EXCLUSIVE: Gildo Zegna Discusses Road to IPO

MILAN — Gildo Zegna has “great ambitions for the next 111 years” of the Ermenegildo Zegna Group. “As a family business, we think long term, but we like to be seen as pioneers, taking bold actions and hopefully this will be rewarded,” the chief executive officer of the company said in an exclusive interview.

These forward-looking steps include the group’s decision to publicly list on the New York Stock Exchange later this month after entering into a business agreement with Investindustrial Acquisition Corp., a special purpose acquisition corporation, sponsored by investment subsidiaries of Investindustrial VII LP.

More from WWD

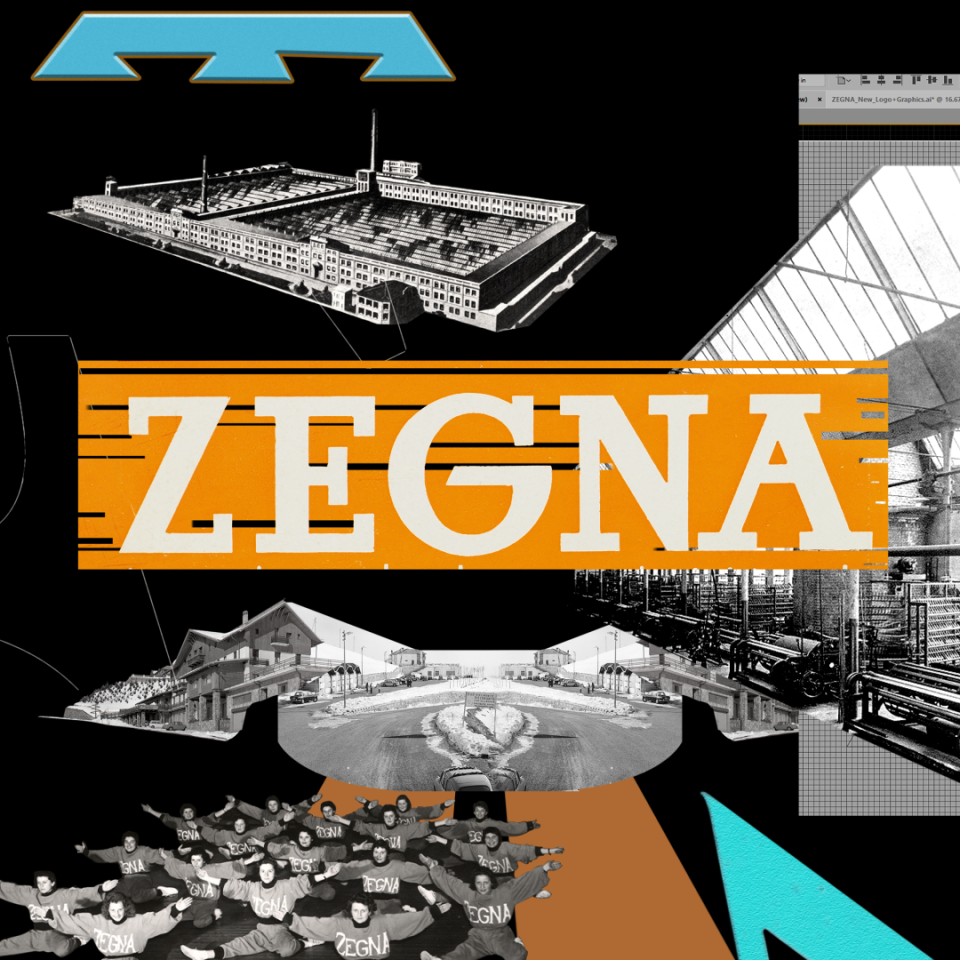

Ahead of the listing, as reported, the men’s wear giant has kicked off a major rebranding project, which will result in the label to being known simply as Zegna.

The executive, speaking at the group’s sprawling headquarters in Milan, and his son Edoardo, chief marketing, digital and sustainability officer, in a video call from London, underscored that the rebranding strategy had been initiated two years ago with the goal to elevate the brand to pure luxury and to be further recognizable.

“We were comfortable with the decisions pre-COVID-19, and the IPO was a propeller, it made us go faster, and be more disciplined,” Gildo Zegna said.

Edoardo acknowledged that the brand had been known for years for its tailoring, but said that now more than 50 percent of sales derive from leisurewear, a trend seen before COVID-19 and accentuated by the pandemic.

“Just look at what my father is wearing,” said the young executive, donning a blue sweater. Sure enough, for the interview Zegna senior wore a soft cashmere overshirt — a cornerstone of Zegna’s Luxury Leisurewear collection — and comfortable looking pants in a brown palette.

Asked about these past few months in preparation for the listing, which is expected some time after the SPAC’s board meeting scheduled on Dec. 15, Gildo Zegna said he has been “controlling [his] anxiety with positive energy and minimizing unexpected things. It’s been a very interesting journey. The team did a fantastic job, as the burden of requests and paperwork is huge.”

He gave a shoutout to chief financial and operating officer Gianluca Tagliabue, who was part of the roadshow — all done digitally — with his son Edoardo, as well as Rodrigo Bazan, CEO of Thom Browne, which Zegna acquired in 2018; Antonio Gatti, managing principal of Investindustrial, and Alessandro Sartori, artistic director of Zegna.

“It was a big undertaking, with 75 different interviews over two months,” he said.

He also cited Francesca di Pasquantonio, director of investor relations; Riccardo Mulone, UBS Country Head Italy, and attorney Scott Miller, as well as Sergio Ermotti, chairman of Investindustrial Acquisition Corp.

As is often the case, personal relations were key in the development of the group’s new chapter. Zegna said the deal with Investindustrial stems from a longtime acquaintance with Andrea C. Bonomi, founder of Investindustrial and chairman of the Industrial Advisory Board. “Our family knew Andrea Bonomi and his family, and as family companies, not many things have to be explained,” the executive said.

Bonomi and Ermotti contacted Zegna in January, and “over afternoon tea” made their offer.

“There was an interesting negotiation over three months and they convinced me of the validity of the project. It was extremely confidential, it was the most delicate decision of my life, but I think I made the right decision for the family and the future of the brand.”

Zegna explained that going public through a merger with IIAC’s investment entity allowed the group “to move more quickly than through a traditional IPO. It also allowed us to continue to focus on managing Zegna throughout the process.”

He noted that “this is the type of transaction SPACs were designed to support: taking public a well-managed company with strong fundamentals and growth potential.”

He also underscored the importance of “trusted, long-term partnerships.” Bonomi and his team at Investindustrial “share our values — including a commitment to sustainability and a focus on the growth of great Italian brands and companies.”

While the Omicron variant spreads and uncertainties continue to hover, Zegna admitted these “past couple of years have been challenging for the industry and, of course, COVID-19 continues to keep us on our toes,” but he highlighted that the group has “demonstrated strength and resilience over our entire history and in particular in the recent years. We are stronger than before and we look to the long term. We have a very robust organization that is ready for anything, it’s fire-proof and I’m very proud of how we reacted, the energy is very high. I think we have done the right changes during COVID-19 regardless of this project. I learned a lot during COVID-19, the hardship and silence helped me to control myself, and be focused on protecting the health of our employees and we got through 2020. These past two years have been the most exciting and challenging of my career, but I remain positive and I have no regrets.”

Asked what he expects from the IPO, Zegna said the family company is “a true industrial reality, with factories and an integrated supply chain. Our objective is to continue to strengthen our industrial roots and at the same time remain laser-like focused on building our brand equity.”

The company “is first and foremost targeting organic growth,” taking “a major step” with the rebranding and the reorganization of the group. “We did this to create a more streamlined and focused brand that is both unique and immediately recognizable. This also allows us to focus more on the creation of new and iconic products such as the Triple Stitch,” he said, showing his own sneaker model in a brown hue. “Together with other actions on the positioning and pricing and on the store footprint optimization this should support organic growth.”

courtesy image

That said, he acknowledged Zegna is open to additional acquisitions to strengthen the group’s supply chain or to buy “another like-minded brand. This transaction is going to fuel Zegna’s growth in many ways, including the potential for additional and selective M&As. Continuing to build our Made in Italy platform is key. I am a firm believer that nothing in the world compares to Italian craftsmanship and quality, and our goal is to create and have access to the best fabrics, textiles and other materials through our platform.”

Zegna is indeed “evaluating possible new acquisitions,” as the group “will very carefully consider potential targets to ensure they align with our overall, long-term strategy — as was the case with Thom Browne. We’re extremely pleased with that acquisition, and we want to pursue similar ones in the future.”

He pointed to the acquisition of Achillfarm in 2014 or the more recent investments in Tessitura Ubertino and Filati Biagioli Modesto earlier this year with the Prada Group, as reflections of a strategy focused on the acquisition of manufacturers that produce raw materials and artisanal fabrics and textiles of the highest quality.

The executive was confirmed as CEO and will also take on the role of chairman, which ensures continuity.

“Zegna has been a family business ever since my grandfather started his wool mill in Trivero, Italy, in 1910. It was very important to me and to the family that we continue to lead the company and build on its success and legacy — which were built on a unique set of values, especially a focus on sustainability and community.”

Never losing focus of these values means to further respect nature and people. “At the same time, I have run the company like a public company hiring and developing a strong management team and a strong sense of belonging. Going public will help us grow the successful company our family built and deliver quality to our customers and value to our shareholders. It also helps build loyalty and retain and attract new talent.”

Next year, the company will focus on the execution of the new singular brand strategy which the executive expects “to be a tailwind going forward.”

Asked about the men’s wear segment, he said that “luxury leisurewear is our present and our future and we have read the market transformation well.”

He underscored the company has always done “a phenomenal job at staying close” to customers, which remains a priority. “We’re going to do this in many different ways, but two important ones are by focusing on the growth of our luxury leisurewear segment and engaging in various collaborations to attract a new generation of customers.”

Edoardo said the new five-letter logo “creates dynamism and projects us into the future, digs into what makes us different and amplifies it. It is inspired by font and branding of the past” and will mark all collections and products.

The road in the new logo is inspired by Road 232 that founder Ermenegildo Zegna built more than 110 years ago in the mountains of Northern Italy, Piedmont, surrounding the Trivero headquarters. “The road is our road and is a metaphor of our legacy. I am a member of the fourth generation, which is still here, and our road continues with new challenges and opportunities. Zegna belongs to today.”

He believes the company’s message is “unique,” differentiated thanks to the Oasi Zegna park and its sustainability and ethical message that goes back to the founder.

More than 70 stores have already changed their banners with the new logo and the transformation is expected to be completed within 2022.

Maggie Marguerite Inc.

“It’s a visual pointer, a verbal remembrance. Five letters have more space on stores, on the clothing, it’s a modern paradigm and mind-set. I am used to seeing the Ermenegildo Zegna logo, but I almost need spectacles compared to the new logo,” he quipped. “The founder is not going anywhere, the group is still called Ermenegildo Zegna but the new logo has a more simplified structure from an architectural standpoint. It is more powerful, more modern and more recognizable. We have always been a low-key family, but now we go to the next level, we need to be bolder and prouder of where we come from.”

The new Zegna logo and the double-stripe vicuña-colored signifier will be revealed for the first time with an exclusive outdoor and activewear capsule collection, designed with the mountaineering and the world of winter sports in mind, to bow on Dec. 3.

This capsule adds an element of technical performance to the world of Zegna and involves external partners. The capsule includes ski suits and puffers in Techmerino, technical jumpers, trousers and underpinnings. Zegna has developed mountaineering shoes with La Sportiva; a new customized version of the famed Piuma-R ski helmet with Kask; a performance ski with Zai, and a drinking bottle in a black aluminum version with Sigg.

As reported, the initial public offering deal is expected to give the fashion group a market capitalization of $2.5 billion. The Zegna family will continue to control the company with a stake of about 62 percent. Investindustrial will have an 11 percent stake and 27 percent will be free floating. Based on the transaction value, the merged entity will have an anticipated initial enterprise value of $3.2 billion.

courtesy image

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.

Yahoo Finance

Yahoo Finance