Evergold Receives Drill Permit for Rockland Gold-Silver Project, Walker Lane Trend, Nevada

Figure 1

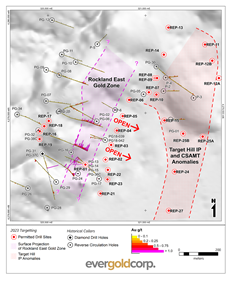

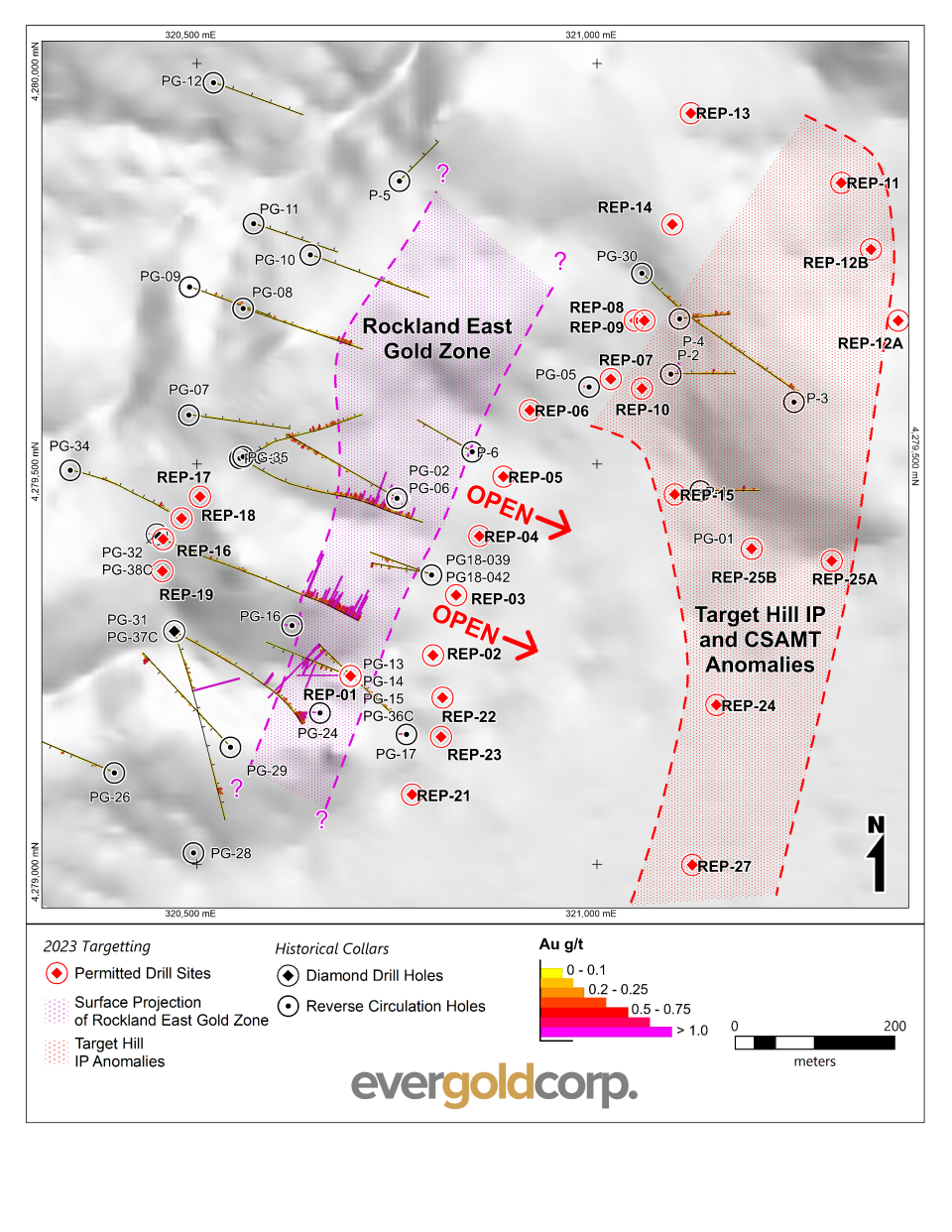

Figure 2

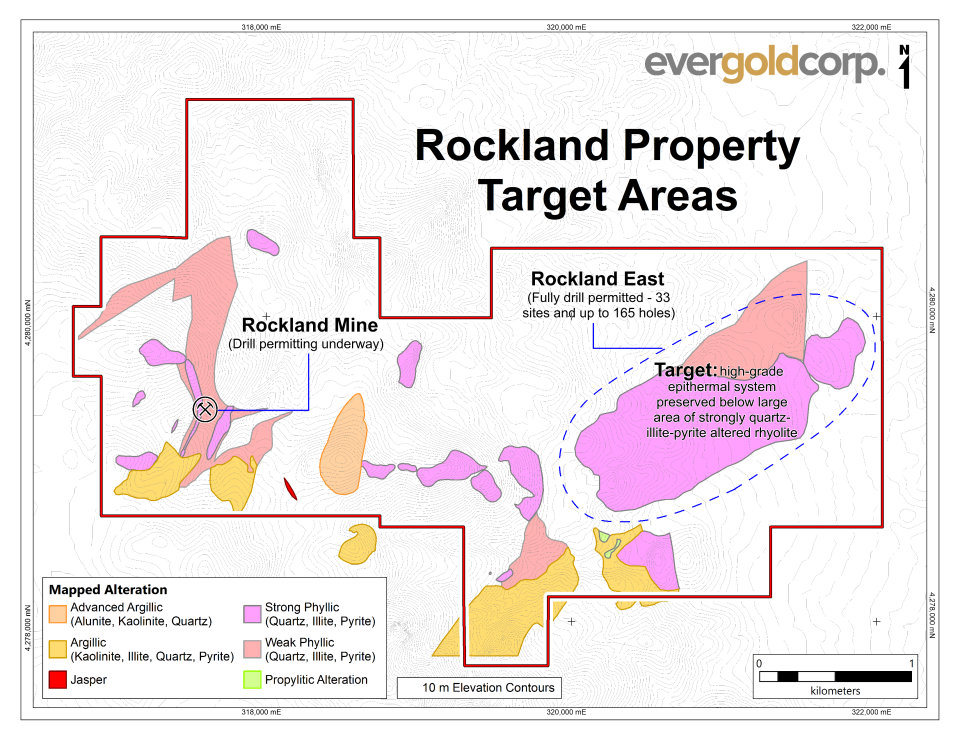

Figure 3

TORONTO, Feb. 13, 2023 (GLOBE NEWSWIRE) -- Evergold Corp. (TSX-V: EVER, OTC: EVGUF, WKN: A2PTHZ) (“Evergold” or the “Company”) is pleased to report that a detailed Plan of Operations has been approved, and a drill permit received, for its road-accessible Rockland gold-silver property, located in the Walker Lane trend of western Nevada (Figure 1). The permit approves 33 drill sites and up to 165 drill holes in the eastern half of the property, covering the 800 metre long Rockland East gold zone and nearby targets (Figures 2 and 3) which, along with the minimum 900X1500 metre area of exposed and altered rocks near the upper limit of the Mason Valley pediment, is believed to represent the upper levels of a high-grade epithermal vein system preserved as a result of down-dropping on range-front faults. As cited below, impressively long intercepts were delivered by the historical discovery holes into the Rockland East gold zone, with key holes stopping in their best mineralization, and highest grades, only due to a shortage of drill steel.

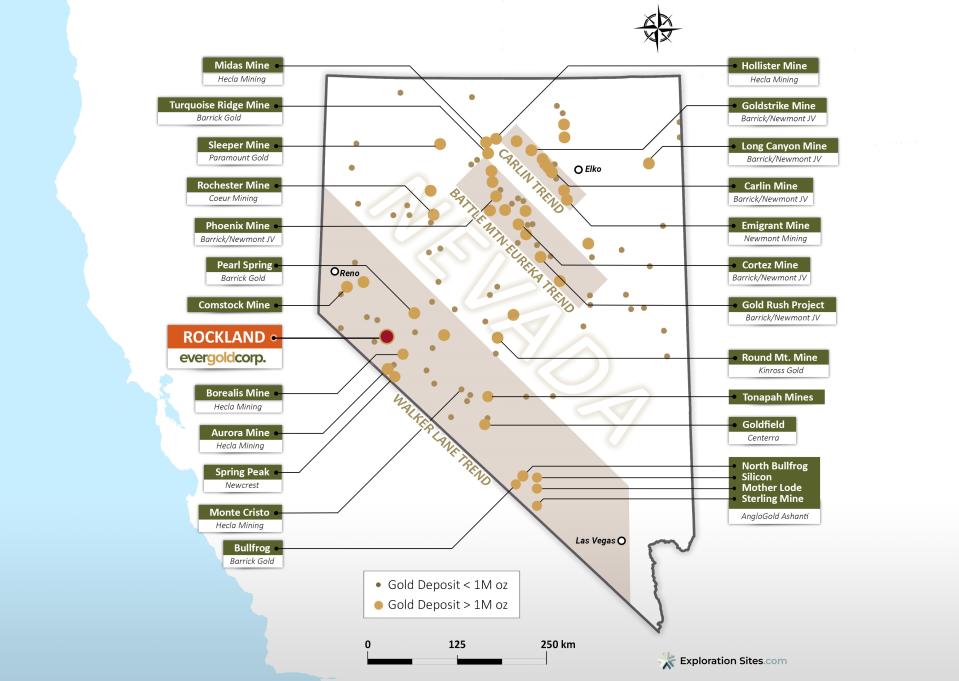

Exploration in the Walker Lane is surging, stemming in part from AngloGold Ashanti’s (AGA) exciting new ‘Silicon’ gold discovery near Beatty, now hosting more than 3 million ounces of gold and 14 million ounces of silver. In addition to the Silicon discovery, in 2022 AGA also purchased Corvus Gold for an effective enterprise value of US$459 million, acquired the Sterling project from Coeur Mining for up to US$200 million, and noted that its Walker Lane assets “are expected to yield more than 300,000 ounces of gold annually over more than a decade at a tier one cost structure.” In addition to AGA, other senior gold producers are active in the Walker Lane trend including Newcrest, Centerra, Barrick, Hecla and Coeur, highlighting the prospectivity and renewed attention to this under-explored district and the desirability of quality epithermal projects like Rockland.

“The granting of a drill permit for Rockland East is a major catalyst to our plans and we are excited to be able to move forward in evaluating key targets,” said Kevin Keough, President & CEO. “We have steadily advanced the project over the past 24 months and can now test what we believe to be one of the best drill-ready projects in the Walker Lane. Rockland East presents an excellent opportunity to explore for high-quality, high-margin ounces, and we’re very much looking forward to executing our drill plan, possibly with the assistance of a partner.”

About the Rockland Property

Gold and silver mineralization exposed at the Rockland project is related to a low-sulphidation epithermal vein system that formed approximately 6 to 8 million years ago at the western margin of the Great Basin. Mineralization is spatially and genetically associated with Late Miocene-age rhyolite intrusive activity and occurs in intensely altered rhyolites, associated sedimentary and tuffaceous rocks, and pre-Tertiary granodiorite. The best gold grades are associated with quartz veins and rhyolite feeder dikes that cut the basement granodiorite and the overlying younger rocks. Alteration and mineralization is primarily controlled by NNE- to NE-trending structures, which are common orientations of the high-grade veins at the nearby Aurora and Borealis gold-silver mines.

Rockland East Target Area

The Rockland East project area consists of a large NE-trending zone of strong quartz-illite-pyrite+/-kaolinite alteration hosted within and adjacent to a series of five or more coalesced rhyolite domes. The strongly altered zone is over 900 metres wide and up to 1500 metres long and contains numerous banded crustiform to chalcedonic quartz veins and vein breccias, as well as other silicified and/or sulfidized structures. Alteration and mineralization is associated with strongly anomalous pathfinder elements typical of the upper portion of a well-mineralized epithermal system (e.g. As up to 3370 ppm; Sb up to 610 ppm; Hg up to 350 ppm).

Limited historical drilling indicates a large, low-grade epithermal-style gold zone at Rockland East, with higher-grades interspersed within the zone, at moderate depth, and only sparsely drilled by historical operators along some 800 metres of strike, where it remains open along strike and at depth. The geometry of this zone is still poorly understood. Map relations in this generally poorly-exposed area, coupled with abundant associated pathfinder elements (particularly As, Sb and Hg) characteristic of the upper levels of low sulphidation epithermal vein systems found at Nevada mines such as Sleeper, Hollister and Midas, and El Peñón in Chile (all +1.5 Moz deposits), and at the southern Walker Lane systems mentioned above, indicate that the Rockland East target area is down-dropped relative to the historic Rockland Mine area on the west side of the property. This suggests that the entire epithermal system could be preserved under thin cover.

Significant Rockland East historical drilling intercepts include:

30.5 metres of 1.29 g/t Au including 3.1 metres of 6.13 g/t Au in Inmet hole PG-13;

16.8 metres of 1.05 g/t Au and 9.1 metres of 2.82 g/t Au including 1.5 metres of 9.20 g/t Au in Inmet hole PG-15;

109.7 metres of 0.96 g/t Au including 12.2 metres of 1.88 g/t Au in Romarco hole PG-32;

182.9 metres of 0.40 g/t Au in Romarco hole PG-33; and

59.4 metres of 1.09 g/t Au including 1.5 metres of 19.80 g/t Au in Romarco hole PG-36C

Note: The historical assays referenced in this news release have not been independently confirmed. Nonetheless, the historical drilling and sampling is believed to have been carried out by competent personnel working for reputable companies, as cited. Intercept true widths are not known.

Rockland Mine Target Area

The past-producing Rockland Mine is located within the western part of the Rockland property. Production between 1870 and the late 1930’s was largely undocumented but is estimated to have amounted to some 50,000 ounces of gold equivalent (AuEq), with grades as high 2.8 ounces per ton AuEq (96 g/t AuEq). Ore was drawn from high-grade epithermal-style veins, commonly encompassed by broad halos of lower-grade stockworks and breccia. The Rockland Mine area has yielded selected surface values to highs of 50.9 g/t Au and 1,758 g/t Ag, as well as numerous high-grade values from systematic sampling of underground workings carried out by BHP in 1989, including highs to 91 g/t Au. Stopes along the Rockland Mine adit level are reported to be several feet wide and semi-continuous for nearly 1,000 ft. along strike, and up to 1,400 feet down dip.

Evergold has submitted a drill permit application for the Rockland Mine part of the project area that is separate from the newly received permit for the Rockland East area. Permit approvals for the Rockland Mine are anticipated this summer.

In the vicinity of the Rockland Mine, drilling by BHP in the late 1980s returned shallow, broad intercepts of low-grade mineralization encompassing intervals of higher grade (true widths unknown), including:

39.6 metres of 1.16 g/t Au including 3.1 metres of 8.56 g/t Au in BHP hole RK-17;

59.4 metres of 1.03 g/t Au including 6.1 metres of 4.80 g/t Au in BHP hole RK-11; and

67.1 metres of 0.34 g/t Au in BHP hole RK-8

Much of the greater than 1.5 kilometre strike length of the Rockland Mine vein system remains untested for high-grade mineralization, particularly below the Rockland Mine adit level. Drilling by B2Gold in 2018 intersected a vein with 5.08 g/t Au and 354 g/t Ag over 1.5 metres in hole RK18-27, which is interpreted as the down-dip extension of the main vein historically mined.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2a6ac1d2-34c3-4dbf-98bd-e774165c60c9

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/919a878b-8fda-453c-99b9-e8e4f435298b

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/174f5234-a4c5-44f3-844a-e28ed68b2ce2

QA/QC

Charles J. Greig, P.Geo., a Qualified Person as defined by NI 43-101, has reviewed and approved the technical information in this news release.

About Evergold

Evergold Corp. is a TSX Venture listed mineral exploration company with wholly-owned projects in B.C. (Golden Lion, Holy Cross, Snoball), and a single project under option in Nevada (Rockland), to which it has the right to earn a 100% ownership position. Company management is proven, with a track record of recent exploration success, most recently the establishment of GT Gold Corp. in 2016, the discovery in 2017 of both the Saddle South epithermal vein and Saddle North porphyry copper-gold deposits near Iskut B.C., and the Corporation’s sale to Newmont Corporation in 2021.

For additional information, please contact:

Kevin M. Keough

President and CEO

Tel: (613) 622-1916

www.evergoldcorp.ca

kevin.keough@evergoldcorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political and geopolitical risks; an inability to fulfill the duty to accommodate First Nations; an inability to predict and counteract the effects of COVID-19 on the business of the Company; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets, inflation, and exchange rates; fluctuations in commodity prices; delays in the development of projects; other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release. No assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Yahoo Finance

Yahoo Finance