Expedia Group's (EXPE) Q3 Earnings Miss, Revenues Up Y/Y

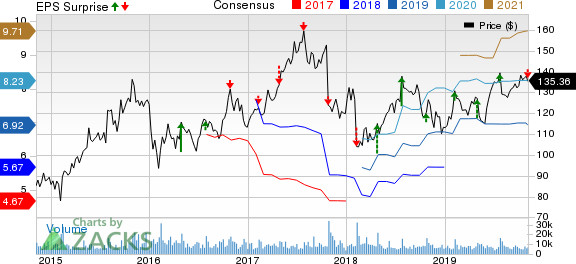

Expedia Group, Inc. EXPE reported third-quarter 2019 adjusted earnings of $3.38 per share, missing the Zacks Consensus Estimate by 11.5%. The figure also declined 7% on a year-over-year basis. However, the bottom line improved 90.9% from the previous quarter.

Revenues increased 9% year over year and 12.1% on a sequential basis to $3.56 billion. Top-line growth was driven by robust performance of Expedia Partner Solutions, Vrbo and Hotels.com. Further, growing stayed nights and expanding lodging portfolio continued to accelerate revenue generation.

However, the figure lagged the Zacks Consensus Estimate of $3.58 billion.

Unfavorable foreign exchange fluctuation remained an overhang during the reported quarter. Further, sluggishness in trivago impacted the top line negatively.

Expedia witnessed gross bookings of $26.93 billion in the third quarter. Moreover, the figure improved 9.1% year over year but declined .8% sequentially. Further, the figure was lower than the Zacks Consensus Estimate of $27.03 billion.

Following the unimpressive results, shares of the company plunged 12.8% in the pre-market trade. Moreover, the company has provided a weak outlook for 2019, which is a concern.

Further, Expedia has returned 20.1% on a year-to-date basis, underperforming the industry’s rally of 27.5%.

Nevertheless, the company remains optimistic about its strong supply, acquisition efforts, strategic investments and product innovation. These initiatives are anticipated to drive business in the days ahead.

Operating Details

Adjusted EBITDA was $912 million, which remained flat year over year. Notably, Core OTA and Vrbo EBITDA witnessed year-over-year growth of 3% each. However, Egencia and trivago EBITDA were down 1% and 60% from the year-ago quarter, respectively.

Further, adjusted selling and marketing expenses were $1.63 billion, up 11% year over year. As a percentage of revenues, these expenses expanded 90 bps year over year to 46%.

Additionally, general and administrative expenses were $182 million, which rose 8% from the prior-year quarter. As a percentage of revenues, the figure remained flat from the year-ago quarter to 5.1%.

Operating margin came in 17.1% in the reported quarter, which contracted 340 bps from prior-year quarter.

Balance Sheet & Cash Flow

As of Sep 30, 2019, cash and cash equivalents were $3.79 billion, down from $4.26 billion as of Jun 30, 2019. Short-term investments totaled $658 million, improved from $631 million in the previous quarter.

Further, Expedia utilized $861 million cash in operations during the reported quarter against $1.14 billion of cash generated from operations in the prior quarter. Further, free cash flow was ($1.15) billion compared with $839 million in the previous quarter.

Unfavorable changes in timing of payables impacted the company’s cash flow negatively.

The company paid out quarterly dividend worth $50 million (34 cents per share) during the reported quarter.

Guidance for 2019

Expedia revised the guidance for adjusted EBITDA growth downward from 12-15% to 5-8% for 2019. This includes the impact of high cost channels and low ADRs.

Further, the company expects sluggish contributions from Vrbo and trivago in 2019.

Zacks Rank & Key Picks

Expedia Group currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the retail-wholesale sector are Stamps.com STMP, Qurate Retail Group QRTEA and Carvana CVNA. All the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth rate for Stamps.com, Qurate Retail Group and Carvana is currently pegged at 15%, 11.81% and 9%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Click to get this free report Stamps.com Inc. (STMP) : Free Stock Analysis Report Expedia Group, Inc. (EXPE) : Free Stock Analysis Report Carvana Co. (CVNA) : Free Stock Analysis Report Qurate Retail Group, Inc. (QRTEA) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance