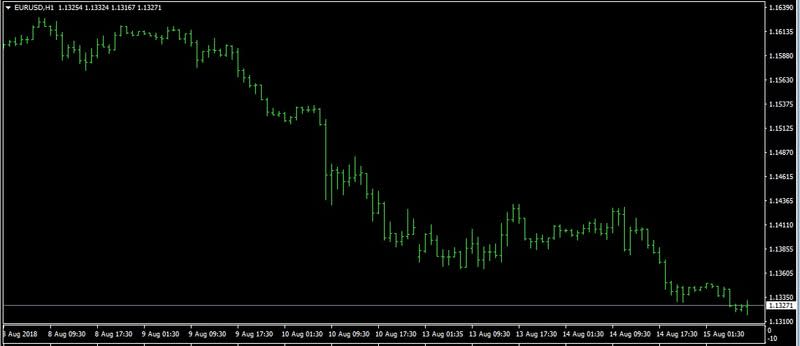

EUR/USD Daily Price Forecast – EUR/USD Hits 13-Month Low on Continued Woes from Turkish Crisis & New CNY Lows

The EURO has continued to struggle with the situations in Turkey, as there is contagion fears of European banks, especially in France and Spain, being so heavily exposed to Turkish debt. Also market saw added woes over CNY as Chinese Yuan (CNY) fell to a new trend low of 6.9068 per US dollar in Asia, leading to a broad-based USD rally. As a result, the EUR/USD fell to 13-month low of 1.1320, bolstering the already bearish technical setup: the common currency suffered a pennant breakdown earlier this month and closed yesterday below the all-important 200-week moving average support of 1.1356. Hence, it seems safe to say the bears are in control and the EUR could soon drop to 1.1300 handle. The dollar held firm near a 13-month high against a basket of major currencies on Wednesday after safe-haven demand on fears over fallout from the Turkish lira’s recent drop boosted the U.S. currency. As of writing this article, EURUSD pair is trading at 1.1328 down 0.15% on the day.

Turkish Crisis Continues To Weigh Down European Market

In light of all the turmoil we’ve seen out of Turkey and the subsequent contagion into other emerging markets, the dollar is pretty much establishing itself as the safe-haven currency. The dollar is the higher-yielding of the safe-haven currencies, so it obviously will attract the most flows. If you are going to park your money somewhere to stay away from the turmoil, the dollar is going to be the currency of choice. The lira has lost more than two-fifths of its value against the greenback this year, hit by worries over President Tayyip Erdogan’s calls for lower interest rates and fraying ties between the United States and Turkey, a NATO ally. Turkish President Tayyip Erdogan said on Tuesday that Ankara would boycott electronic products from the United States, retaliating in a row with Washington that has helped drive the lira to record lows. Lira was supported by remarks from Turkish Finance Minister Berat Albayrak, who told a news conference the lira will strengthen.

As Euro suffers from Turkish crisis, global market will continue to focus on Sino-U.S trade wars as both issues continue to strengthen US greenback in global market. On the data front, the US July retail sales are scheduled for release at 12:30 GMT. A better-than-expected print would only add to the bearish pressure around the EUR. On the other hand, a weak reading could help the oversold EUR regain some poise. The EUR pairs could also turn volatile during Bundesbank President Jens Weidmann’s speech, scheduled at 16:00 GMT. Looking from technical perspective, the 14-day relative strength index (RSI) is reporting oversold conditions. Meanwhile, the hourly relative strength index (RSI) is creating a bullish divergence. Thus, bearish momentum could wane in the next few hours. Expected support and resistance for the pair are at 1.1312, 1.1285, 1.1187 and 1.1360, 1.1400, 1.1433 respectively.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance