What to Expect From Enbridge's (ENB) Q2 Earnings Report

Enbridge Inc. ENB is scheduled to report second-quarter 2021 earnings on Jul 30, before the opening bell.

In the last reported quarter, the leading energy infrastructure company’s adjusted earnings per share of 62 cents beat the Zacks Consensus Estimate of 56 cents, thanks to higher gas distribution charges and contribution from renewable power generation.

Let’s see how things have shaped up prior to this announcement.

Trend in Estimate Revision

The Zacks Consensus Estimate for second-quarter earnings per share of 45 cents has witnessed no upward revision but two downward movements over the past 30 days. The estimated figure, however, suggests an increase of 9.8% from the prior-year reported number.

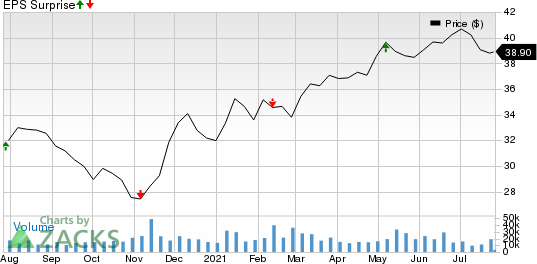

Enbridge’s earnings beat the Zacks Consensus Estimate once, missed on two occasions and met the same once in the trailing four quarters, with the average negative surprise being 1.5%. This is depicted in the graph below:

Enbridge Inc Price and EPS Surprise

Enbridge Inc price-eps-surprise | Enbridge Inc Quote

Factors to Consider

Enbridge, a leading North American midstream energy firm, is likely to have generated stable fee-based revenues in the second quarter from its massive crude and liquids pipeline system that spreads across 17,127 miles.

With a recovery in energy demand in the second quarter, the company’s pipelines might have seen higher utilization of midstream assets. Crude prices in the second quarter made a significant recovery from the year-ago level, which is expected to have triggered higher activities in the North American upstream market. This, in turn, is expected to have boosted Enbridge’s profits in the quarter from the year-ago period.

However, its Texas Eastern Transmission (TETCO) unit declared a force majeure during May-end, following a partial pressure restriction from the watchdogs. This might have resulted in lower natural gas flows from Appalachia to the Gulf Coast through the unit, thereby hurting profits.

Also, contributions from the Energy Services segment are expected to have remained under pressure in the second quarter. The aforementioned negatives are expected to have partially offset the positives from higher liquids flows.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Enbridge this time around. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Earnings ESP: Enbridge has an Earnings ESP of +0.75%. This is because the Most Accurate Estimate for the quarter is currently pegged higher than the Zacks Consensus Estimate of 45 cents per share. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: Enbridge currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

While an earnings beat looks uncertain for Enbridge, here are some companies from the Energy space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat in the upcoming quarterly reports:

EOG Resources, Inc. EOG has an Earnings ESP of +3.54% and a Zacks Rank of 1. It is scheduled to report second-quarter results on Aug 4. You can see the complete list of today’s Zacks #1 Rank stocks here.

ConocoPhillips COP has an Earnings ESP of +8.25% and is a Zacks #1 Ranked player. The company is scheduled to release second-quarter results on Aug 3.

Continental Resources, Inc. CLR has an Earnings ESP of +8.88% and a Zacks Rank #1. The firm is scheduled to release quarterly earnings on Aug 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Enbridge Inc (ENB) : Free Stock Analysis Report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance