EUR/USD Daily Forecast – Euro Attempts to Hold Above 1.10

A Range May Form Ahead of Fed Meeting

With a relatively light economic calendar in the early week, we may see EUR/USD consolidate within a range over the next few days.

Much of the recent volatility in EUR/USD came on the back of last week’s European Central Bank meeting. The ECB eased policy by sending the interest rate into further negative territory and expanding its quantitative easing program.

Market participants will now look to the Fed, who meets on Wednesday, to see if they will also look to cut rates to offset some weakness in the economy and the effects of an ongoing trade war.

There are only a few economic releases ahead of Wednesday’s meeting, and they are not likely to have much of an impact on EUR/USD. The highlight ahead of the Fed meeting will be inflation data out of Europe.

The latest Eurozone consumer price index will be released on Wednesday. Annual CPI was reported at just 1.0% at the last reading which was the lowest since December 2016. CPI peaked at 2.2% in November last year and has steadily dropped lower since. The ECB watches this particular figure closely and it heavily influences their monetary policy decisions.

Technical Analysis

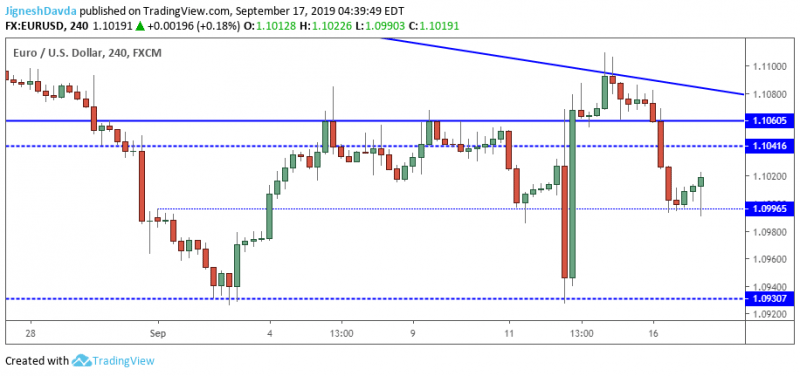

Considering the light data docket ahead of the Fed meeting, I expect a range might play out in EUR/USD ahead of it.

Yesterday, sellers drove the exchange rate lower after a failed attempt to break through upside resistance. The overhead hurdle in the pair comes from a declining trendline originating from late June highs, best seen on a daily chart.

The currency pair has caught a bid after briefly dipping below the psychological 1.1000 handle and this area stands to cap declines in the session ahead.

The first major area of resistance resides at 1.1041. There is a horizontal level in the area as well as several moving averages on a 4-hour chart.

Yesterday’s decline has led to a bearish reversal signal on a daily chart. However, the weekly chart continues to point to upward momentum. This sends mixed signals, however, we may see a breakout on Wednesday which should once again clarify a directional bias.

Bottom Line

EUR/USD dropped sharply on Monday to negate some of the upward momentum post-ECB.

Buyers have defended the 1.1000 level in early trading on Tuesday.

A major resistance confluence resides at 1.1041.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance