EUR/USD Daily Fundamental Forecast – February 23, 2018

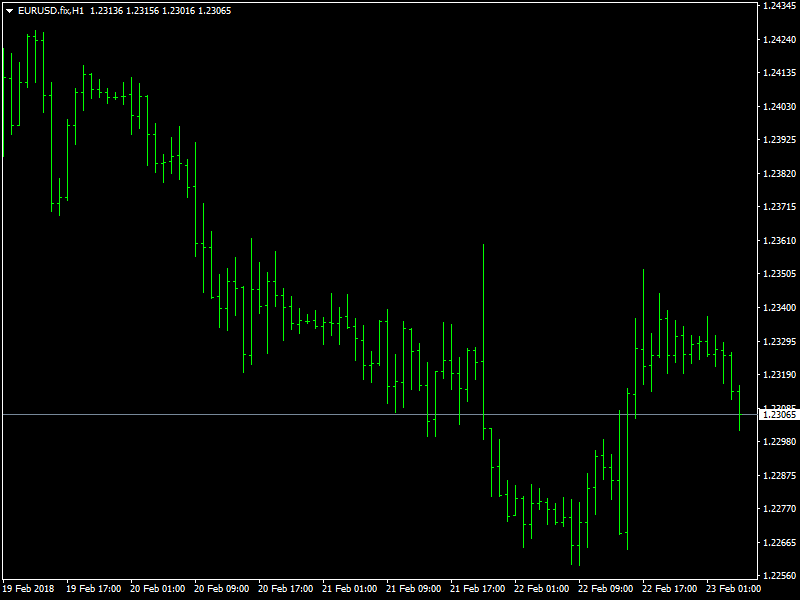

The EURUSD pair had a choppy day of trading yesterday as the pair moved lower during the initial part of the day, as the momentum of the dollar strength from the previous day helped the dollar to continue to push ahead but as the day wore on, the pair managed to reverse back and end the day higher.

EURUSD Bounces Off Lows

There were small bits and pieces of data from the US which came in stronger than expected but they seemed to have little impact on the dollar strength. The dollar turned weak towards the end of the day and this has since helped the pair to climb back through the 1.23 region and it continues to trade in that region as of this writing. Though there has been a bounce from the lows in the pair, we believe that the bears continue to retain control of the pair.

This would mean that any kind of bounce needs to be sold into and the traders need to make sure that they plan their trades. The region around 1.2240 is a strong support region and that is where the bounce began yesterday. Unless this region is broken, the bears cannot be confident of their strength and if the price region gives way, then we should be looking much lower, probably even below the 1.20 region in due course of time.

Looking ahead to the rest of the day, we do not have any major news from the US or the Eurozone and hence the consolidation and ranging is set to continue for the day. We have the monetary policy report from the Fed later in the day and this is the first piece of report which is being made after the new Fed Chief Powell took charge and it will be interesting to see whether there is any change in language. This is not market moving news in any case and so we should see some consolidation today.

This article was originally posted on FX Empire

More From FXEMPIRE:

Alt Coins Price Forecast February 23, 2018, Technical Analysis

GBP/USD Price Forecast February 23, 2018, Technical Analysis

Ethereum Price Forecast February 23, 2018, Technical Analysis

Crude Oil Price Forecast February 23, 2018, Technical Analysis

Bitcoin Price Forecast February 23, 2018, Technical Analysis

Yahoo Finance

Yahoo Finance