The Excellon Resources (TSE:EXN) Share Price Is Down 43% So Some Shareholders Are Getting Worried

It is doubtless a positive to see that the Excellon Resources Inc. (TSE:EXN) share price has gained some 39% in the last three months. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 43% in the last three years, falling well short of the market return.

Check out our latest analysis for Excellon Resources

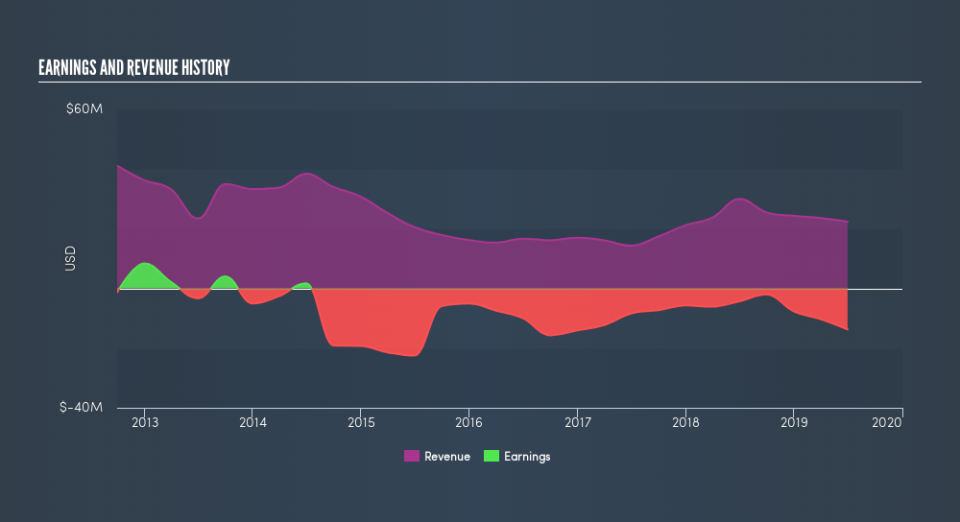

Because Excellon Resources is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Excellon Resources grew revenue at 18% per year. That's a pretty good rate of top-line growth. Shareholders have endured a share price decline of 17% per year. This implies the market had higher expectations of Excellon Resources. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Excellon Resources's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Excellon Resources shareholders are down 17% for the year. Unfortunately, that's worse than the broader market decline of 3.0%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6.0% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Excellon Resources may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance