EUR/USD Daily Forecast – Euro Rallies to Wipe Fed-Inspired Losses

Federal Reserve Delivers Another Rate cut

The Fed lowered the benchmark overnight lending rate by a quarter percentage point on Wednesday which was largely expected by the markets.

Fed Chair Powell described it as an insurance cut, to stave off any negative impacts of an ongoing trade war and slowing global growth. Policymakers did not signal intent to ease further, although I suspect market participants are not ruling out another quarter basis point cut this year.

There were three Fed members that opposed yesterday’s decision to ease policy. Two of those three had wanted to keep rates unchanged. One member was looking for a more aggressive measure and advocated for a 50 basis point cut.

The Fed’s decision not to signal further easing appears to reflect the desire to remain data-dependent. In this context, progress in the trade war and incoming growth data will clarify what the central bank intends to do next.

The dollar strengthened on Wednesday following the meeting. I suspect the lack of a signal for further easing provided the driver. However, the pair has fuly recovered in early trading today. This seems to suggest the markets are not convinced that the Fed is done easing this year.

Technical Analysis

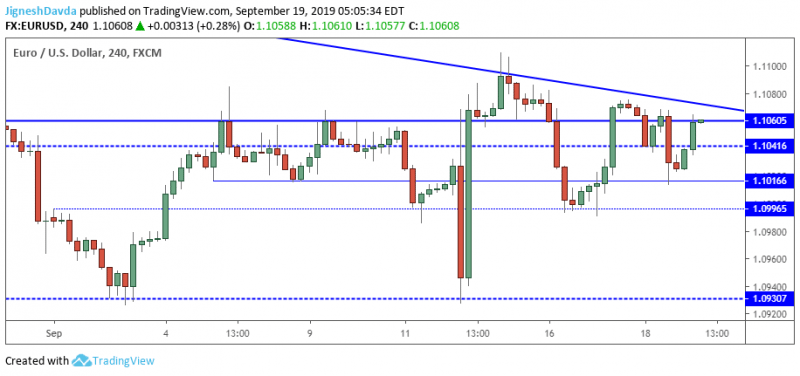

EUR/USD is once again testing a major resistance level found at 1.1060. At this stage, the pair appears to be forming a range as overhead resistance had blocked rallies for four straight sessions.

At the same time, the pair is dangerously close to a resistance level that, if breached, could signal an upside breakout. This resistance comes in the form of a declining trendline that extends from a peak in late June. Currently, it is just slightly above the horizontal level at 1.1060.

Support for the session ahead resides at 1.1041. While above it, I have a bit of a bullish bias for the pair even though it has been ranging in the past few sessions.

Bottom Line

The Fed-Inspired decline in EUR/USD was short-lived.

EUR/USD is once again threatening a major resistance area that could signal a bullish breakout if breached.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance