2021 are expected to surge 71.7% year over year.

Hess’ earnings for 2021 are expected to surge 123% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

Range Resources Corporation (RRC) : Free Stock Analysis Report

W&T Offshore, Inc. (WTI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance