Euro May Be Preparing for a Move

The Euro’s relative tranquility the past two days may be positive for traders. Two key risk events will take place next week, the U.S Fed interest rate decision, and the U.K and E.U Brexit Summit. These events could be a positive lynchpin for the Euro.

Tranquility of Euro Good for Traders

The Euro has been relatively tranquil the past couple of days and this may be good news for traders.

The Euro is near 1.1840 against the U.S Dollar in early trading today and it appears investors have found a comfortable equilibrium the past week.

Resistance Has Proven Strong

As next week’s U.S Federal Reserve interest rate decision draws closer – and a likely hike takes place from the U.S central bank, and the Brexit summit also looms – the Euro could be well positioned for a breakout.

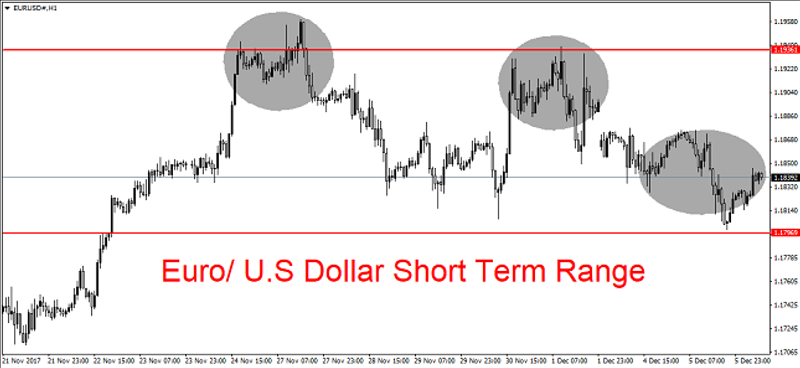

The Euro showed the ability to test higher values in September and also made forays upwards early last week. However, resistance proved rather strong in both cases.

Reasons for Suspect Higher Values

Traders who have patience and the ability to maintain buying positions should consider buying the Euro. There is the reason to suspect values around the 1.19 to 1.20 level is attainable again.

Next week’s important risk events coming from the U.S Fed, and the Brexit Summit will be lynchpins. And they may prove positive for the Euro against the U.S Dollar.

In the short term, we believe the Euro may be positive. In the mid-term and long-term, we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance