Equinor (EQNR) Submits Development Plan for Irpa Gas Project

Equinor ASA EQNR submitted a plan for development and operation to the Norwegian Minister for Petroleum and Energy for the Irpa gas project in the Norwegian Sea.

Equinor and partners would invest 14.8 billion Norwegian crowns to develop the Irpa gas discovery to boost supplies amid the urgency to replace Russian flows.

Situated in the Voring Basin, the Irpa gas discovery is intended to commence production in the fourth quarter of 2026. Equinor operates the Irpa field with a 51% interest.

Irpa is one of the deepest discoveries to be developed offshore Norway. The discovery has an estimated recoverable gas resource of around 20 billion standard cubic meters. This is equivalent to 124 million barrels of oil equivalent or the gas requirements of 2.4 million British homes for seven years.

The gas discovery, formerly known as Asterix, will be developed by drilling three wells and an 80-kilometer pipeline to the Aasta Hansteen platform. The Aasta Hansteen gas field has been operational since 2018.

The Irpa gas project will extend the lifespan of the Aasta Hansteen platform from 2032 to 2039. Equinor mentioned that there will be joint production from the Irpa and Aasta Hansteen fields through 2031. The development will ensure steady gas supplies from Aasta Hansteen.

The gas extracted from the Irpa field will be brought into existing infrastructure through the Aasta Hansteen spar platform. It will then be transported to the Nyhamna gas processing facility through the Polarled pipeline. From there, customers in the U.K. and continental Europe will receive gas via the Langeled pipeline system.

As Europe faces uncertainty over gas supplies, the development of the Irpa gas project will contribute to long-term supplies of gas to customers in the EU and the U.K.

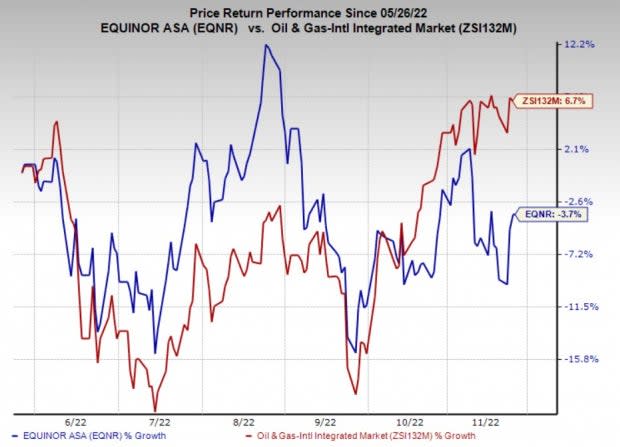

Price Performance

Shares of Equinor have underperformed the industry in the past six months. The stock has declined 3.7% against the industry’s 6.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Equinor currently carries a Zack Rank #2 (Buy).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

MPLX LP MPLX is a master limited partnership that provides a wide range of midstream energy services, including fuel distribution solutions. MPLX’s third-quarter earnings of 96 cents per unit beat the Zacks Consensus Estimate of 81 cents.

MPLX’s distribution per unit was 77.5 cents for the third quarter, indicating a 10% hike from the prior distribution of 70.5 cents. The distribution will be paid out on Nov 22, 2022, to common unitholders of record as of Nov 15, 2022.

Liberty Energy Inc. LBRT offers hydraulic fracturing services to onshore upstream energy companies across multiple basins in North America. LBRT’s third-quarter 2022 earnings per share of 78 cents beat the Zacks Consensus Estimate of 63 cents.

As of Sep 30, 2022, Liberty had $298 million of available liquidity, including $24 million of cash on hand and supported by the revolving credit facility. LBRT’s debt-to-capitalization stands at just 15.2% compared with most peers hugely burdened with debts.

Phillips 66 PSX is the leading player in each of its operations, like refining, chemicals and midstream, in terms of size, efficiency and strengths. PSX’s third-quarter 2022 adjusted earnings per share of $6.46 beat the Zacks Consensus Estimate of $4.98.

Phillips 66’s board of directors recently authorized a $5-billion increase to its stock repurchase program, bringing the total share repurchases authorized since 2012 to $20 billion. This represents Phillips 66’s strong focus on returning capital to stockholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Phillips 66 (PSX) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance