Eversource (ES) Q3 Earnings Beat Estimates, Revenues Miss

Eversource Energy ES reported third-quarter 2019 operating earnings of 98 cents per share, beating the Zacks Consensus Estimate of 94 cents by 4.3%. The reported earnings also improved 7.7% year over year.

Total Revenues

Third-quarter revenues of $2,176 million lagged the Zacks Consensus Estimate of $2,318 million by 6.1% and declined 4.2% from the year-ago figure of $2,271 million.

Highlights of the Release

Operating expenses decreased 7.7% year over year to $1,666.6 million, primarily owing to lower operation and maintenance costs.

Operating income was up 9.3% from the prior-year quarter to $509.3 million. Interest expenses increased 8% year over year to $135.2 million in the quarter.

Its earnings in the first nine months of 2019 included after-tax impairment charge of 64 cents related to the company’s investment in the Northern Pass Transmission (“NPT”) project. However, the project had to be shelved due to an adverse court ruling.

Net income in the quarter under review was $320.8 million, up 10.1% from $291.3 million recorded in the year-ago period.

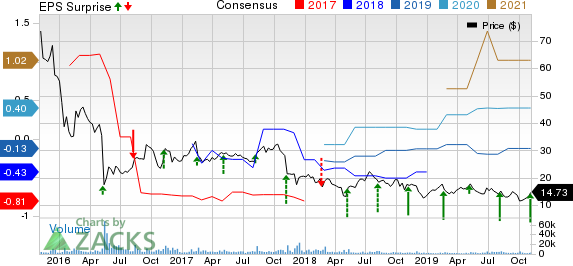

Eversource Energy Price, Consensus and EPS Surprise

Eversource Energy price-consensus-eps-surprise-chart | Eversource Energy Quote

Segmental Performance

Electric Distribution: Earnings from this segment were up 13.5% from the prior-year quarter to $197.3 million. The upside was primarily attributable to higher distribution revenues, and lower operation and maintenance expenses.

Electric Transmission: Earnings of the segment were down 1.8% year over year to $107.5 million. The decline was due to the absence of benefits from capitalizing interest and equity costs related to the canceled NPT project.

Natural Gas Distribution: This segment’s loss was $17.1 million compared with a loss of $12.6 million in the year-ago quarter. The segment’s weak results were due to the timing of distribution revenues.

Water Distribution: Earnings from this segment were $17.5 million compared with $17.6 million in the year-ago quarter.

Eversource Parent & Other Companies: The segment’s income was $13.7 million compared with $1.1 million in the year-ago quarter. The strong results were due to the absence of Access Northeast impairment charges.

Financial Highlights

Cash was $22.7 million as of Sep 30, 2019, down from $108.1 million on Dec 31, 2018.

Long-term debt (excluding current portion) was $13.4 billion as of Sep 30, 2019, higher than $12.3 billion on Dec 31, 2018.

Guidance

Eversource reiterated its 2019 earnings guidance in the range of $3.40-$3.50 per share. The midpoint of management’s 2019 EPS guidance is $3.45, which is higher than the current Zacks Consensus Estimate of $3.44 for the period.

Excluding NPT impairment charges, the company expects earnings per share to improve 5-7% over the long term.

Zacks Rank

Eversource currently carries a Zacks Rank #2 (Buy).

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Dominion Energy Inc. D reported third-quarter 2019 operating earnings of $1.18 per share, beating the Zacks Consensus Estimate of $1.16 by 1.7%.

Exelon Corporation’s EXC third-quarter 2019 operating earnings of 92 cents per share surpassed the Zacks Consensus Estimate of 88 cents by 4.5%.

NextEra Energy, Inc. NEE reported third-quarter 2019 adjusted earnings of $2.39 per share, beating the Zacks Consensus Estimate of $2.27 by 5.3%.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dominion Energy Inc. (D) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Exelon Corporation (EXC) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance