EUR/USD March Higher Continues, Fed Speak and Euro News Compete with Trump

DailyFX.com -

Talking Points:

EUR/USD extended its advance into the new week, hitting a six month high that clears out further resistance

The Dollar is struggling to control its own bearings, but Fed speak Monday and Tuesday will span the extremes of policy

Complacency is setting back in for risk trends as we await key global meetings; Kiwi and Bitcoin top the market movers

Traders have expectations that they will ride the volatility of a high-level event risk to quick profit, but the realities are often very different. Download the strategy guide for Trading Forex News on the DailyFX trading guides page.

The run continues. EUR/USD - the most liquid currency pair in the FX market and arguably one of the most traded assets in the entire financial system - continued its climb to a fresh six-month high. This move has defied the traditional fundamental hurdles and easily cleared a range of otherwise influential technical barriers. How far this pair reaches holds far more influence than just the opportunities in a EUR/GBP wedge break or EUR/AUD trend extension, it can dictate the bearings of an otherwise passive Greenback. As the world's most used currency, that can have far-reaching implication out to the sphere of influence including systemic risk trends. That is the potential, but what are the practicalities.

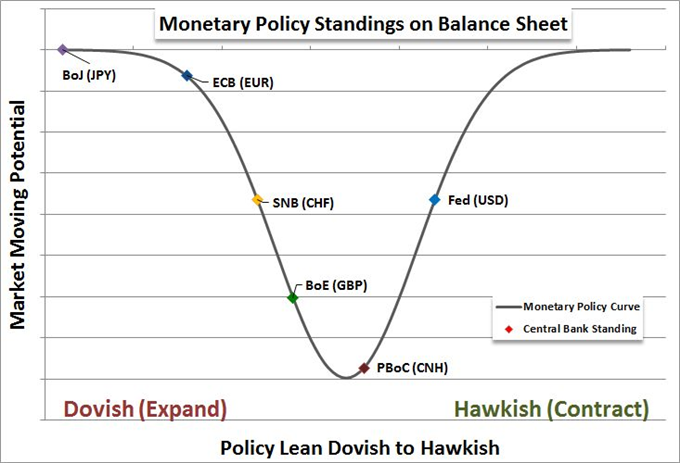

Looking across very crosses, we can come to the conclusion that the Euro has been doing the heavy-lifting as of late. On its own docket to start this new trading week, we had a few headlines that popped up on traders' radars. The data registered low on the influence scale, but there were a couple of developments that crossed the wires that no doubt drew attention. The first day of the EU and Eurozone Finance Ministers meeting didn't bear fruit with Greece, but that was expected. Germany's economic forecast for 2017 was raised but that too follows a normal course. The unexpected would come from German Chancellor suggesting that the Euro was too low on the backdrop of the ECB's exceptional easing. While that is atypical and comes from a rather influential person, officials' evaluations of value rarely translate into genuine market movement. From the Dollar, the circumstances were equally couched in measured potential. The Chicago Fed's upgraded assessment of the US economy is a welcome sign after the weak 1Q GDP reading, but of limited interest for traders looking elsewhere. More remarkable but losing its power was the Fed speak which included Kaplan's reiteration of support for a FOMC QE reversal this year.

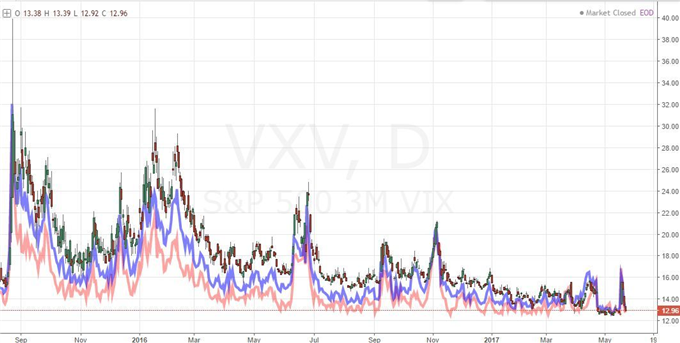

Neither Dollar nor Euro seems strongly motivated, and that should dampen our expectations for dramatic opportunity. The same should be assessed for general risk trends. While benchmarks for sentiment from US equity indexes to global shares to high risk assets all ticked higher, it was a very measured performance. Traders should remain observant and flexible to developments which translates into shorter duration trades, lower risk and an open mind to flipping views. Meanwhile, the anticipated volatility measures continue to deflate to extreme complacency levels. While it may be reasonable for expected activity levels one week forward to drop to very low levels, it is increasingly dubious that the same should be assessed for 1 month and 3 months forward. With US President Trump's meetings escalating in economic importance - with NATO and G7 meetings in the latter half - we should at least count for the out chance that volatility can show up. Meanwhile, this past session's top movers were the New Zealand Dollar's remarkable surge and Bitcoin's extreme extension (and subsequent retreat). We discuss what is developing and what is likely ahead in today's Trading Video.

To receive John’s analysis directly via email, please SIGN UP HERE

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance