Ethereum, Litecoin, and Ripple’s XRP – Daily Tech Analysis – July 23rd, 2021

Ethereum

Ethereum rose by 1.43% on Thursday. Consolidating an 11.74% rally from Wednesday, Ethereum ended the day at $2,024.75.

After a mixed start to the day, Ethereum fell to a mid-day intraday low $1,948.68 before making a move.

Steering clear of the first major support level at $1,823, Ethereum rallied to a late afternoon intraday high $2,046.74.

Falling short of the first major resistance level at $2,102, however, Ethereum fell back to sub-$2,000 levels before ending the day at $2,000 levels.

At the time of writing, Ethereum was up by 0.10% to $2,026.79. A mixed start to the day saw Ethereum rise to an early morning high $2,032.00 before falling to a low $2,014.94.

Ethereum left the major support and resistance levels untested early on.

For the day ahead

Ethereum would need to avoid the $2,007 pivot to bring the first major resistance level at $2,065 into play.

Support from the broader market would be needed, however, for Ethereum to breakout from Thursday’s high $2,046.74.

Barring an extended crypto rally, the first major resistance level would likely cap any upside.

In the event of a broad-based crypto rally, Ethereum could resistance at $2,150 before any pullback. The second major resistance level sits at $2,105.

A fall the $2,007 pivot would bring the first major support level at $1,967 into play.

Barring an extended sell-off, however, Ethereum should steer clear of sub-$1,900 levels. The second major support level at $1,909 should limit the downside.

Looking at the Technical Indicators

First Major Support Level: $1,967

Pivot Level: $2,007

First Major Resistance Level: $2,065

23.6% FIB Retracement Level: $3,369

38.2% FIB Retracement Level: $2,740

62% FIB Retracement Level: $1,725

Litecoin

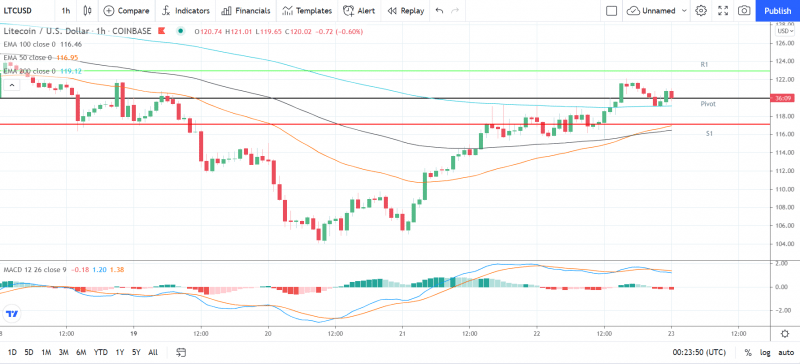

Litecoin rose by 2.44% on Thursday Following a 9.66% rally on Wednesday, Litecoin ended the day at $120.74.

A bearish start to the day saw Litecoin fall to an early morning intraday low $115.63 before making a move.

Steering clear of the first major resistance level at $109, Litecoin rallied to a late afternoon intraday high $122.10.

Coming within range of the first major resistance level at $123, Litecoin fell back to sub-$120 before ending the day at $120 levels.

At the time of writing, Litecoin was down by 0.60% to $120.02. A mixed start to the day saw Litecoin rise to an early morning high $121.01 before falling to a low $119.65.

Litecoin left the major support and resistance levels untested early on.

For the day ahead

Litecoin would need to avoid the $120 pivot to bring the first major resistance level at $123 into play.

Support from the broader market would be needed, however, for Litecoin to break out from Wednesday’s high $122.10.

Barring an extended crypto rally, the first major resistance level and resistance at $125 would likely cap any upside.

In the event of an extended breakout, Litecoin could test resistance at $130. The second major resistance level sits at $126.

A fall through the $120 pivot would bring the first major support level at $117 into play.

Barring another extended sell-off, however, Litecoin should steer clear of sub-$110 levels. The second major support level at $113 should limit the downside.

Looking at the Technical Indicators

First Major Support Level: $117

Pivot Level: $120

First Major Resistance Level: $123

23.6% FIB Retracement Level: $178

38.2% FIB Retracement Level: $223

62% FIB Retracement Level: $296

Ripple’s XRP

Ripple’s XRP rose by 3.99% on Thursday. Following a 7.90% rally on Wednesday, Ripple’s XRP ended the day at $0.59332.

A mixed start to the day saw Ripple’s XRP fall to an early morning intraday low $0.56139 before making a move.

Steering clear of the first major support level at $0.5317, Ripple’s XRP rallied to a late intraday high $0.60294.

Ripple’s XRP broke through the first major resistance level at $0.5957 before easing back to end the day at sub-$0.594 levels.

At the time of writing, Ripple’s XRP was up by 0.07% to $0.59286. A mixed start to the day saw Ripple’s XRP rise to an early morning high $0.59428 before falling to a low $0.58886.

Ripple’s XRP left the major support and resistance levels untested early on.

For the day ahead

Ripple’s XRP will need to avoid the $0.5859 pivot to bring the first major resistance level at $0.6104 into play.

Support from the broader market would be needed, however, for Ripple’s XRP to break out from $0.6050 levels.

Barring an extended crypto rally, the first major resistance level would likely cap any upside.

In the event of another breakout, Ripple’s XRP could test resistance at $0.63 before any pullback. The second major resistance level sits at $0.6274.

A fall through the $0.5859 pivot would bring the first major support level at $0.5688 into play.

Barring another extended sell-off, however, Ripple’s XRP should steer clear of sub-$0.55 levels. The second major support level sits at $0.5443.

Looking at the Technical Indicators

First Major Support Level: $0.5688

Pivot Level: $0.5859

First Major resistance Level: $0.6104

23.6% FIB Retracement Level: $0.8533

38.2% FIB Retracement Level: $1.0659

62% FIB Retracement Level: $1.4096

Please let us know what you think in the comments below.

Thanks, Bob

This article was originally posted on FX Empire

More From FXEMPIRE:

NZD/USD Forex Technical Analysis – Strengthens Over .6982, Weakens Under .6963

S&P 500 Price Forecast – Stock Markets Sluggish During Thursday Session

Natural Gas Price Prediction – Prices Rise Following Less than Expected Build in Stockpiles

Gold Price Prediction – Prices Climb as Yields Drop Following Jobless Claims Data

Twitter’s Shares Rally Following Fastest Revenue Growth In Seven Years

USD/JPY Forex Technical Analysis – Sustained Move Under 110.362 Could Trigger Break into 109.726

Yahoo Finance

Yahoo Finance