Everest Re (RE) Q2 Earnings Top, Revenues Miss, Premiums Up Y/Y

Everest Re Group, Ltd.’s RE second-quarter 2022 operating income per share of $9.79 beat the Zacks Consensus Estimate by 7.9%. The bottom line decreased 33.1% year over year.

Everest Re witnessed higher premiums across its reinsurance and insurance businesses. Margins expanded in both insurance and reinsurance businesses, driven by disciplined growth, scale in insurance platform and capitalization on strategic market opportunities that improved the diversity and economics of its book, while reducing volatility in the reinsurance business. An active cat environment induced deterioration in the combined ratio.

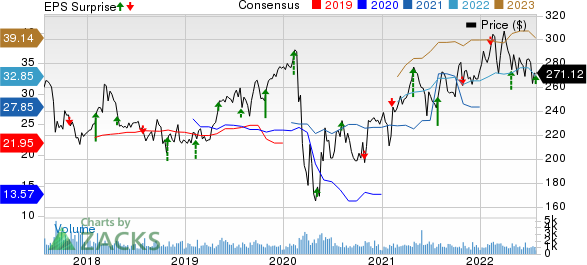

Everest Re Group, Ltd. Price, Consensus and EPS Surprise

Everest Re Group, Ltd. price-consensus-eps-surprise-chart | Everest Re Group, Ltd. Quote

Operational Update

Everest Re’s total operating revenues of nearly $3.1 billion increased 3.4% year over year on higher premiums earned. The top line, however, missed the consensus estimate by 2.8%.

Gross written premiums improved 8.1% year over year to $3.4 billion. The Reinsurance segment generated premiums of $2.2 billion, up 2.5% year over year, including a highly successful Jun 1 and Jul 1 renewal where Everest Re was successful in writing a stronger, less volatile, more diversified, and more profitable book of business. The Insurance segment generated a premium of $1.2 billion, up 16.9% year over year, driven by balanced and diversified growth across most lines of business and geographies, partially offset by the company’s continued focus on reducing exposure in property CAT.

Net investment income was $226 million, down 44.5% year over year.

Total claims and expenses increased 17.2% to $2.6 billion, primarily due to higher incurred losses and loss adjustment expenses, commission, brokerage, taxes and fees, other underwriting expenses, and interest, fees and bond issue cost amortization expense.

Pre-tax underwriting income was $240 million, including $85 million of catastrophe losses net of recoveries and reinstatement premiums. Catastrophe events comprised South Africa flood losses, Canadian and European storms, and second-quarter events in the United States.

The combined ratio deteriorated 250 basis points (bps) year over year to 91.8 in the reported quarter. The combined ratio of the Reinsurance segment deteriorated 20 bps to 91.8 while the same improved 200 bps to 91.5 for the Insurance segment.

Financial Update

Everest Re exited the second quarter of 2022 with total investments and cash of $28.7 billion, down 3.2% from the 2021 level. Shareholder equity at the end of the reported quarter decreased 12.7% from 2021 end to $8.9 billion.

Book value per share was $224.59 as of Jun 30, 2022, down 13.7% from the 2021-end level.

The annualized net income return on equity was 4.8%, down 2360 bps.

Everest Re’s cash flow from operations was $715 million in the quarter, down 1.2% year over year.

Everest Re paid common share dividends of $65 million during the quarter.

Zacks Rank

Everest Re currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other P&C Insurers

Of the insurance industry players that have reported second-quarter results so far, The Travelers Companies TRV and RLI Corporation RLI beat the respective Zacks Consensus Estimate for earnings, while The Progressive Corporation PGR met the mark.

Travelers’ core income of $2.57 per share beat the Zacks Consensus Estimate by 28.5% but decreased 26% year over year. Total revenues increased 7% year over year, primarily due to higher premiums and beat the consensus estimate by 1.8%. Net written premiums increased 11%, driven by strong retention rates and positive renewal premium changes across all the segments. Underwriting gain of $113 million decreased 65% year over year in the reported quarter.

Travelers’ combined ratio deteriorated 300 bps year over year to 98.3 due to higher catastrophe losses and a higher underlying combined ratio.

RLI’s operating earnings of $1.49 per share beat the Zacks Consensus Estimate by 6.1% and improved 36.7% from the prior-year quarter. Operating revenues were $301.3 million, up 16.9% year over year, driven by 17.3% higher net premiums earned and 10.5% higher net investment income. The top line beat the Zacks Consensus Estimate of $276 million by 0.9%.

RLI’s underwriting income of $56 million increased 53%, primarily due to the strong performance of the Property and Surety segments. The combined ratio improved 460 bps year over year to 80.2.

Progressive’s earnings per share of 95 cents came in line with the Zacks Consensus Estimate. The bottom line declined 37.1% year over year. Net premiums written were $12.4 billion in the quarter, up 8% from $11.7 billion a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Everest Re Group, Ltd. (RE) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance