Euro Traders Swimming with the Sharks

The Euro has seen a vast amount of turbulence today and is likely to remain fast as political developments from Germany sweep into forex. Technical trading will likely be impactful over the coming days as the Euro tries to find an equilibrium.

German News Challenges Traders

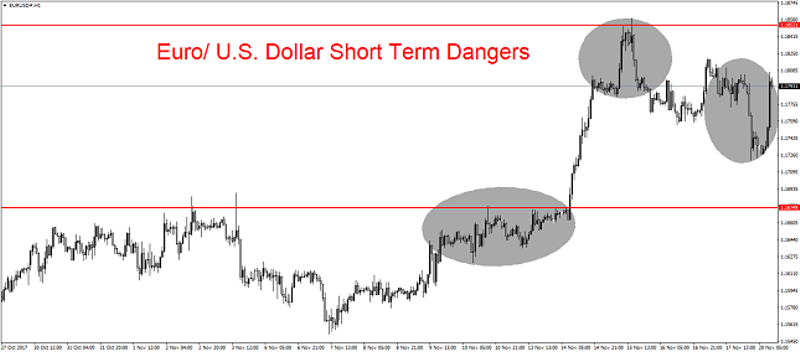

Short-term traders of the Euro are literally swimming among sharks this morning. The European currency has seen hyper-volatility on the developing political news from Germany.

The Euro has recovered from early morning lows and is within the 1.18 ratio, but traders will have to be extraordinarily careful today and tomorrow with the currency.

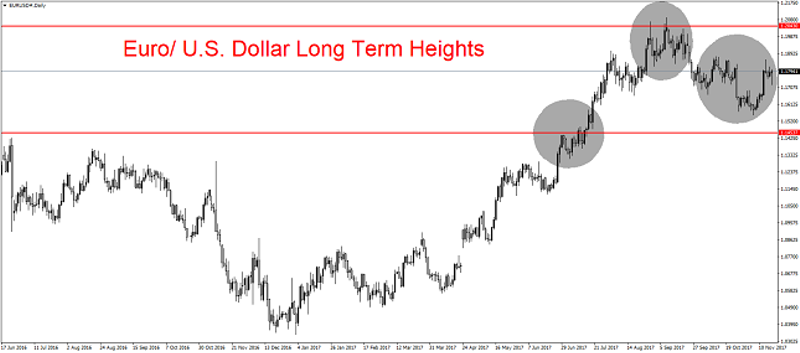

An Ability to Re-Capture Lost Momentum

The Euro has shown the ability to gain the past week and recapture some of its lost momentum against the U.S Dollar and some speculators may still be embracing the goal of a 1.19 juncture.

However, the failure of Angela Merkel to form a coalition government has sent shockwaves into forex and the Euro has been wounded.

Technical Reversals Important Today and Tomorrow

Chancellor Merkel will try to form a government, but if her attempts fail again it will make traders nervous as they contemplate an uncertain mid-term which could involve new German elections.

Technical traders will be challenged via support and resistance levels. Speculators may look for reversals in the coming days as ranges are tested while the Euro finds an equilibrium.

In the short term, we believe the Euro may be negative on technical reversals. Mid-term and Long-term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini S&P 500 Index (ES) Futures Technical Analysis – November 20, 2017 Forecast

US Dollar Index (DX) Futures Technical Analysis – November 20, 2017 Forecast

USD/JPY Fundamental Daily Forecast – Expecting Low Volume, Two-Sided Trade

AUD/USD and NZD/USD Fundamental Daily Forecast – Light Volume Could Lead to Counter-Trend Trade

Yahoo Finance

Yahoo Finance