EV Roundup: Key Tidbits From Quarterly Releases of NIO, LI, RIVN, CHPT & BLNK

The quarterly results of NIO Inc. NIO, Li Auto LI, Rivian Automotive RIVN, ChargePoint Holdings CHPT and Blink Charging BLNK dominated last week’s key stories in the electric vehicle (EV) space. Li Auto incurred a quarterly loss amid high operating costs.

While LI currently carries a Zacks Rank #2 (Buy), NIO is #5 Ranked (Strong Sell). RIVN, CHPT and BLNK currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Here are the key takeaways from the quarterly reports of these companies.

NIO incurred a loss per American Depositary Share (ADS) of 51 cents in the fourth quarter of 2022, wider than the year-ago loss of 21 cents due to lower vehicle margins and higher operating expenses, despite improved deliveries. The company posted revenues of $2,329 million, up 62.2% year over year on the back of robust deliveries.The revenues generated from vehicle sales amounted to $2,139.9 million, rising 60.2% year over year. The increase in vehicle sales was mainly led by higher deliveries. Other sales amounted to $189.1 million, up 90.3%. The vehicle margin in the reported quarter declined to 6.8% from 20.9%.

Cash and cash equivalents totaled $2,883.4 million as of Dec 31, 2022. The long-term debt was $1,578.3 million as of the same date. For the first quarter of 2023, NIO expects deliveries in the band of 31,000-33,000 vehicles, signaling a year-over-year uptick of 20.3-28.1%. Revenues are envisioned between $1,584 million and $1,674 million, indicating a year-over-year increase of 10.2-16.5%.

Li Auto reported earnings per ADS of 13 cents for the fourth quarter of 2022 versus the Zacks Consensus Estimate of a loss of 19 cents. In the year-ago period, the firm had posted earnings of 68 cents a share. Revenues of $2.56 billion were up 66.2% year over year on higher vehicle sales. Li Auto delivered 46,319 vehicles in the fourth quarter, up 31.5% year over year. The revenues generated from vehicle sales amounted to $2.5 billion, rising 66.4% year over year. Other sales amounted to $55.3 million, up 55.9%. Vehicle margin came in at 20% in the quarter under review.

As of Dec 31, cash and cash equivalents were $5.57 billion. Total long-term debt was $1.33 billion. For the first quarter of 2023, Li Auto expects deliveries in the band of 52,000-55,000 vehicles, signaling a year-over-year jump of 64-73.4%. Revenues are envisioned between $2.53 and $2.68 billion, indicating a year-over-year rise of 82.5-93%.

Rivian incurred a net adjusted loss of $1.73 a share for the fourth quarter of 2022, narrower than the Zacks Consensus Estimate of a loss of $1.89 a share. The bottom line also improved from the year-ago loss figure of $2.43 a share. Total revenues came in at $663 million, missing the consensus mark of $714 million. In the year-ago quarter, the EV maker reported revenues of $54 million. Fourth-quarter revenues improved from $536 million generated in the third quarter of 2022.

During the quarter under review, Rivian produced and delivered 10,020 and 8,054 vehicles, respectively. The company exited 2022 with $12,099 million in cash, cash equivalents, and restricted cash.RIVN targets to produce 50,000 vehicles this year. It expects a negative adjusted EBITDA of $4,300 million for 2023. Capex is forecast to be $2,000 million for the year. Although Rivian is focused on ramping up production, it believes supply-chain bottlenecks will remain a hindrance.

ChargePoint reported fourth-quarter fiscal 2023 (ending Jan 31, 2023) loss per share of 13 cents, narrower than the Zacks Consensus Estimate of a loss of 16 cents. This compares to loss of 21 cents per share incurred a year ago. Revenues came in at $152.83 million, soaring 93% year over year but missing the consensus mark of $164 million. Revenues from networked charging systems jumped from $58.6 million to $122.3 million in the quarter under discussion, Subscription revenues rose 49.4% to $25.7 million.

Total operating expenses during the fiscal fourth quarter 2023 were $111.3 million, up from $96.7 million recorded in the year-ago period. As of Jan 31, 2023, the company’s cash and cash equivalents totaled $264.2 million and long-term debt was $295 million. For the first fiscal quarter ending Apr 30, 2023, ChargePoint envisions revenues in the band of $122-$132 million, implying a year-over-year increase of 56% from the midpoint of the guided range.

Blink Charging reported fourth-quarter loss of 41 cents a share, narrower than the Zacks Consensus Estimate of 49 cents. The loss also narrowed from 44 cents incurred in the year-ago period. Total revenues increased 184% to $22.6 million during the quarter under review and topped the consensus mark of $19 million. Product Sales rocketed 176% to $15.8 million, service revenues jumped 213% to $5.7 million, and network fees were up a whopping 827% to $2.3 million.

Total operating expenses during the fourth quarter of 2022 were $34.2 million, up from $20.5 million recorded in the year-ago period. As of Dec 31, 2022, the company’s cash and cash equivalents totaled $36.5 million. Subsequent to the fourth quarter, Blink closed a public offering with gross proceeds of $100 million. The company forecasts revenues in the band of $100-$110 million and gross profit in excess of 30% for 2023.

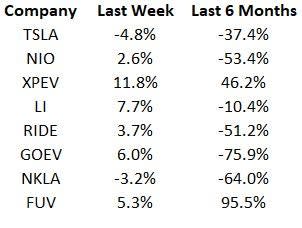

Price Performance

The following table shows the price movement of some of the major EV players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Space?

Stay tuned for announcements of upcoming EV models and any important updates from the red-hot industry.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Blink Charging Co. (BLNK) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

ChargePoint Holdings, Inc. (CHPT) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance