Equity Residential (EQR) Meets Q1 FFO Estimates, Scraps View

Equity Residential EQR reported first-quarter 2020 normalized funds from operations (FFO) per share of 87 cents, up 6.1% from the year-ago quarter’s 82 cents. The reported figure comes in line with the Zacks Consensus Estimate.

Results reflect improved same-store net operating income (NOI) and growth in average rental rate.

Total revenues in the first quarter came in at $682.3 million, up about 3% from the prior-year reported figure. However, the revenue figure missed the Zacks Consensus Estimate of $683.7 million.

The company’s rent collections were strong in April with receipts being approximately 97% of residential cash collections in March. Occupancy at the end of April stood at 94.7%, with a renewal rate of 2.8%. The company witnessed a dip of 1.9% in its new lease change.

In light of the coronavirus pandemic and related uncertainties, the company has withdrawn its current-year guidance.

Quarter in Detail

Same-store revenues (includes 74,919 apartment units) were up 2.9% year over year to $682.3 million, while expenses flared up 2.3% year over year to $115.8 million. As a result, same-store NOI climbed 3.2% year over year to $422.1 million.

Physical occupancy contracted 10 basis points sequentially to 96% for the same-store portfolio at the end of the first quarter.

Balance Sheet

The company exited first-quarter 2020 with cash and cash equivalents of $82.3 million, up from the $45.8 million recorded at the end of 2019. Moreover, the company boosted its liquidity and financial flexibility by closing a $495-million secured loan. The tenure of the loan is 10 years and has a fixed interest rate of 2.6%. As of May 4, 2020, the company had $2.2 billion available under its unsecured revolving credit facility.

Portfolio Activity

During the reported quarter, the company also sold two properties for $370.2 million at a weighted average Disposition Yield of 5.0%. The properties are located inSan Francisco Bay Area and one partly-owned property in Phoenix. These properties had 897 apartment units in total.

After the end of the quarter, the company sold one wholly-owned property located in the San Francisco Bay Area for $108.0 million at a Disposition Yield of 4.5%.

Outlook

Equity Residential has withdrawn its 2020 guidance due to the current volatile situation. It shall not issue any guidance until there is certainty about the impact of the pandemic on its operations.

The company had earlier projected normalized FFO per share of $3.59-$3.69 for the ongoing year. The full-year outlook was backed by same-store portfolio revenue growth of 2.3-3.3%, physical occupancy of 96.4%, and NOI change of 1.5-3.5%.

Equity Residential currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

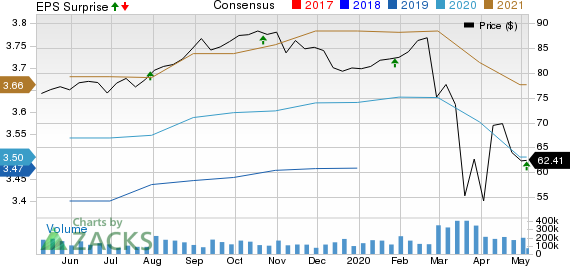

Equity Residential Price, Consensus and EPS Surprise

Equity Residential price-consensus-eps-surprise-chart | Equity Residential Quote

We now look forward to the earnings releases of other REITs like Ventas, Inc. VTR, Kimco Realty Corp. KIM and Simon Property Group, Inc. SPG.All three companies are scheduled to release quarterly numbers on May 7.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Equity Residential (EQR) : Free Stock Analysis Report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Ventas, Inc. (VTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance