EUR/USD Mid-Session Technical Analysis for September 20, 2019

The Euro is trading flat against the U.S. Dollar on Friday after giving up earlier gains. In Europe, German PPI came in at -0.5%, lower than the 0.0% forecast and the previously reported 0.1%. This may be one of the reasons for the weakness. There are no major U.S. economic reports today so the weakness could also be blamed on firmer U.S. Treasury yields and increased demand for risky assets.

At 11:07 GMT, the EUR/USD is trading 1.1040, up 0.0001 or +0.01%.

Fed speakers are also on tap today, which could offer traders some clarity after central bank policymakers cut rates 25 basis points on Wednesday as expected, but left open the possibility of future rate cuts. Last week, the European Central Bank (ECB) cut rates and announced another round of quantitative easing. The Euro has been underpinned ever since as some traders feel the ECB is out of options.

Daily Technical Analysis

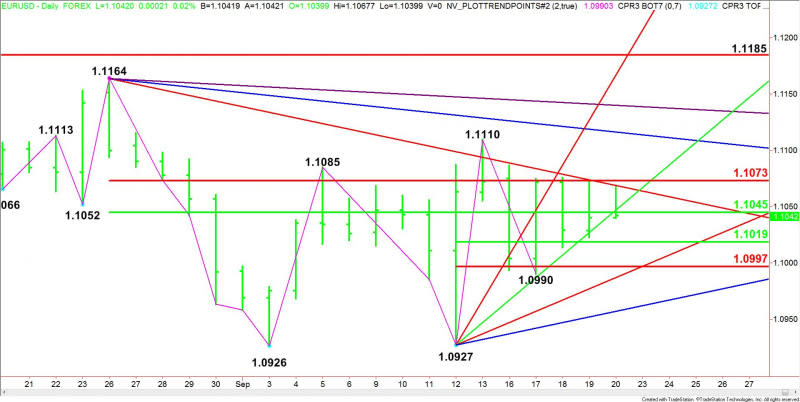

The main trend is up according to the daily swing chart. A trade through 1.1110 will signal a resumption of the uptrend. The main trend changes to down on a move through 1.0927.

The minor trend is also up. A trade through 1.0990 will change the minor trend to down. This will also shift momentum to the downside.

The main range is 1.1164 to 1.0926. Its retracement zone at 1.1045 to 1.1073 is acting like resistance. It’s also controlling the near-term direction of the EUR/USD.

The short-term range is 1.0927 to 1.1110. Its retracement zone at 1.1019 to 1.0997 is support.

Daily Technical Forecast

Based on the early price action and the current price at 1.1040, the direction of the EUR/USD is likely to be determined by trader reaction to the main 50% level at 1.1045 and the uptrending Gann angle at 1.1047.

Bearish Scenario

A sustained move under 1.1045 will indicate the presence of sellers. If this move creates enough downside momentum then look for a possible break into the short-term 50% level at 1.1019. Look for a technical bounce on the first test of this level. If it fails then look for the selling to possibly extend into the short-term Fibonacci level at 1.0997, followed closely by the minor bottom at 1.0990 and the uptrending Gann angle at 1.10987.

Bullish Scenario

A sustained move over 1.0147 will signal the presence of buyers. The first target is a downtrending Gann angle at 1.1069, followed by the main Fibonacci level at 1.1073. This is a potential trigger point for an acceleration to the upside.

This article was originally posted on FX Empire

More From FXEMPIRE:

Global Markets Are Cautious, Trade Talks Yield Mixed Results, No Deal Expected Soon

Crude Oil Price Update – Strengthens Over $59.49, Weakens Under $57.58

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – Trading on Bullish Side of 7883.25 Pivot

EUR/USD Daily Forecast – Euro Continues to Range Below Resistance

Yahoo Finance

Yahoo Finance