EUR/USD Mid-Session Technical Analysis for January 14, 2020

The Euro is trading lower against the U.S. Dollar on Tuesday as benchmark 10-year government bond yields in the Euro Zone inched down, making the single-currency a less-desirable asset. After rising to near two-week highs on Monday, most 10-year bond yields edged back down in what analysts said was largely position squaring.

At 13:26 GMT, the EUR/USD is trading 1.1107, down 0.0027 or -0.25%.

In other news, European Central Bank board member Yves Mersch said on Tuesday, economic growth and inflation in the Euro Zone are showing “good signs of stabilization” after a slowdown. The ECB holds its first meeting of the year next week.

Today’s U.S. consumer inflation reports were mixed. The CPI rose 0.2 percent in December on a seasonally adjusted basis after rising 0.3 percent in November, the U.S. Bureau of Labor Statistics reported.

Core CPI rose 0.1 percent in December after increasing 0.2 percent in November. This figure came in below the forecast. The EUR/USD reported slightly after the report.

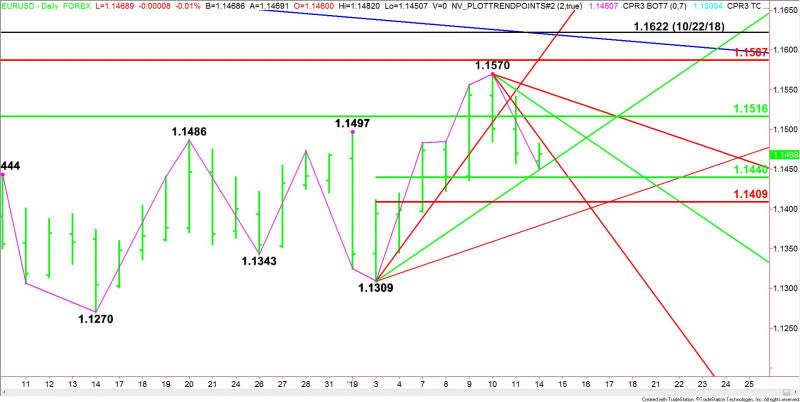

Daily Technical Analysis

The main trend is up according to the daily swing chart. However, momentum is trending lower. A trade through 1.1085 will change the main trend to down.

The minor trend is also down. This confirms the shift in momentum. The minor trend will change to up on a move through 1.1147.

The downside target zone comes in at 1.1096 to 1.1045. On the upside, the resistance zone is 1.1146 to 1.1209. Longer-term resistance comes in at 1.1185.

Daily Technical Forecast

Based on the early price action, the direction of the EUR/USD the rest of the session on Tuesday is likely to be determined by trader reaction to the uptrending Gann angle at 1.1131.

Bearish Scenario

A sustained move under 1.1131 will indicate the presence of sellers. This could create the downside momentum needed to challenge the 50% level at 1.1096, followed by the main bottom at 1.1085.

A trade through 1.1085 will change the main trend to down with a support cluster at 1.1056 to 1.1045 the next likely target.

Bullish Scenario

Overtaking 1.1131 will signal the return of buyers. This could create the momentum needed to test a potential resistance cluster at 1.1146, 1.1147 and 1.1149.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance